The term “lot” refers to a standardized measure representing the amount of currency exchanged in a transaction. It is the basic unit for buying and selling currency, and orders on trading platforms are specified in lot sizes. The most common standard lot size is 100,000 units of the base currency. However, there are mini, micro, and nano lots for traders looking to trade smaller amounts, corresponding to 10,000, 1,000, and 100 units, respectively. These lots offer flexibility in trading strategies and risk management.

The five lots in forex represent a trading size of 500,000 units. Buying five lots of EUR/USD in forex trading means purchasing 500,000 units of the Euro, using the US Dollar to pay for it. Therefore, if you profit ten pips using five lots trading EURUSD, you will profit $500.

When trading with five lots in the forex market, particularly with a currency pair like EUR/USD, you’re engaging in a transaction that involves a significant volume of currency—500,000 units of the base currency (in this case, Euros) if we’re talking about standard lots. Each standard lot consists of 100,000 currency units, so five lots multiply this by 500,000 units.

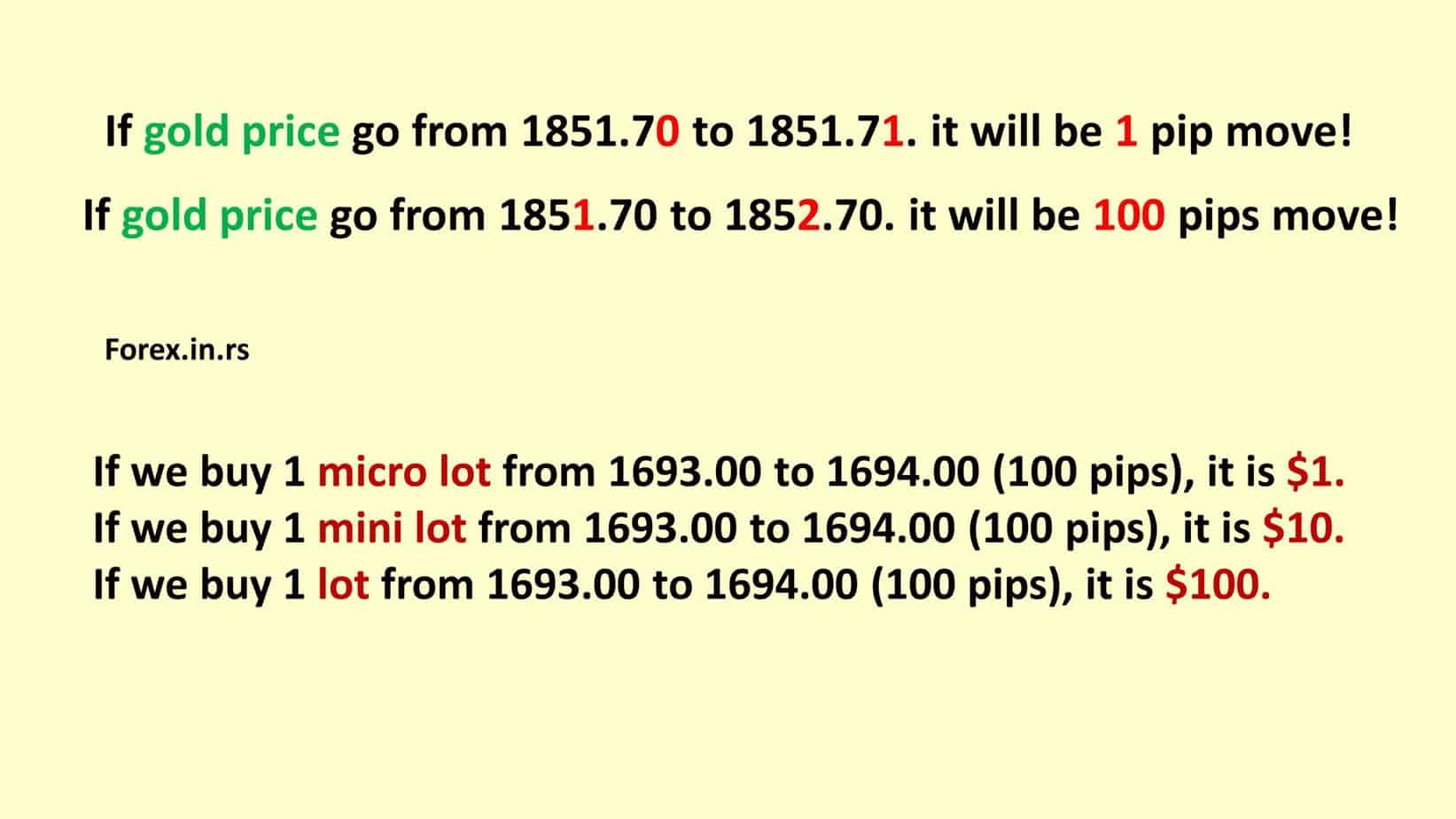

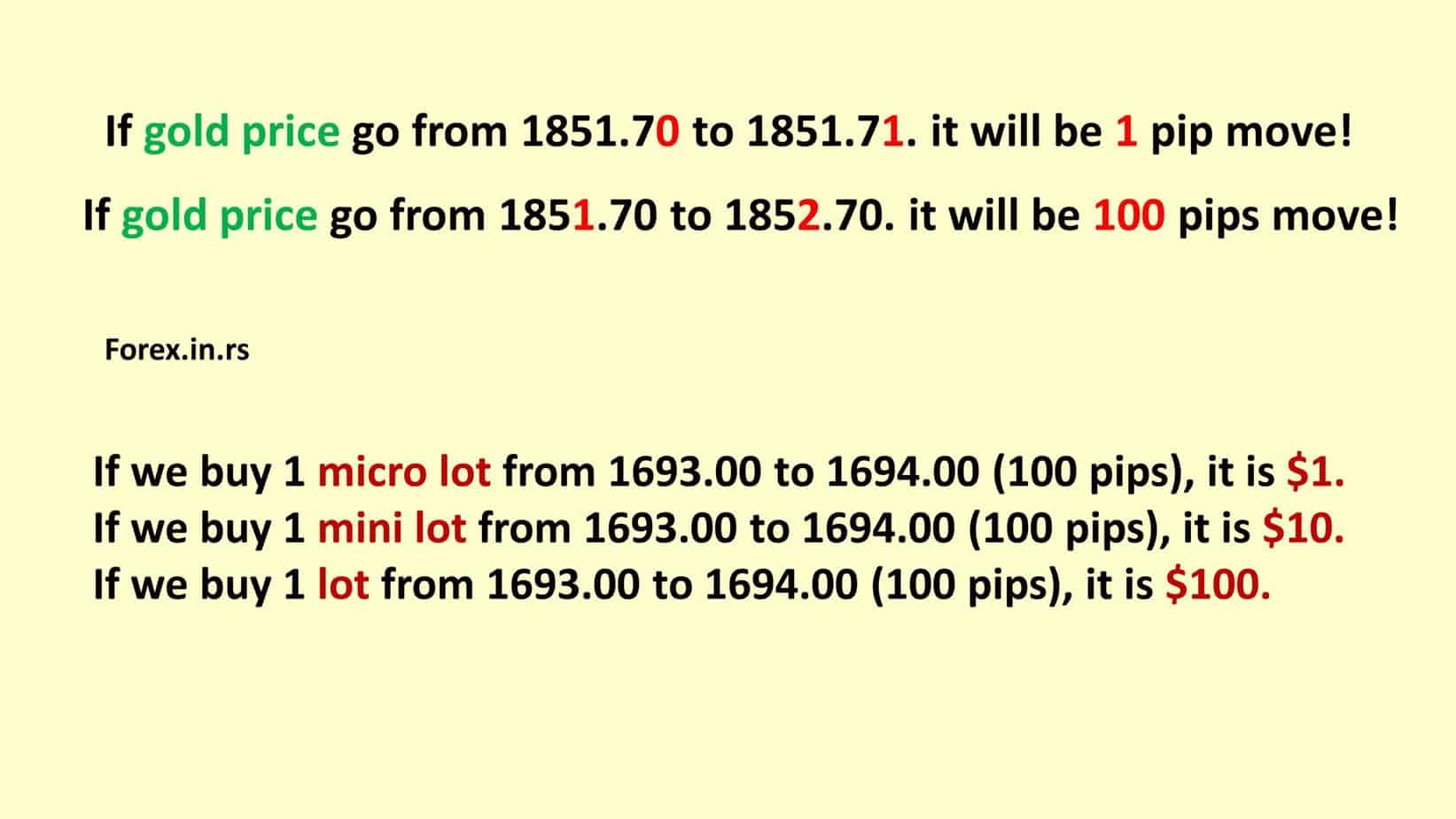

The profit or loss from such a trade is determined by the number of pips the currency pair moves and the value of each pip. A “pip” is the most minor price move a given exchange rate can make in forex trading based on market convention. For most currency pairs, a pip is a movement in the fourth decimal place (0.0001). However, a pip is the movement in the second decimal place (0.01) for Japanese Yen pairs.

