Many struggle to decide which option is best: a Roth IRA or a savings account. While both options can be beneficial in their ways, it is essential to understand their differences and weigh the pros and cons before deciding where to spend your hard-earned money.

What is a Roth IRA?

A Roth IRA is an individual retirement account (IRA) that allows you to contribute after-tax dollars to your retirement savings. Your contributions to a Roth IRA are not tax-deductible, but any investment gains and withdrawals you make in retirement are tax-free.

You can read our article Can You Lose Money in a Roth IRA?

What is a savings account?

A savings account is a bank account designed to help individuals save money. Savings accounts typically offer a low-risk way to earn interest on your deposits while providing easy access to your funds when needed.

Firstly, a savings account is designed to provide quick and easy access to your money. This type of account is typically used for short-term savings goals, such as saving for a down payment on a house, a vacation, or a rainy day fund. In addition, savings accounts are FDIC-insured, meaning your funds are protected up to $250,000, making it a low-risk investment option.

Which is a Better, a Roth IRA or a Savings Account?

A Roth IRA may be a better option if you’re saving for retirement and have a longer time horizon, as it can provide you with tax benefits and the potential for higher returns. On the other hand, a savings account may be better if you’re saving for a shorter-term goal or want to keep your funds easily accessible in an emergency.

On the other hand, a Roth IRA is a retirement savings account that allows you to save money for your future, earning tax-free growth and withdrawals. Unlike traditional IRAs, a Roth IRA requires you to pay taxes on your contributions upfront. Still, it allows you to withdraw all earnings tax-free if you meet specific criteria, such as being at least 59 and a half years old and having the account open for at least five years.

Whether a Roth IRA or a savings account is better depends on your financial goals, time horizon, and risk tolerance.

