Table of Contents

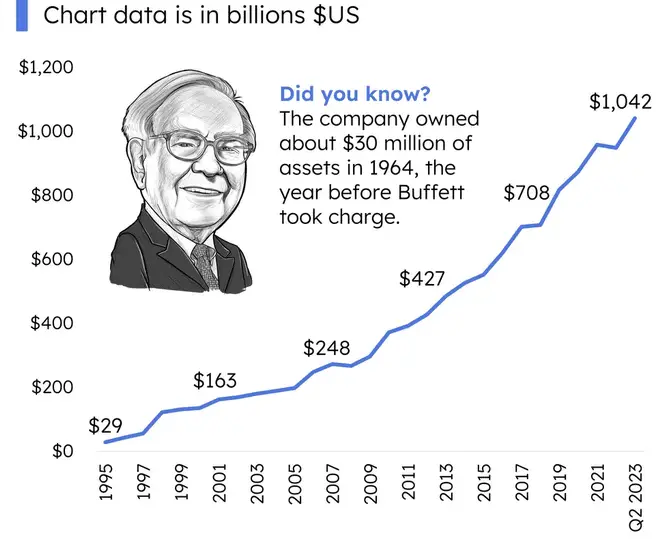

Berkshire Hathaway, the conglomerate led by Warren Buffett, has long been the gold standard for investment success. Known for its impressive returns and strategic investments, many investors wonder why they can’t simply replicate Berkshire’s portfolio to achieve similar financial results. While the idea might seem straightforward, several nuanced barriers make it difficult for individual investors or smaller funds to mirror Berkshire’s success.

