The question is this: How can we sell something if we don’t own it?

Stock short-selling can be defined as the practice of contacting a broker to borrow financial instruments and selling them at the prevailing prices in the market when lower prices are expected. The borrowed financial instruments can be returned to the broker by buying them from the market when their prices fall. The difference between the selling prices and buying prices will be your profit.

Forex short selling is the process of selling the base currency and buying the quote currency with the expectation that the currency pair’s value will fall. For example, I want to sell GBP as the base currency. The US economy is excellent, and the dollar is solid in a rising trend, and the USD. GBPUSD is a currency pair whose price will decrease (my prediction). So, forex’s short-selling of GBPUSD currency pair is when I SELL GBP base currency and BUY quote currency USD in the expectation that the currency pair GBPUSD will fall.

How can currency be shorted in a market?

Technically, a seller sells base currency at the current market price and buys the quote currency. So, if a trader sells EURUSD, he sells EUR and buys USD. To short a currency, you need:

- Sell base currency as a short seller at the current market price.

- Waits for the price to fall

- Buy quote currency to close the trade.

When you trade in the forex market, then you can do business not only in bull markets but also in bear markets. When prices increase in the forex market, people usually buy a currency and hold their investment until its price increases so that the difference in selling and buying prices can give them a profit. However, most people do not know how to trade in the forex market when prices fall. The information provided in this write-up will help you learn how to shorten your forex trading.

How do you short the dollar, for example? I choose the strong currency in the market at that time—CAD. Then, I SELL USD and BUY CAD to expect that the value of the currency pair USDCAD will fall.

Meaning of short forex trading

Usually, you can profit in the forex market by buying a currency and selling it afterward when its price rises. The difference in that currency’s selling and buying price will be your profit. For this reason, most forex traders look for undervalued stocks to invest in, hoping to earn profits someday when their prices rise.

But you can also earn profits when the price of that currency falls. It is called short-selling.

