The Sydney session in forex trading refers to when the Australian forex market becomes active, often overlapping with the Tokyo session. Given that Australia and New Zealand are geographically close and share strong economic ties, their currencies – the Australian Dollar (AUD) and New Zealand Dollar (NZD) – are very active during this session.

The best Currency Pairs to Trade in the Sydney Session are AUDUSD and NZDUSD for range trading, while AUDJPY and NZDJPY are excellent for trend trading strategy. The Sydney session has a narrow price range. Usually, export-related news has a significant impact on AUD and NZD prices.

Here’s a breakdown of the mentioned currency pairs and their characteristics:

- AUD/NZD: This is the direct currency pair of the two closely-tied economies. It sees a lot of action during the Sydney session, but the overall movements may not be as large as some other pairs. This pair can indicate regional economic shifts and is often affected by local economic data and events.

- AUD/JPY and NZD/JPY: These pairs reflect the AUD or NZD and the Japanese Yen (JPY) relationship. This pair often sees increased volatility because the Tokyo and Sydney sessions overlap. Japan and Australia are major trading partners so this pair can be sensitive to economic data from either country.

- USD/JPY: The U.S. Dollar to Japanese Yen is a central currency pair actively traded in all sessions. During the Sydney session, traders can sometimes anticipate movements based on Asian economic data and sentiments.

- AUD/USD and NZD/USD: These pairs showcase the relationship of the AUD or NZD to the U.S. Dollar (USD). The US is a significant trading partner for both Australia and New Zealand. Movements in these pairs can be driven by economic data from either of the countries involved, as well as shifts in global risk sentiment.

- USD/SGD: This is the U.S. Dollar to Singapore Dollar pair. Singapore is a central financial hub in the Asia-Pacific region. The pair might see some activity during the Sydney session due to regional economic activities, but it’s not as directly impacted by Australian or New Zealand economic events.

- NZD/USD: As mentioned earlier, it’s a direct relationship between New Zealand and U.S. Dollar.

Strategies:

- Range Trading: Some pairs might move in a range during the quieter times of the Sydney session. This means they oscillate between support and resistance levels. Traders can aim to buy at the support and sell at the resistance.

- Trend Trading: When there’s a clear trend, either upwards or downwards, traders try to follow that trend. Pairs like AUD/JPY and NZD/JPY may show well-defined trends during the Sydney session, especially if significant economic data is released.

Sydney Session Time

The Sydney or the Australian session in forex trading is when the Australian market is active. Here are the general timings for the Sydney session:

- Australian Eastern Standard Time (AEST):

- Starts: 7:00 AM

- Ends: 4:00 PM

- Greenwich Mean Time (GMT):

- Starts: 9:00 PM (previous day)

- Ends: 6:00 AM

- Eastern Standard Time (EST):

- Starts: 5:00 PM (previous day)

- Ends: 2:00 AM

However, it’s essential to note a couple of things:

- Daylight Saving Time: Australia and the U.S. observe daylight saving time but shift their clocks at different times of the year. This discrepancy can result in a change in the relative start and end times for the Sydney session. When it’s daylight saving time in Australia, the starting and ending times of the session will shift by an hour.

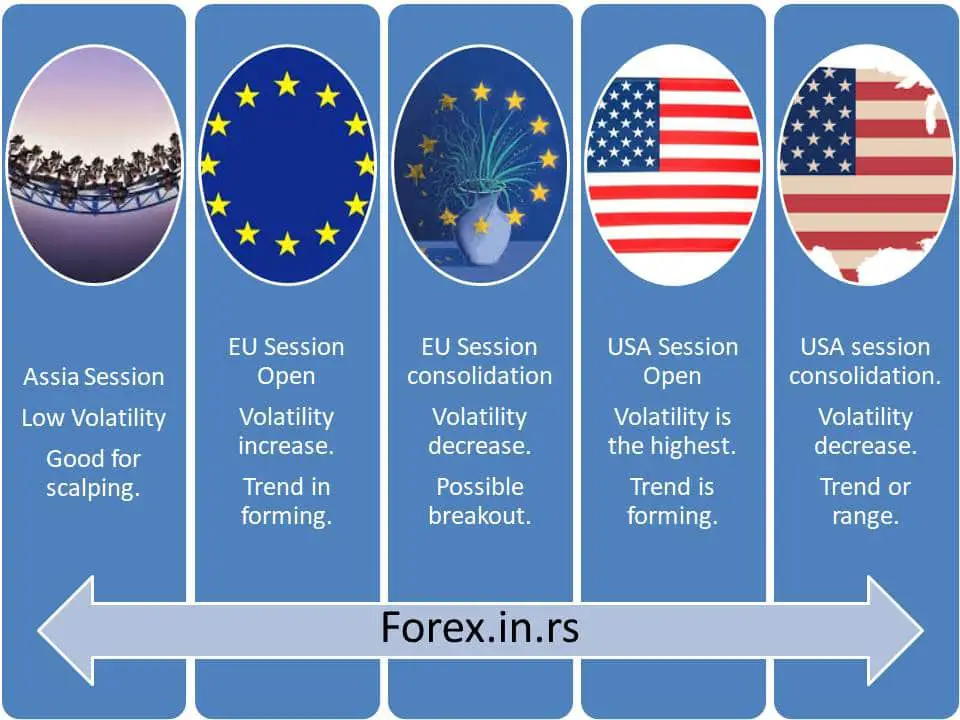

- Overlap with Tokyo Session: The Sydney session overlaps with the Tokyo session (the Asian session), which can often lead to increased volatility during the overlap hours.

Always check the specific local times each year, especially around daylight saving changes, to be accurate in your trading activities.

In conclusion, the best currency pairs to trade during the Sydney session largely depend on a trader’s strategy, risk tolerance, and the specific events on a given day. Continuously monitor the economic calendar and news events to anticipate potential movements.