Table of Contents

Your trade records and exits may require many nuances if you’re a seasoned trader with sophisticated strategies. However, the minimum stock order type can still cover your specific financial requirements. Alternatively, you can choose from advanced stock orders if your commands require more tweaks.

TD Ameritrade is one of the largest and most popular online brokerages, offering investors a wide range of services and access to hundreds of markets. Setting up a stop loss for your position on TD Ameritrade is easy and essential for protecting your assets against unexpected losses. This article will walk you through how to set up a stop-loss order on the desktop platform.

Many TD Ameritrade users use the Trading Ideas website or TrendSpider for the best stock trading opportunities.

How to set a stop loss on TD Ameritrade?

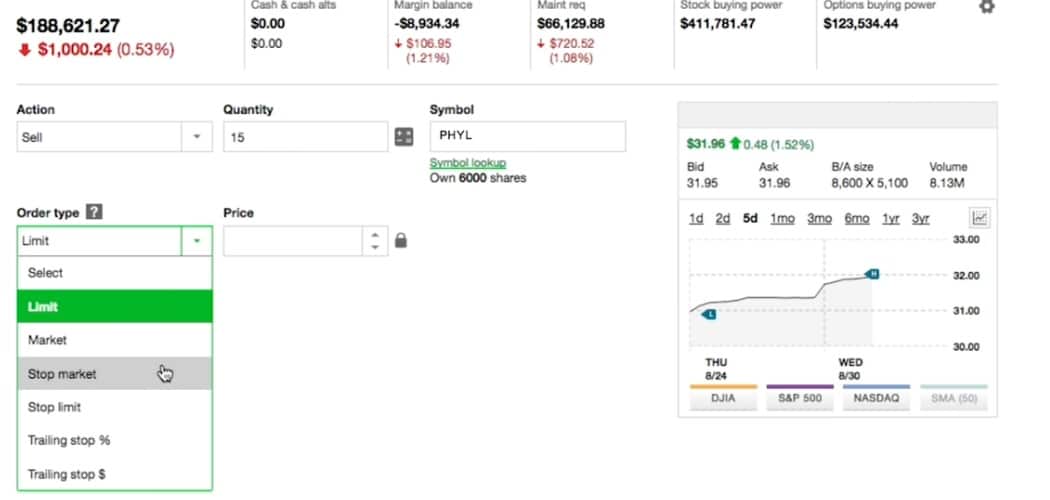

To set a stop loss on Thinkorswim, TD Ameritrade’s platform, you must define “Order type” when creating your position to set a stop loss on the Desktop platform. To select fixed stop loss, choose the “stop market” order type, or if you want to limit the order, choose “stop-limit.”

See the below screenshot:

A stop-loss order with a brokerage automatically closes out an existing position if the price falls beyond a certain pre-defined level. In other words, if you’re currently holding onto stocks but don’t want to risk taking any further losses, setting up a stop loss will ensure that your holdings are automatically sold off at this predetermined price level, should it be reached. This helps protect your investments from significant losses by limiting the amount you can lose in any trade.

Setting up a stop-loss order on TD Ameritrade’s desktop platform is relatively straightforward and can be done in steps:

- Log into your TD Ameritrade account and select “Trade” from the menu bar.

- In the “Symbols” field, enter either the name of the security you wish to place a stop loss order against or its ticker symbol.

- Underneath “Order Type,” select either “stop market” or “stop-limit” as appropriate for your needs. A “stop market” order type will create an immediate selloff at whichever price you specify, whereas, with a “stop-limit” order type, you can select both your entry and exit points—i.e., when exactly you want the stop-loss order to trigger, as well as what price it should close out at—which provides additional protection against extreme price movements during volatile markets.

- Finally, enter whatever other information (such as quantity, duration, etc.) is necessary for completing your trade before submitting the order.

- Once submitted, confirm within your accounts page that the position has been opened with a valid ‘Stop Order’ attached to it per your specifications before leaving it alone—do not attempt to modify or cancel this already placed order unless necessary!

Because these types of advanced orders can be risky and expensive if mishandled, you’ll probably need to learn more about these types of progressive orders just as you would with the more basic stock orders. As a result, you may need to become familiar with all the trading platforms described here to understand when to utilize them.