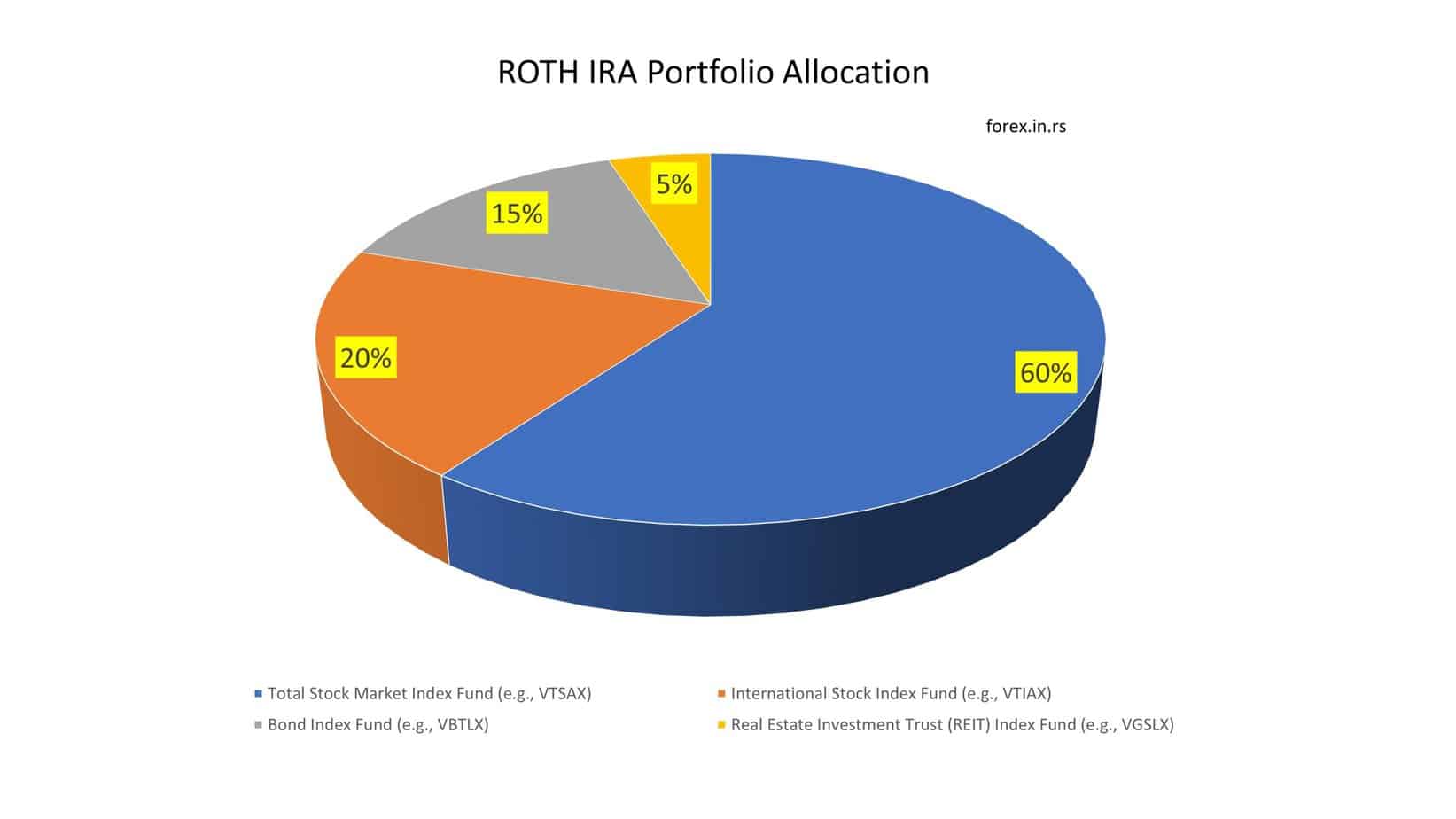

A Roth IRA is a retirement savings account that allows you to contribute after-tax dollars and invest them in stocks, bonds, mutual funds, and other securities. The earnings in a Roth IRA grow tax-free, and qualified withdrawals in retirement are also tax-free. The advantage of a Roth IRA is that it can provide you with significant tax benefits and the potential for higher returns than a savings account. However, you will typically need to keep your funds invested for the long term to see the full benefits.

On the other hand, a savings account is a low-risk, low-return option that allows you to earn interest on your deposits. In addition, savings accounts are FDIC-insured, meaning your deposits are protected up to a certain amount in case the bank fails. The advantage of a savings account is that it provides easy access to your funds and a guaranteed return, but the interest rates are often relatively low.

It’s important to remember that investing in a Roth IRA always carries some level of risk, as the value of your investments can fluctuate based on market conditions. Therefore, it’s essential to research and consult with a financial advisor to determine the best option for your situation.

Benefits of a Roth IRA:

- Tax-free growth: Contributions and earnings grow tax-free, meaning you won’t owe taxes on the money you withdraw in retirement.

- Higher potential returns: A Roth IRA can earn higher returns than a savings account because it allows investors to invest in a broader range of assets.

- More flexibility: You can withdraw your contributions without penalty and withdraw your earnings penalty-free for specific reasons, such as a first-time home purchase or qualified education expenses.

- More retirement savings options: Roth IRAs have higher contribution limits than savings accounts, so you can potentially save more money for retirement.

Benefits of a savings account:

- Guaranteed returns: Savings accounts offer a guaranteed return on your money, which can appeal to those who want a low-risk investment.

- Easy access to funds: Unlike a Roth IRA, you can withdraw money from a savings account without penalty.

- No contribution limits: You can contribute as much money as you want to a savings account, making it a good option for short-term savings goals or emergency funds.

- FDIC insured: Savings accounts are FDIC insured, meaning your deposits are insured up to $250,000 per depositor, per insured bank.

Ultimately, deciding between a Roth IRA and a savings account depends on your financial goals and time horizon. For example, if you ara Roth IRA may be a better option e saving for retirement and have a longer time horizon, a Roth he tax-free growth and the potential for higher returns. On the other hand, a savings account may be a better option if you are saving for a shorter-term goal or emergency fund due to the guaranteed returns and easy access to funds.

One key benefit of a Roth IRA is that it allows your money to grow tax-free. This means that none of the earnings on your investments are subject to taxes, which can add up to significant savings over time. For example, if you invest $5,000 per year into a Roth IRA for 30 years and earn an average annual return of 8%, you could have over $500,000 in tax-free savings by the time you retire.

Another advantage of a Roth IRA is its flexibility. Unlike traditional IRAs or 401k plans, you are not required to take minimum distributions at a certain age. This means you can let your money grow as long as you need to without worrying about losing any of it to the IRS.

However, there are also some downsides to consider when investing in a Roth IRA. Firstly, there are income limits that could prevent you from being eligible to contribute to a Roth IRA. If you earn too much money, you may not be able to contribute to a Roth IRA at all, or you may be limited in how much you can contribute.

Additionally, you may be subject to penalties and taxes if you must withdraw money from your Roth IRA before you turn 59 and a half years old. Alternatively, it can negatively impact your retirement savings. This is why ensuring you have enough emergency savings in a separate account before investing in a Roth IRA is essential.

When it comes to choosing between a Roth IRA and a savings account, it ultimately depends on your financial goals and priorities. A savings account can be a good option for short-term savings goals or emergency funds, while a Roth IRA is best suited for those looking to invest in their future and save for retirement.

Overall, both options have benefits and drawbacks. Research and consult a financial advisor before deciding; with the right strategy, you can save money and achieve your financial goals, whether you choose a Roth IRA or a savings account.

Investing in IRA precious metals can protect your retirement fund. Investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free PDF about Gold IRA.

GET GOLD IRA GUIDE