When working for a prop trading company, managing risks effectively is crucial, often aiming for a maximum drawdown of 5% to safeguard the firm’s capital. This can be achieved by implementing a strict trading strategy, which includes setting stop losses to limit potential losses on a trade. Traders have two main options: a tight stop loss, which minimizes the loss per trade but may result in more frequent exits, or a more wider stop loss, which allows more room for market fluctuations but requires a higher risk-reward ratio to be profitable. Regardless of the approach, maintaining a high risk-reward ratio is essential, ensuring that potential profits on successful trades significantly outweigh the losses on unsuccessful ones. This balance is critical to long-term profitability and aligning with the risk management policies of the prop trading firm.

Instant funding for forex traders is possible!

INSTANT FUNDING TO MANAGE MONEY - NO CHALLENGES

I made an explanation in my video:

Below is presented one example:

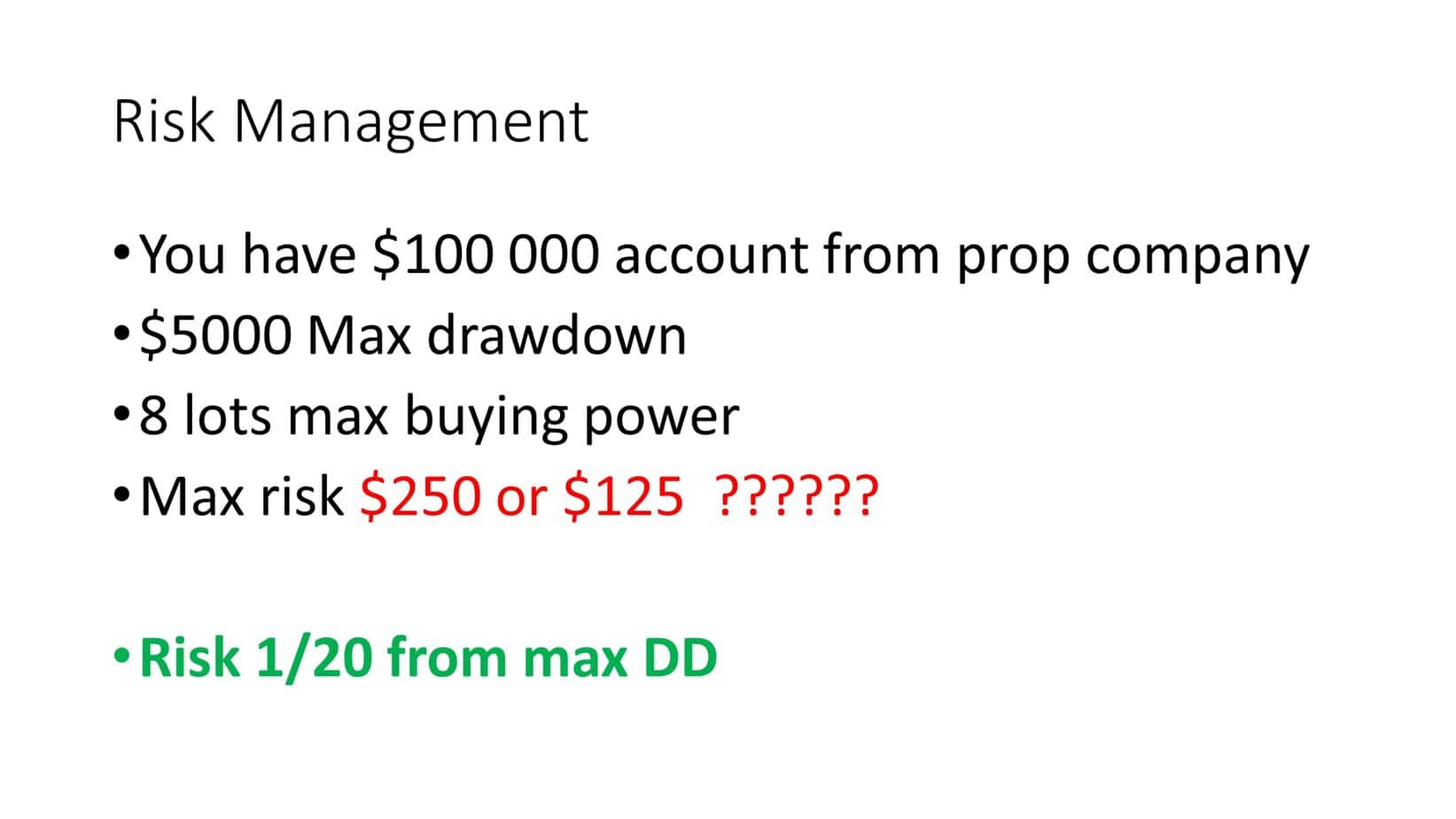

To effectively manage a $100,000 trading account while controlling risk, you can follow a systematic approach:

- Begin with a single trade, committing only a small portion of your equity, such as 0.25%, to maintain a low-risk profile.

- As the trade moves in your favor and covers a specified distance or achieves certain profit milestones, initiate additional trades, risking only 0.25% of your current equity each time.

- Adjust your stop-loss orders for all open positions with each new trade to protect your accumulated profits and limit potential losses.

- Adding trades and adjusting stop-losses can be repeated, allowing you to open up to 8 lots, each representing a fraction of your total equity while never exceeding the 0.25% risk per trade.

- This strategy helps capitalize on favorable market movements while keeping the overall risk to the account controlled and within a predefined limit.

Below, you can see one example of what typical account size and buying power look like:

Below, you can see what typical account trade characteristics look like:

My typical trading account has a win rate of around 50%, which means I win about half of my trades. Despite the balanced win-lose ratio, I maintain a low-risk approach, ensuring minimal potential losses on each trade. My profit factor is around 2, indicating that my total gross profit is twice as much as my total gross loss. This is achieved because I often opt for trades with high reward potential relative to the risk. I frequently move my stop loss to breakeven or to lock in a small profit of about one pip, leading to a significant number of breakeven or slightly profitable trades. This strategy helps me manage risk effectively while capturing substantial gains when the market moves favorably.

Risk Management Strategy

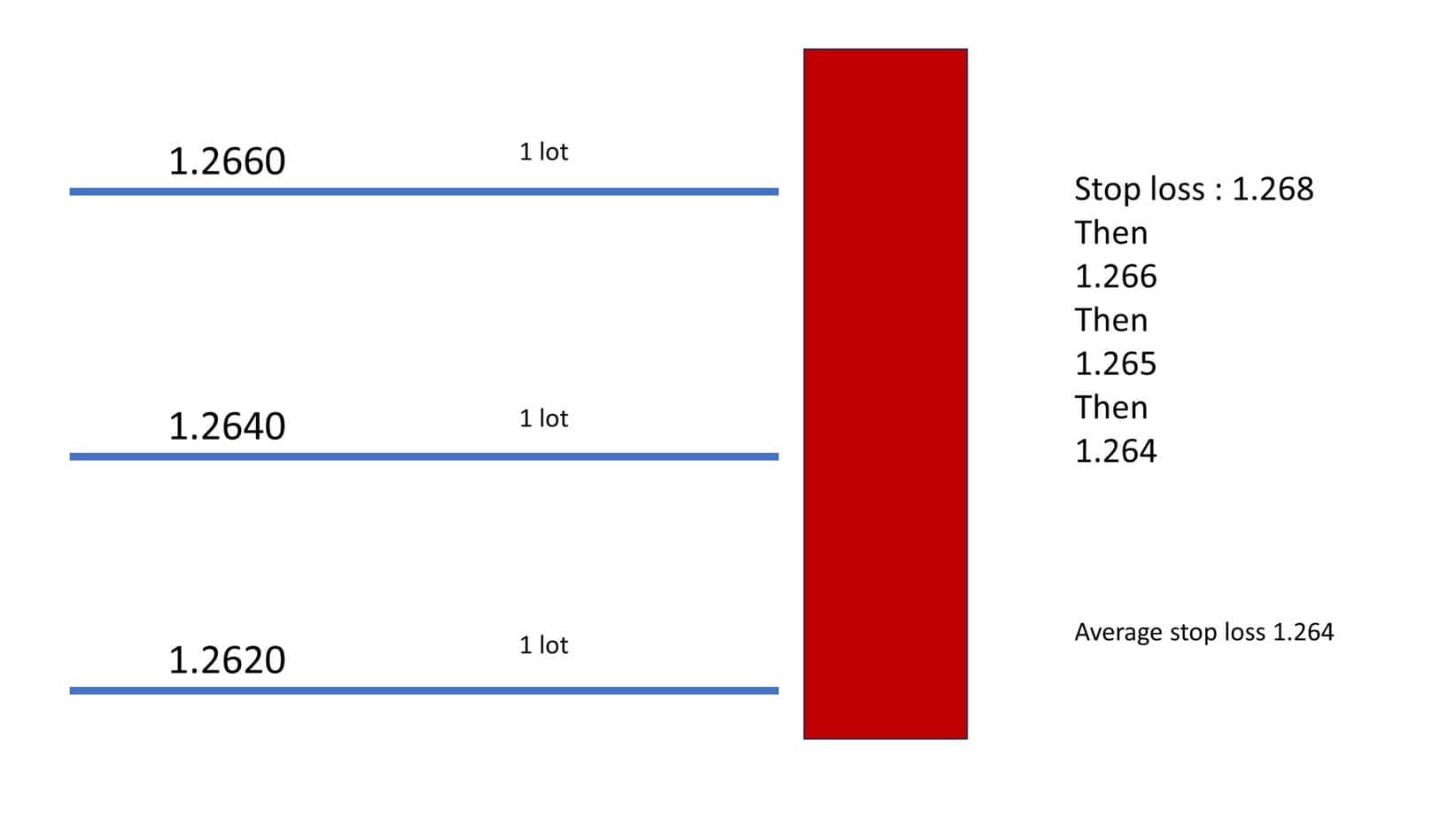

In my risk management strategy for a $100,000 account, I start by placing one trade of 1 lot, where I risk $250. This initial trade is opened for 1.264. After the market moves in my favor by 20 pips, I add another trade of 1 lot while simultaneously moving the stop loss for both positions to 1.265. This adjustment ensures that my first trade is at breakeven or a small profit, effectively reducing my overall risk. Once the market advances another 20 pips, I add a third position and adjust the stop loss for all three positions to 1.264. By doing this, I eliminate any risk from the first two trades and now have three lots open in the market, all protected by the revised stop loss, ensuring that my initial risk is no longer exposed.

- Starting Position: Open one lot trade in a $100,000 account, risking $250 (0.25% of the account).

- Initial Trade Price: Enter the first trade at a price level 1.264.

- First Adjustment:

- After the market moves 20 pips in favor, add a second trade of 1 lot.

- Move the stop loss of both positions to 1.265, securing the first trade at breakeven or a small profit.

- Second Adjustment:

- Once the market moves another 20 pips favorably, add a third trade of 1 lot.

- Adjust the stop loss for all three positions to 1.264.

- Risk Management:

- This strategy eliminates risk from the initial trades by regularly adjusting stop losses.

- The incremental addition of trades capitalizes on favorable market movements while controlling overall exposure.

