Table of Contents

An exchange rate swap is an agreement between two parties to exchange a series of payments over time to fix the exchange rate between two currencies. Parties involved in a forex swap agree to exchange a set amount of one currency for another at an agreed-upon date in the future. The most common use for swaps is to fix the value of a foreign currency payment stream for a business or individual.

Forex swaps can also minimize the risks associated with foreign currency fluctuations. For example, if a company has income in a foreign currency but needs to pay bills in its home currency, it can enter into a swap agreement with a bank or other party to lock in the exchange rate and minimize its risk. Swaps can also be used to speculate on changes in currency rates.

This article will discuss calculating swap points and their importance in forex trading strategies.

As we wrote in our article about the Forex swap fee:

What is a forex swap fee?

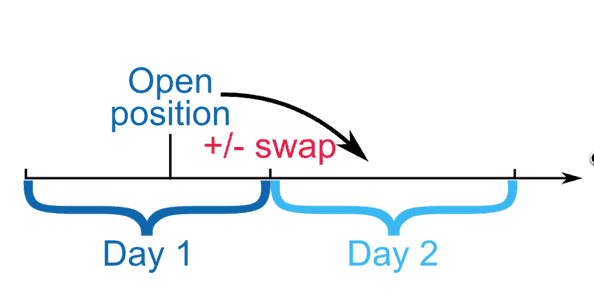

Forex swap fee or rollover represents the interest traders can earn or pay on positions held overnight on the Forex market. The swap fee can be applied if traders have the positions at the daily rollover point, 00:00 server time, or “tomorrow next.”

An extended swap fee will be applied when traders keep long positions open overnight, and swap short will be applied when traders support short positions open overnight.

A forex swap is an essential part of the foreign exchange market. It represents the interest traders can earn or pay on overnight positions. The swap fee can be applied if traders have the positions at the daily rollover point, 00:00 server time, or “tomorrow next.” An extended swap fee will be applied when traders keep long positions open overnight, and swap short will be applied when traders support short positions open overnight.

Swap Points and Their Value in Forex Trading Techniques

Fx Swap points or currency swap points are the difference between the spot and forward rates in currency pairs indicated in pips. Usually, this is carried out for a specific type of currency pair that you want to trade.

Within this, a financial concept called Interest Rate Parity calculates the points. This concept reveals that after investing some money and after getting the returns for different foreign currencies, you have to compare with the interest rate without a doubt.

Forward dealers use this concept to identify swap points in Forex currency trading simply by considering the advantage or the net cost when borrowing and lending currency mathematically over a period covering the forward delivery and spot value date.

How to Calculate Forex Swap Points?

The swap point calculates the cost of exchanging one currency for another.

You need to know the spot and forward rates to calculate a swap point. The spot rate is the current market value of a currency. The forward rate is the price at which two traders agree to exchange currencies in the future.

Formula 1= = Lot x Contract Size x Current Price x Long/Short Interest / 360.

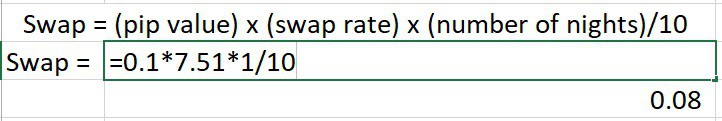

Formula 2 = pip value x swap rate x number of nights /10

To calculate a swap point, divide the forward rate by the spot rate. This will give you the number of swap points needed to exchange one currency for another.

How do you calculate Swap Points using Forward Prices?

To be able to calculate the based currency of the forwarding rate with the U.S. dollar, the equation below can help you:

Spot Price x (1 + Ir Foreign) / (1+Ir US) = Forward Price

Where “Ir Foreign” means the rate of interest for counter currency, whereas “Ir U.S.” indicates the rate of interest in the United States; using this equation, you can calculate the swap points; now you can get:

Forward Price – Spot Price =Swap Points

Spot Price x (1 + Ir Foreign) / (1+Ir US) – 1)

Swap rate calculation forex example

To calculate the swap rate for 1 lot and 1.3 price level in forex, you need to do the following steps:

Swap rate = (Contract x [Interest rate differential. + Broker’s mark-up] /100) x (Price/Number of. days per year)

Swap Short = (100,000 x [0.75 + 0.25] /100) x (1.3000/365)

Swap Short = USD 3.56.

Rollover Swap in Currency Pairs

To understand the equation and how it works for rollover swaps, you must carry out a practical example for calculating the fair value.

Knowing Interbank’s deposit rates for each currency pair you want to deal with is extremely important. You have to understand the predominant terms based on the Interbank period. After learning the terms, using the equation above, you can compute the swap points for the currency pairs you want to deal with by creating the base currency with the U.S. dollar.

Calculating rollovers by discovering the currency pairs’ interest rates is undoubtedly one of the best examples of a rollover swap. Knowing the rollover from the delivery date to the following day, where you can continue doing business in the foreseeable future, is undoubtedly one of the best examples of a rollover swap.

You can also make and crank money using the interest rate of currency pairs you buy and keep them for a long time if the interest rate is 0.25% U.S. Dollar for a short period. Because the interest rate is 5% for the Australian dollar in the short term, the currency held is short, and you must pay the currency pair’s interest rate.

The rollovers annualize a variation in the interest rate of 4.25% of the currency pair. If you aren’t trading with rollovers, you adjust to the specific time frame by implementing the tomorrow/subsequent swap rollovers for 1 year.

Keeping an overnight position for a short AUD/USD, there will be a variation in the interest rate of 4.25% annually divided by 360 for a dealer as a rollover fee. Plus, a rollover period of one day is represented by 30/360. A day rollover swap is defined by tomorrow/subsequent rollovers.

You’ll get the currency pairs’ rollover fee by multiplying the transaction’s sum with the interest rate for tomorrow/ next period. Retail brokers usually charge the rollover fee in pips by converting the currency into AUD/USD to get a fair value price.

Holding an extended position to get the sum equal to the AUD/USD dealers would try to roll over for a long-term deal. However, because of the Forex broker agents’ downward offer, the amount received will be less. Read articles about “Usage of basis swaps for hedging.”

Swaps free brokers list

On our website, we promote mainly swaps-free forex brokers. Please visit our page, where we list top forex brokers.