Now, before we get started, there are very few things to keep in mind. First, orders that are conditional longitudinal orders are the two advanced purchase types. Conditional implies that command will only be filled if certain conditions are met. Second, when a court order is durational, it appears to mean that it must be carried out within a specific time frame, also known as “time in effect.”

How to set a stop loss on Thinkorswim?

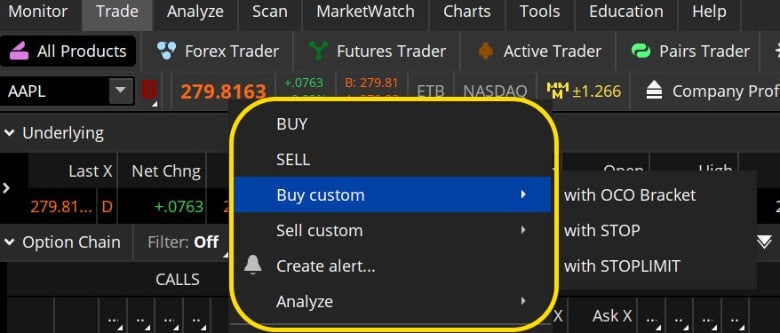

To select a stop-loss order type, choose from the menu to the right of the price. Choose “Buy custom” or “sell custom” order and then select the “stop” option to set stop loss manually. You can also define stop loss as a Sell Limit Order set at your target price and a Stop Loss Market Order set at your risk price.

When you put the Buy custom or Sell custom position, you can choose the OCO BRACKET option, and then an order, once filled, cancels the execution of another order.

How to set a stop loss on Thinkorswim mobile?

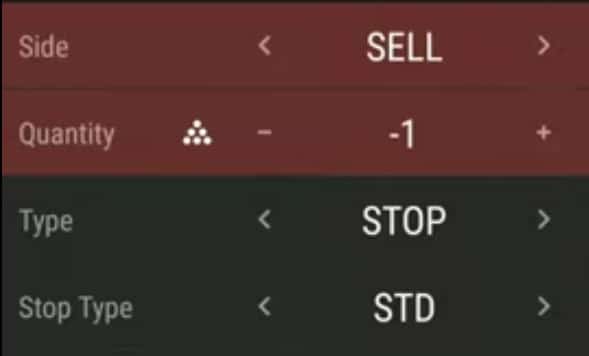

To set a stop loss on Thinkorswim mobile, choose “Stop” and stop type “STD,” which means an order to buy or sell a stock will be stopped once the stock price reaches a specified price.

Thinkorswim order types

- 1st Triggers 2 OCO

- 1st Triggers 3 OCO

- 1st Triggers All

- 1st Triggers OCO

- 1st Triggers Sequence

- Blast All

- EXTO

- GTC+EXTO

- Limit

- Limit on Close

- Market

- Market on Close

- OCO (one cancels the other)

- Stop

- Stop Limit

- Trailing/Trailing Stop Limit

Thinkorswim conditional orders are orders filled under specific conditions that will only be executed or activated in the market if criteria are met, such as stop, stop limit, limit order, etc.

Thinkorswim advanced orders

Thinkorswim advanced orders are OCO brackets, trailing stop, blast all, 1st triggers orders and FOK orders.

One-Cancels-Other Order in Thinkorswim

In an OCO order, two orders can be canceled when the order is filled. This may not seem easy in context, but it’s pretty simple.

Suppose you purchase fractions of a company currently trading at $50 per share. In addition, you don’t want to start losing more than 30 percent of your investment.

OCO orders may include a “Take Profit” order at $40 and a sell stop at $66. Stop-loss is ordering at $36, for instance.

At $52, your role and profit will be closed; sales stop will be promptly deleted, eliminating the danger of accidentally opening a position on the sidelines at $38.

What is Bracket Order in Thinkorswim?

Bracket order will place OCO sell limit (take profit) and sell stop for your long order. Likewise, you will place an OCO buy limit (take profit) and buy stop when you set a short position bracket order.

How to place a bracket order in Thinkorswim?

To place a bracket order under the Trade tab, select a stock, choose Buy custom or Sell custom, and then select OCO bracket order. After that, you can define price levels for a stop-or-take profit.