Strategy preparing

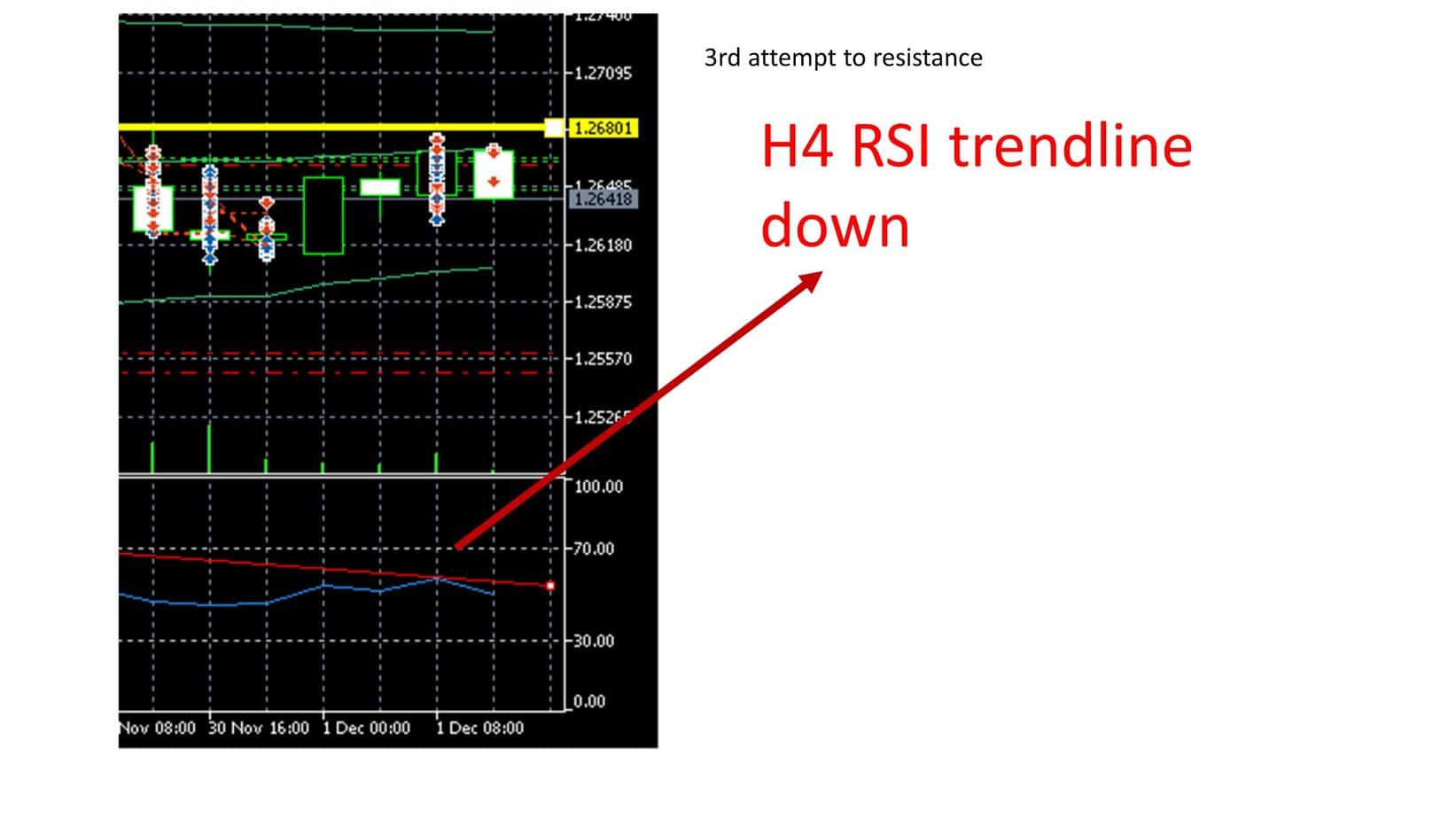

Preparing and writing essential price levels, such as previous highs and supports, on a trading chart is crucial for several reasons. Firstly, these levels visually represent critical market thresholds, allowing traders to identify areas where the market might react quickly. This visual aid is essential for making informed decisions, as it highlights historical points where the price has previously shown significant movement. By marking these levels, traders can anticipate potential price movements, enabling them to plan entry and exit points effectively effectively.

Secondly, a well-defined trading plan based on these price levels aids in maintaining discipline, reducing the likelihood of impulsive decisions driven by emotions. Such a plan, incorporating risk management strategies, helps set clear targets and stop-loss levels, essential for preserving capital and managing losses. Additionally, these levels serve as a benchmark for evaluating the strengths or weaknesses of the market, assisting traders in adjusting their strategies in response to changing market dynamics.

For example, here is the H4 RSI breakout:

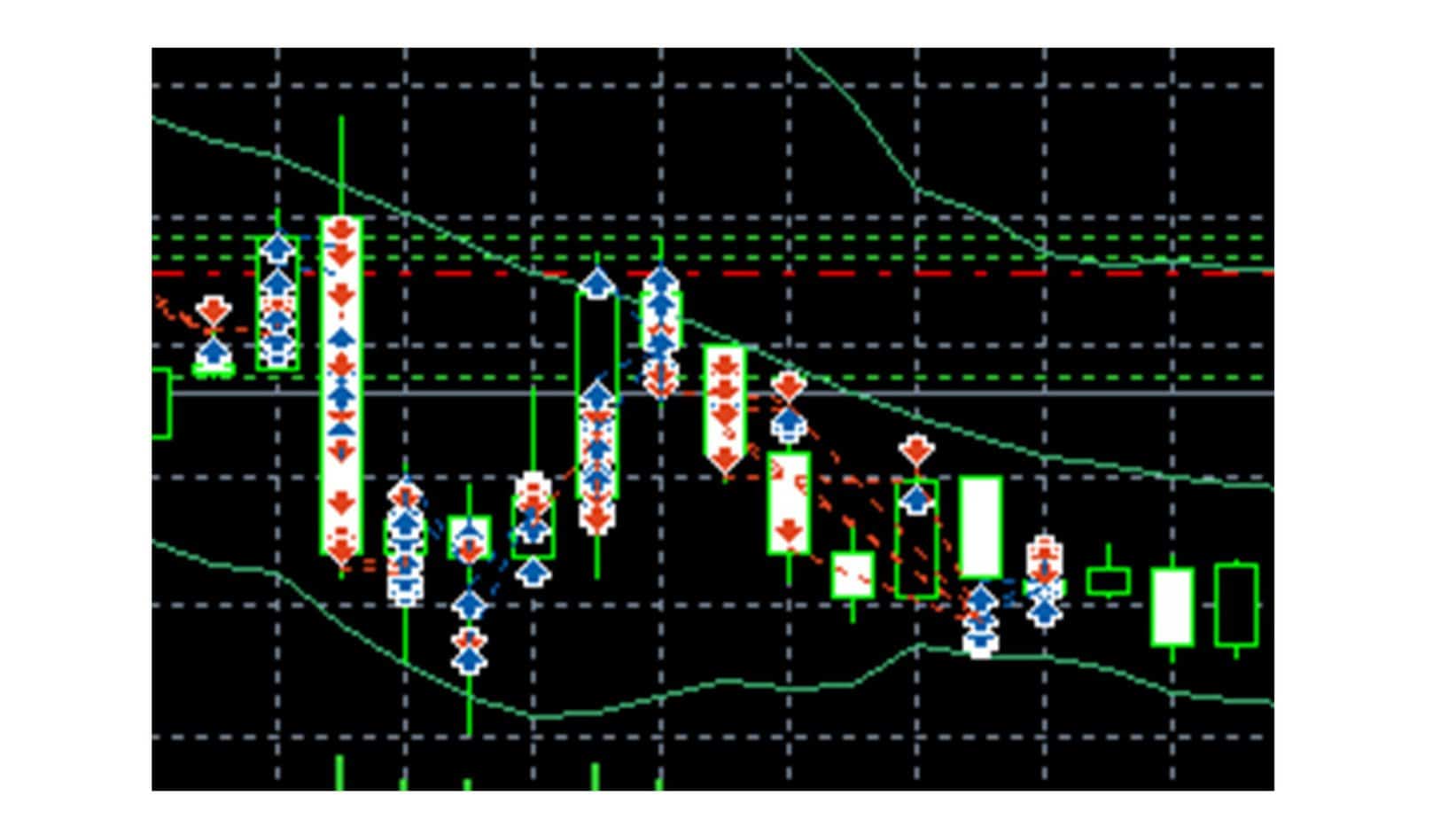

Then you can see what the chart trendline looks like:

Finally, you can see a lot of trades on the charts:

In summary, marking essential price levels and integrating them into a trading plan is fundamental for strategic decision-making, risk management, and overall trading success. It enhances the ability to forecast market movements and fosters a disciplined approach to trading, which is vital for long-term profitability.

Effective risk management in trading, especially when handling multiple trades and adjusting stop-loss orders, is pivotal for safeguarding investments and ensuring long-term profitability. Employing a strategy that incorporates moving stop-loss orders allows traders to dynamically protect gains and limit losses, adapting to changing market conditions. This approach is particularly beneficial in volatile markets, where price movements can be unpredictable. By managing risk across multiple trades, traders can distribute their exposure, reducing the impact of a single losing trade on their overall portfolio.

Moreover, regularly reviewing and adjusting stop-loss levels in response to market movements and new information helps capture profits while minimizing potential losses. This practice encourages a disciplined approach, preventing emotional decision-making and overexposure to risk. However, it’s essential to balance the frequency of adjustments to avoid premature exits from potentially profitable positions.