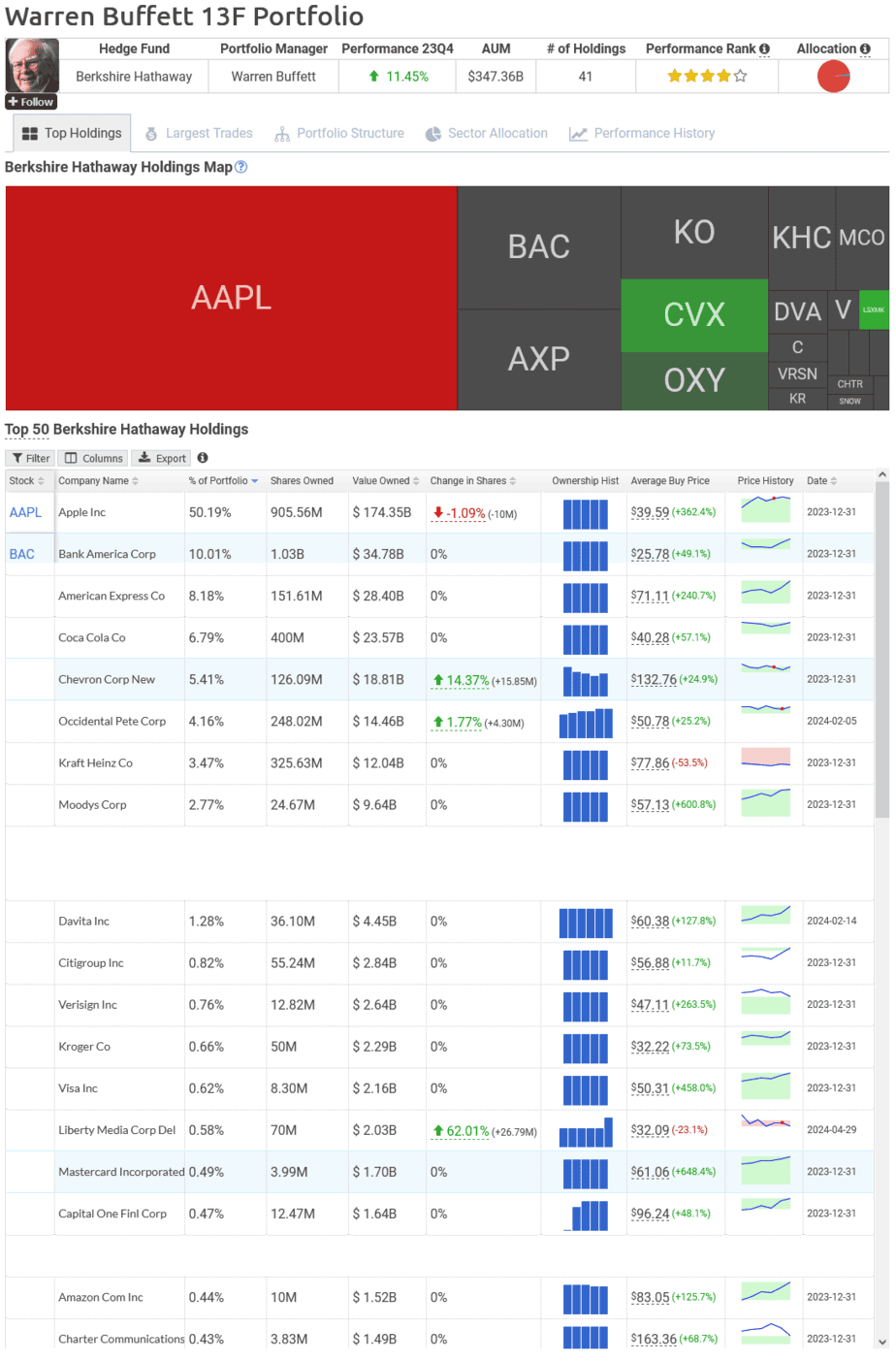

In my opinion, you can not precisely replicate Berkshire Hathaway’s Investment because of the time delay in reporting and negotiating special deals that are off-limits to the average investor.

Timing and Market Influence

One of the primary hurdles in copying Berkshire Hathaway’s investment strategy is the delay in reporting. By SEC regulations, investment firms like Berkshire only need to disclose their holdings 45 days after the quarter ends. During this lag, the market adjusts to the new information, often causing significant price changes in the reported stocks. By the time Berkshire’s moves are public, the optimal entry points are likely long gone, leaving followers to enter at possibly inflated prices.

Below, I will show one example using a publicly available portfolio screenshot:

Scale and Acquisition Capabilities

Berkshire Hathaway’s sheer size and capital reserve allow it to make unattainable moves to smaller investors. This includes acquiring whole companies or negotiating special deals that are off-limits to the average investor. These opportunities often come with financial terms and strategic advantages tailored to Berkshire’s long-term objectives and financial prowess.

Of course, if you are a small investor, you can always invest and make a portfolio similar to big corporations like Berkshire Hathaway and make better returns because of higher risk and smaller allocation.

From a financial perspective, the relationship between risk and return is fundamental. The risk-return tradeoff indicates that higher risk is associated with the potential for higher returns. Small investors are typically more likely to engage in riskier investments that can offer higher payoffs. This is primarily because:

- Portfolio Concentration: Unlike large investors, who must diversify extensively to mitigate risks across vast portfolios, small investors can concentrate their investments on a few high-growth potential assets. While this increases risk, it also amplifies potential returns if the investments perform well.

- Market Agility: Small investors can quickly enter and exit positions in response to market changes, which is often not feasible for large corporations due to the sheer volume of their trades impacting market prices.

Empirical Evidence

Studies have shown that smaller funds often outperform their larger counterparts, especially in niche or emerging markets where significant funds are less active. According to research, smaller hedge funds have demonstrated better returns than larger ones due to their higher operational flexibility and lower market impact costs.

Behavioral Finance Insights

Behavioral finance provides additional insights into why smaller portfolios might achieve higher returns. Small investors are not bound by the institutional constraints and bureaucratic decision-making processes that can hamper large entities. They can make swift decisions based on emerging trends or new information, capitalizing on opportunities before they become widely recognized and priced into the market.

Diversified Revenue Streams

Another aspect that sets Berkshire apart is its vast array of diversified revenue streams, most notably its significant insurance operations, which include giants like GEICO and Berkshire Hathaway Reinsurance Group. These entities provide a substantial float, which Berkshire uses to fund other investments. This internal funding mechanism and the profits from these businesses are intricately woven into Berkshire’s overall returns and are not replicable on a smaller scale.

Investment Horizon and Risk Tolerance

Berkshire’s investment philosophy heavily emphasizes long-term holding periods and weathering volatility, a luxury that its substantial capital base affords. Individual investors, in contrast, often operate under different time horizons and risk profiles. Many lack the financial stability or the temperament to endure the market’s inevitable fluctuations over such extended periods.

Conclusion

In essence, while the positions of Berkshire Hathaway are public and can technically be mimicked to some degree, the nuances of timing, scale, access to unique deals, diversified business operations, and long-term investment strategies contribute to a complex financial tapestry that is difficult to replicate. Investors looking to emulate Berkshire’s success must consider these factors and recognize the inherent limitations of their circumstances compared to a behemoth like Berkshire Hathaway. Instead, adopting principles from Berkshire’s approach, like value investing, long-term horizons, and diversification, may be more practical and ultimately rewarding for individual investors.