If you join a long position, a tournament order will sell an OCO restriction profit taker and stop selling on the position.

This order will put an OCO purchase restriction at a profit halt if you join a sell order.

Stop Limit Order

Using a temporary hold, you can specify a price point for execution, clarifying the price where a directive is needed to be provoked, and it limits the cost at which the sequence should be carried out. For example, “I would like the act of purchasing (sell) at cost X, but none of them greater (lower) than cost Y,” it says.

Let’s say you’re interested in a $120 stock. At $125, you’d like to buy it, and at $130, you’d like to stay away from it. A buy limit of $130 and a buy-in of $125 are placed. The (specified) price lower than your order will be triggered, and any orders above You have reached your price limit will be prevented. Your order will not fill if the share price rises above $130. In the case of short sales, you’d do the opposite.

Your first trade could include brackets with halt and control stop loss if you use the think or swim framework in partnership with TD Ameritrade. Then, if you click Choose a Stock in the Trade tab, you will see a menu that says “Sell custom” or “Buy custom.”

What is Day Order VS. (GTC) Good Til Canceled?

A Day Order means that the order will expire at the end of the day, while a GTC (“Good Till Canceled”) order means it will remain in place until you cancel it or until it’s filled.

It is possible to describe the duration of other conditional orders using this durational order, but it is not recommended. Instead, keep this order active until I can complete it. Then, decide to cancel it if necessary, in essence. As soon as the market closes, any position orders that haven’t avoid filled are usually agreed to cancel outright. This is the case to maintain a buy or place an order for purchase for as long as your broker allows you to (generally over 90 days).

Time in Force: A Better Note

Just a bit of trading sense: you’re putting an order in a conditional form that includes more than one order to ensure that each order’s duration in effect (TIF) is identical before submitting the order. For example, that to be immediately canceled should not be a GTC better ’til canceled order.

Another thing to keep in mind is the difference between the order in the day’s events are canceled at midnight each night) and a GTC purchase, which isn’t canceled). It’s a “mystery job,” flying instead of a refund zone the next day is not something you want to discover. The menu of TIF can be found on the think or swim console a little bit right a sales order.

Trailing Stops in Thinkorswim

Not really “orders,” Stops on the way are simply ways to stop moving or “trailing” (trailing stop orders). Trailing stops can be viewed as exit strategies.

It works like this: You also bought as your entire statement is now black. What could you possibly have a look at? There is no need to remove this. So, if the market goes down, It can be moved up to avoid losing money. As the price rises, you can “trial” your healthy cash flow to ensure you don’t lose out.

How to set trailing stop loss in TD Ameritrade desktop?

To set a trailing stop loss on the TD Ameritrade Desktop platform, you must define “Order type” when creating your position and then define trailing stop loss in dollars or percentages.

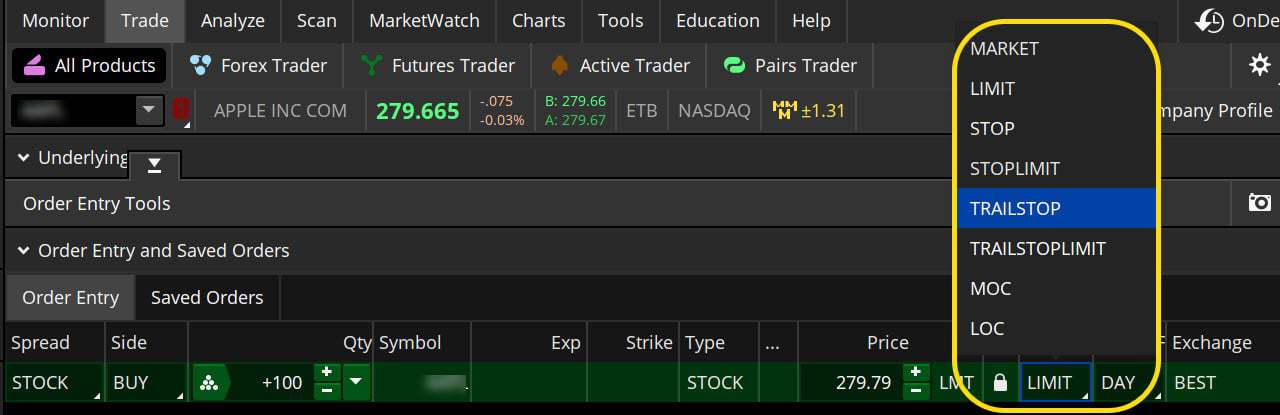

How to set trailing stop loss in Thinkorswim?