Working of short-selling

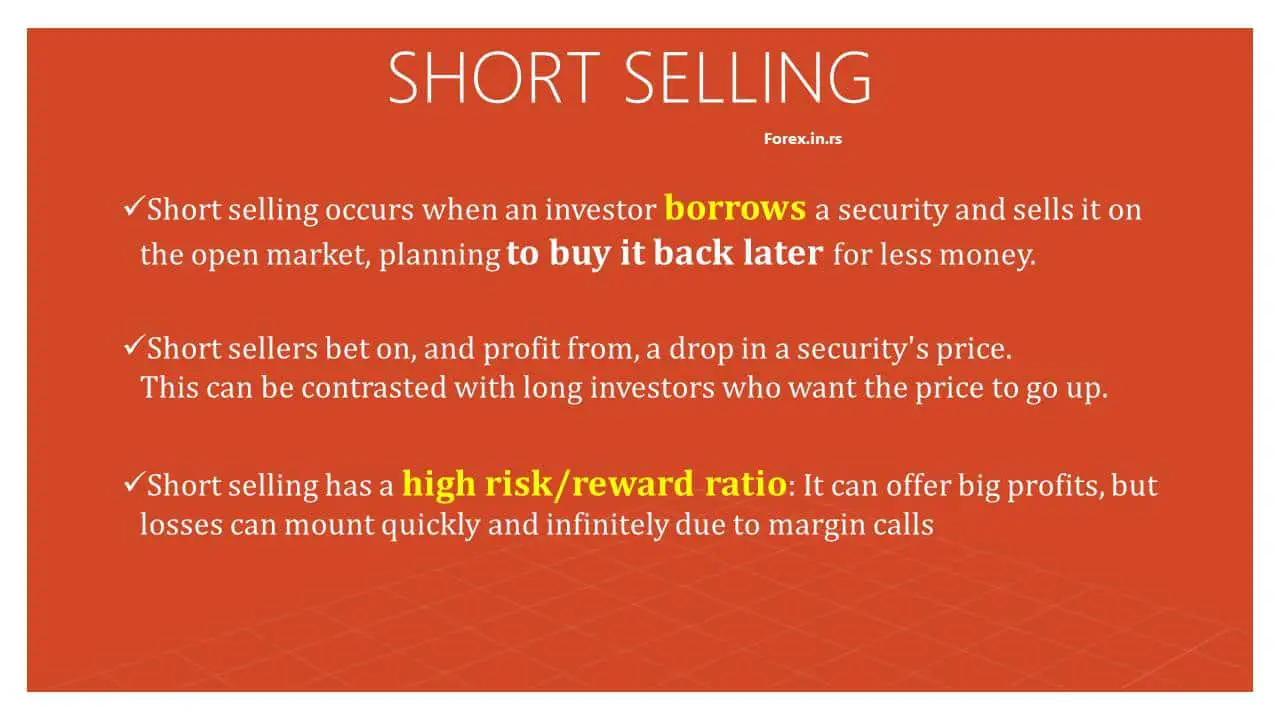

An investor who does not own financial instruments is known as a short seller. He borrows financial instruments from a forex broker and sells them at their current market price.

After some time, when the price of the same instruments falls in the market, the short seller buys them from the market at the prevailing price and returns them to the borrower to close his short trading position. The disparity in the buying and selling prices will be the profit earned by the short seller.

Beginners and professional forex traders use the practice of short-selling financial instruments. Forex trading in the bull and the bear market is the main advantage of forex traders, as they can earn profit in both market conditions by analyzing the market correctly.

Risks involved in short-selling in the financial markets

However, short-sellers should also keep the risks of short-selling in mind. The risk of trading the financial instruments you have bought can be the least as they have unlimited chances of increasing their prices, whereas their price cannot fall below zero. However, in stocks short-selling stocks, the chances of earning profits can be minimal, as zero can be the last limit for falling the prices of short-selling instruments.th, but the chances of increasing their prices can be unlimited. So, you may not be able to earn any profit if the price of the short-sold instruments rises in the future.

Still, many traders in all financial markets short-sell various financial instruments, including CFDs, currencies, stocks, and commodities, to earn profits in the market with falling prices.

Working in forex pair trading

In the forex market, eight main currencies, commonly the Canadian dollar, US dollar, Swiss franc, British pound, Australian dollar, New Zealand dollar, Euro, and Japanese yen, are highly traded in routine. All these currencies are traded by forex traders in pairs instead of individually, as every currency’s price is determined based on the price of the counter-currency paired with it.

In these pairs, the first is the base currency, and the second is the counter-currency. The rate of exchange of these currencies can rise if:

The value of the base currency increases or that of the counter-currency decreases, and the value of the base currency increases along with a decrease in the value of the counter-currency. The value of both currencies increases with a higher increase in the value of the base currency. The value of both currencies decreases with a higher decrease in the value of the counter-currency

Currency pairs are traded in lots daily in the international forex market. You can follow the currency indices to know the rising and falling prices of different currencies. Almost 100,000 units of the base currency are considered a lot to be traded in the forex market.

Many traders practice short-selling or shorting in forex because the risk of shorting in forex is much less than that of shorting stocks. After all, the prices of the currencies in a pair are interrelated.

The forex market environment changes dramatically when the exchange rate of the currencies in a pair increases or decreases, as the exchange rate is determined based on both currencies’ market values.

Risks of short forex

However, the forex market can become frightening for traders from time to time due to unexpected events. The unexpected removal of the pair of EUR/CHF in 2015 by the National Bank of Switzerland can be an excellent example of understanding unexpected events in the forex market. This event has dramatically increased the value of the Swiss Franc by 30% within a few minutes. The traders short of Swiss francs have to bear huge losses.

The vote on Brexit in 2016 is another example of unexpected events in the forex market. Many investors had to bear heavy losses because they were short of the currency pair EUR/GBP.

Costs on short forex

It would help if you also focused on the costs of rollover and financing when the forex market is short, as these can potentially decrease forex traders’ profits.

You will have to pay interest for funding one currency with the other in a pair if one is short. However, you can also earn interest in the currency you are funding depending upon the difference in currency pairs’ interest rates.

Moreover, if you are short on leverage, you will have to pay the broker’s financing cost. This cost can depend on the current rates of interbank transactions plus your broker’s markup.

Thus, knowing how to short-sell in the forex market is essential.