Table of Contents

The Russell 3000 Growth Index is a critical component of the American stock market, providing investors with insights into the performance of the fastest-growing companies within the Russell 3000 Index. However, before we delve deeper into the specifics of the Russell 3000 Growth Index, it’s essential to understand the broader framework within which it operates.

In the last article, we learned Russell 3000 Index vs. S&P 500.

The Russell 3000 Index

The Russell 3000 Index is a market-capitalization-weighted equity index that seeks to track the performance of the 3,000 most extensive U.S.-traded stocks, representing approximately 98% of all U.S. incorporated equity securities. This broad market coverage makes it a comprehensive barometer of the performance of the American stock market.

The Russell 3000 Index is divided into two sub-indexes: the large-cap Russell 1000 Index and the small-cap Russell 2000 Index. These sub-indexes allow investors to examine the performance of different market sectors more closely. Beyond these divisions, the Russell 3000 Index also bifurcates into the Russell 3000 Growth Index and the Russell 3000 Value Index.

What is the Russell 3000 Growth Index?

The Russell 3000 Growth Index is a subset of the Russell 3000 Index that includes companies displaying potential for high growth. The stocks in this index are selected based on two primary growth factors: the projected earnings growth and the historical sales per share.

Unlike the complete Russell 3000 Index, which includes all companies regardless of their financial characteristics, the Russell 3000 Growth Index includes only companies with higher-than-average growth rates. The index relies on specific metrics, such as high price-to-book ratios and high forecasted growth values, to identify these high-growth companies.

Investors and financial analysts use the concept of indexes to compare, contrast and evaluate the average weight of selected stocks and list them against different investments and assets. As a result, investors are granted productive investments in the stock market and financial capitalization as they use indexes.

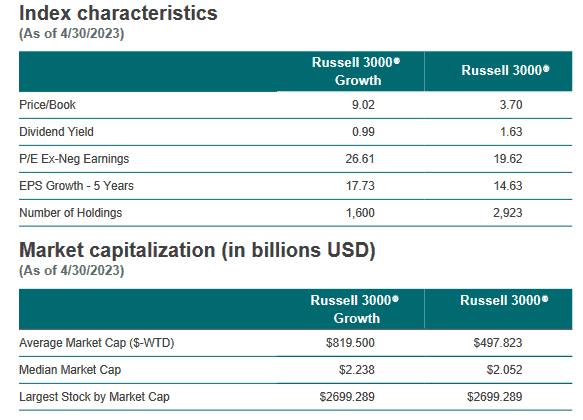

The characteristics of the Russell 3000 Growth Index, as of April 30, 2023, are as follows:

- Price/Book: The Price/Book ratio is a valuation metric that compares the market price of a company’s shares to its book value per share. For the Russell 3000 Growth Index, the Price/Book ratio is 9.02, indicating that the growth stocks in the index are relatively expensive compared to their book value.

- Dividend Yield: Dividend Yield measures the annual dividend payments made by a company relative to its stock price. The Russell 3000 Growth Index has a Dividend Yield of 0.99%, which suggests that the growth stocks in the index generally pay lower dividends than their stock price.

- P/E Ex-Neg Earnings: The P/E Ex-Neg Earnings ratio is the price-to-earnings ratio calculated by excluding companies with negative earnings. It is a valuation metric that compares a company’s stock price to earnings per share. For example, the Russell 3000 Growth Index has a P/E Ex-Neg Earnings ratio of 26.61, indicating that the growth stocks in the index have a higher valuation than their earnings.

- EPS Growth – 5 Years: EPS Growth refers to the compound annual growth rate of a company’s earnings per share over five years. The Russell 3000 Growth Index has an EPS Growth of 17.73%, suggesting that the growth stocks in the index have experienced solid earnings growth over the past five years.

- Number of Holdings: The Russell 3000 Growth Index comprises 2,923 holdings, meaning it includes a diverse range of companies representing the growth segment of the US equity market.

- Average Market Cap ($-WTD): Average Market Cap represents the average market capitalization of the companies in the index. The Russell 3000 Growth Index’s average market cap is $497.823 billion (weighted by market capitalization).

- Median Market Cap: Median Market Cap represents the midpoint of the companies’ market capitalizations in the index. For the Russell 3000 Growth Index, the median market cap is $2.052 billion, indicating that half of the companies in the index have market capitalizations above this value and half have market capitalizations below it.

- Most extensive Stock by Market Cap: The most extensive stock by market capitalization in the Russell 3000 Growth Index is valued at $2,699.289 billion, indicating the size and importance of the largest company in the growing segment of the US equity market.

The Russell 3000 index is a capitalization-oriented stock market index that FTSE Russell regulates. Russell 3000 index is the financial threshold and renowned index form for the entire US stock market. It includes 3000 assets and financial companies operating on a public scale in the United States of America.

These companies display market capitalization and exhibit more than 98% of the American public equity market. Russell 3000 index was made accessible on January 1, 1984, and is currently maintained by FTSE Russell, a non-subsidiary of the London stock exchange club.

The top 10 holdings for Russell 3000 list include Apple, Microsoft car, Amazon, Facebook, Tesla, Alphabet Inc., Johnson and Johnson, Berkshire Hathaway, and JP Morgan Chase and Co. The categories evaluated by Russell 3000 index incorporate technology, consumer discretionary, industrial items, financial domains, healthcare services, existing state facilities, telecommunication services, energy providers, and essential materials.

To understand the philosophy of the Russell 3000 index, the fundamental purpose and mission must be evaluated first. It is the blueprint for more than the 3000 most extensive US-traded stocks. It is a foundation for various financial items and possessions, incorporating the Russell 1000 and Russell 2000 indexes. The thousand US-traded stocks are index interest of 3000, constituting Russell 1000, whereas Russell 2000 is a small-scale category or subset of 2000 components. Most American mutual and exchange funds are defensive when the markets are complete and glorified.

However, Russell 3000 appears within the standard onset, does not take on a defensive role, and has an entirely passive strategy. The available stocks within the rest of the 3000 Index Corporation are re-handled annually, mainly on the last Friday of June. By this time, the flourishing companies and companies that experience loss are displayed in the index’s overall availability and are marked according to their current market portfolio and capitalization.

The number of securities is expected to fluctuate on an annual basis. If the securities are modified, they will likely replace them at the preceding reconstitution scheduled for next year. The fluctuation occurs due to market performance, such as mergers, acquisitions, and private dealerships.

Importance of the Russell 3000 Growth Index

The Russell 3000 Growth Index provides a valuable tool for investors focusing on growth investing. This strategy involves investing in companies expected to grow at an above-average rate compared to other companies in the market. Investors using this approach aim to achieve capital gains rather than dividend income.

The index is also crucial for passive investment strategies, with many index funds and ETFs mirroring its composition to offer investment products to their clients. Furthermore, it is a benchmark for fund managers specializing in U.S. equities to compare their performance.

Investing in the Russell 3000 Growth Index

Investors cannot directly invest in the Russell 3000 Growth Index, as it’s not a financial product but a statistical measure. However, several index funds and ETFs replicate their holdings and performance. These funds offer investors exposure to the high-growth companies within the broader Russell 3000 Index, allowing them to participate in their potential returns.

Conclusion

The Russell 3000 Growth Index represents an essential component of the U.S. equity market, highlighting the performance of high-growth companies within the Russell 3000 universe. It is a crucial tool for investors, fund managers, and analysts, enabling them to gauge the health and direction of the growth segment in U.S. equities and providing a foundation for many financial products. By understanding this index, investors can make more informed decisions when creating a diversified investment portfolio.