To set trailing stop loss in Thinkorswim, select an order type, choose from the menu to the right of the price, and then select the Trail stop option.

For example, let’s say you want your trailing halt to be sure to the left of your current role.

Your trailing stop will also climb higher if your role continues to rise.

Stop orders are triggered if the cost of your role declines to the price match of your dragging stop, closing one’s position.

Okay, and the distance between me and my current role, should the downtrend stop after that? It can quantify its trailing finish in several different ways. First, use the Think or Swim platform to purchase tickets and choose from the drop-down menu order type.

You should know several things about stop orders before actually implementing anyone in the following order types. First, it’s possible to miss the market completely When you use a stop-loss order. You might not be able to cause the order to be placed at the stop-limit prices and then have it executed as close as possible to the price limit in a fast-moving market. Second, trailing stop orders are not guaranteed to be performed at the activation price or even close. These orders rival other market orders as soon as they’re active. Finally, limit orders aren’t guaranteed to be filled because the market will never attain the limit price.

When it comes to the fine-tuning of the entryway and the exit way, sophisticated order types can be beneficial. Each one has a specific purpose. First, however, you must know what they are. And, as with any new exchange, a thought element, prevent or treat at first by simulating a world as an example think or swim platform, which allows you to trade virtually.

If you want to cancel your order immediately, you can use the IOC option.

Unlike an all-or-nothing order, durational ordering has to do with the rather than quantities. When the timer expires, all unfulfilled orders will be canceled, according to the order of the IOC. For this order or sequence, you could specify this same time in effect at the time of the order.

Assume you’re looking to purchase 4,000 company shares, but you would not want to pay a wide price to get them delivered to you. And you do not wish to disturb the market if the volume is low. Five seconds before the order window closes, you can place an order placed on the market by IOC. For example, you might only get an incomplete fill of 4,000 shares. If prices drop, you can place another order.

Unlike investment firms that can trade at high volumes, most shareholders don’t have to fret about the marketplaces. In the form of a may influence the penny stock market, for example, according to some. However, most investors avoid such high-risk investments (brokers dissuade you from doing it) as a rule of thumb). Because of this, an order like this isn’t often needed or wanted.

“All or Nothing” order

Don’t forget to include the number of shares you are trying to ask for. You’ll never obtain only a partial fill with an AON order. The amount you order will be delivered in full, as enough stock is available when you place your order.

This ensures that the company is famous and is rare: People who trade undervalued stocks have been familiar with AON orders. Moreover, a high-risk profile means that most shareholders avoid penny stocks, and most brokers like them to reduce the client-broker relationship. As a result, there are few options for ordering AON.

Fill or Kill FOK Order

As a result of its uniqueness, FOK orders are the only type that should not be called into your broker on the street; strangers will get it wrong every time impression. This is because FOK orders are similar to There is no middle ground (AON) orders, but they have a time limit equal to the immediacy of cancellation (IOC).

Why is this type of order necessary? So rare: FOK orders have too many conditionals to be practical in most situations while nuanced and geared toward accuracy. Many traders are left to other trading platforms without completing their trades. By using Orders in different categories, market participants have effectively eliminated the order to fill or kill due to low demand.

What trading tool to use with the combination of TD Ameritrade?

Trendspider’s automated technical analysis online platform is the best tool you can use with TD Ameritrade. Using this tool, you can develop no coding strategies, detect the right time to enter a trade, spy on big investors, analyze stocks and forex, etc.

Concluding Thoughts

Setting up a stop-loss order is essential to any investor’s portfolio strategy. It helps protect against unexpected drops in stock prices while still allowing them to profit from any potential upside movement in their chosen securities over time. Following these simple steps, investors can easily set up protective stops via TD Ameritrade’s desktop platform within just minutes!