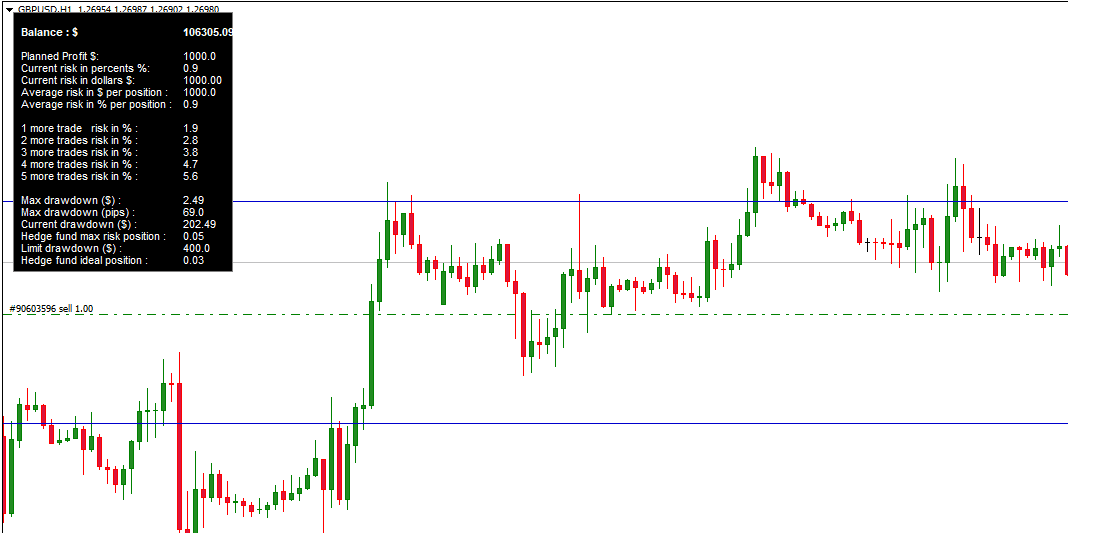

The Risk Management Indicator I created for my trading manages the risk for funded accounts. It does this by analyzing the drawdown (peak-to-trough decline during a specific recorded period of an investment or fund) over a certain number of days (default is 200) and helps you to plan your trades.

Please see my video about this indicator:

Here’s how each component could be interpreted:

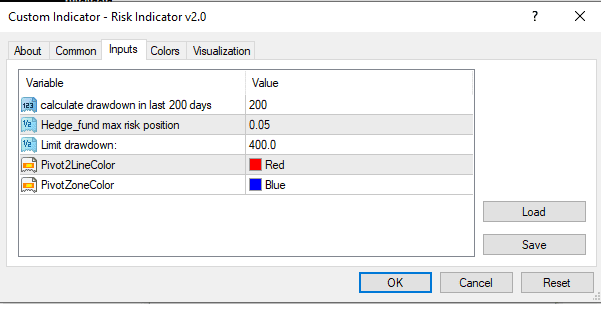

- Max.Drawdown: This is a measure of reduction in your account balance from a trade or series of trades. For example, if you start with $1000, and after a series of trades, your balance is $800, your drawdown is $200, or 20%. The indicator calculates this over the last X days (default 200), which helps to provide a perspective on potential risks based on past performance.

- Hedge_fund_max_risk_position=0.5: This could be a parameter that limits the risk a trader is willing to take on any single position. In this case, it’s set to 5 mini lots by default. A trade should not expose more than five mini lots of the account balance.

- Limit_drawdown=400: This is the maximum drawdown you’re willing to tolerate. If the indicator calculates a potential drawdown that exceeds this limit, it will advise against opening new trades.

- New positions: Based on the above parameters, the indicator can show how many additional trades you can add without exceeding your predetermined risk parameters.

Drawdown is critical to understand and monitor when trading on any account. Still, it becomes especially critical when trading on a funded account with a specified drawdown limit. This is because a high drawdown could result in loss of your trading privileges or even financial penalties.

Download the Risk Management Indicator

You can download the MT4 indicator if you press the button below:

Please see my article about Maximum Drawdown.

If your limit is a 5% max drawdown, the maximum allowable loss from the peak value of your account is 5%. You violate your account terms if your account value drops more than 5% from its peak.

Monitoring drawdown and understanding potential risk for several reasons:

- Protecting Capital: The primary goal of risk management in forex trading is to protect your trading capital. Keeping drawdowns small will ensure you have enough capital to continue tangibly and recover your losses.

- Avoiding Violations: As mentioned, exceeding the max drawdown limit on a funded account can lead to penalties or loss of trading privileges. Consistent monitoring can help avoid these scenarios.

- Performance Metrics: Drawdown a critical performance metric. It helps measure the riskiness of your trading strategy. A system with frequent high drawdowns might be too risky and needs adjustment.

- Psychological Factors: Large drawdowns can cause stress and lead to poor decision-making. By keeping drawdowns within a limit, you can better maintain your trading discipline and make more objective decisions.

- Compounding: Drawdown affects the compounding of your profits. A 50% loss requires a 100% gain to break even. However, a 5% loss only requires a roughly 5.3% gain to recover. The smaller the drawdown, the easier it is to recover your losses.

Using risk management tools that monitor maximum drawdown, along with stop-loss orders and risk-per-trade limits, can significantly improve the sustainability of your trading in the long term. These strategies aim to reduce the likelihood of substantial losses and help ensure you are not unduly risking your capital.

Avoid Costly Mistakes During Prop-funded Accounts Trading

Trading on a funded forex account requires a robust understanding of risk management, market dynamics, and trading strategy. It’s important to remember that the money you’re trading with is not entirely yours – you are accountable to the funder and must adhere to specific risk parameters. Here acritical some critical points for managing a funded forex account, avoiding overtrading, excessive drawdown, and mitigating risks associated with over-the-weekend trades:

- Risk Management: Managing risk is vital in any trading scenario, especially with a funded account. This involves knowing how much you’re willing to risk per trade and ensuring it aligns with the risk parameters set by your funding partner. It would be best if so were watchful about your drawdown level not to breach the pre-agreed thresholds.

- Avoiding Overtrading: Overtrading is a common pitfall for many trades, mainly early when using a funded account. It involves trading excessively, driven by various factors, including the desire to make quick profits, fear of missing out or trying to recover from losses. Overtrading can often lead to increased risk and potential for unnecessary losses. One way to avoid overtrading is by sticking to a well-defined trading p outlining when and under what circumstances you will enter and exit trades.

- Monitoring Drawdown: Constant monitoring of your drawdown levels is crucial. Critical to ensuring you stay within the acceptable risk parameters funding provider sets. Failure to manage drawdowns can lead to substantial losses, and even the termination of your funded account-lossless orders and other risk management tools can help keep drawdowns under control.

- Weekend Trades: Holding trades over the weekend can expose traders to ‘gap risk’ – the risk that the market opens at a significantly different price from its close on Friday. This can result in losses exceeding your predetermined risk levels. It’s usually recommended to close trades before the weekend, especially if you cannot monitor the markets or lack a strategy to handle such gaps. Crypto positions are precarious during the weekend.

- Education and Continual Learning: Always be in the loop with market news and indicators. Understanding how geopolitical and economic events impact currency rates can help make informed trading decisioKeepkeep; refining and backtesting your strategies based on new learnings and market experiences.

In conclusion, successful management of a funded forex account requires a disciplined approach to trading, effective risk management strategies, continuous learning, and the emotional stability to handle the ups and downs of the market. Remember, the goal isn’t just to make profitable trades but to do so in a way that aligns with your risk tolerance and the guidelines set by the funding provider.