Table of Contents

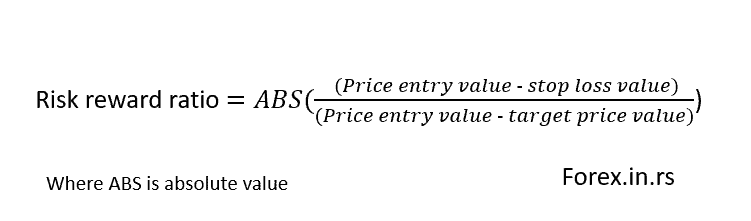

Below is the risk-reward calculator:

The risk-reward ratio or risk-return ratio in trading represents the expected return and risk of a given trade or trade based on the entry and close positions. A good risk-reward ratio tends to be less than 1; that is, the return (reward) is greater than the risk.

The risk-reward ratio is a crucial concept in trading and investing. It helps traders to evaluate the potential reward for every unit of risk they are taking. Let’s break down the concept:

Definition:

The risk-reward ratio quantifies the potential reward you can make for every dollar you risk on a trade.

Formula:

How to calculate:

- Potential Loss (Risk): This is the difference between your entry price and your stop-loss price. It represents the amount you’re willing to lose on a trade.

- Potential Gain (Reward): This is the difference between your entry and target price (take-profit level). It represents the profit you aim to achieve.

Interpretation:

- Risk-Reward of 1:1: This means you are risking the same amount of money as the profit you’re aiming to achieve. For example, if you’re risking $100 to make $100 potentially, the ratio is 1:1.

- Risk-Reward of 1:2: This indicates that for every dollar you’re willing to risk, you aim to make two. If you risk $100, you’re aiming to make $200.

- Risk-Reward of 1:3: For every dollar risked, you aim to make three. For a risk of $100, your target profit is $300, and so on.

Importance of a Good Risk-Reward Ratio:

- Improves Profitability: Even if a trader has a 50% win rate with an excellent risk-reward ratio (e.g., 1:2), they can still be profitable. For instance, losing $100 on five trades and gaining $200 on the other five trades gives a net gain of $500 over ten trades.

- Psychological Comfort: An excellent risk-reward ratio provides traders with psychological comfort. Knowing that one winning trade can offset multiple losses lets traders maintain composure and stick to their strategy.

- Risk Management: Employing a favorable risk-reward ratio ensures disciplined risk management. It prevents traders from risking too much on trades with low-profit potential.

Why a Risk-Reward Ratio Less Than one is Considered Good:

When the risk-reward ratio is less than 1 (e.g., 1:2, 1:3), the potential reward is greater than the risk. This setup is generally favorable because:

- You don’t need a high win rate to be profitable in the long run.

- It allows for some flexibility. Even if your trade analysis isn’t perfect and you have some losing trades, a few winning trades with a good risk-reward ratio can cover those losses.

Limitations:

- Not the Only Metric: While it’s an essential metric, the risk-reward ratio shouldn’t be the only criterion for evaluating trades. Factors like trade setup, market conditions, and fundamentals should also be considered.

- Achievability: A high reward potential is excellent, but it should also be realistically achievable. Setting a target too far from the entry might result in missed profit-taking opportunities.

In conclusion, understanding and utilizing the risk-reward ratio can significantly enhance a trader’s decision-making process, risk management, and overall profitability.