To calculate the monetary value of a pip when trading EUR/USD, we use the formula:

For EUR/USD, assuming an exchange rate of 1.0000 for simplicity, the value of one pip for one standard lot (100,000 units) is $10 (0.0001 / 1.0000 * 100,000). Therefore, when trading five lots, the value of one pip is $50 ($10 * 5).

Given this, if you make a profit of 10 pips on a trade where you’re trading five lots of EUR/USD, your total profit would be:

Total Profit=Pips Gained×Pip Value

With a ten that IP movement in your favor, trading five lots of EUR/USD, you would earn a profit of $500, considering there are other costs (like spread or commission) involved in the calculation. This example underscores the leverage effect in forex trading, where small market movements can lead to significant profits or losses, especially when trading large volumes.

Personal Trading Account: Risking 1% with 5 Standard Lots

When traders use five standard lots, they deal with 500,000 currency units since one standard lot is 100,000.

- Account Size: $100,000

- Risk per Trade: 1% of $100,000 = $1,000

- Trade Volume: 5 standard lots = 500,000 units of currency.

The trader meticulously calculates the stop-loss placement to maintain the 1% risk on a $100,000 account while trading five standard lots. The stop-loss has to ensure that if the Trade goes against them, the maximum they would lose is $1,000. This requires precise pip value calculation relative to lot size and the acceptable pip movement against their position, which amounts to a $1,000 loss.

Trading for a Prop Firm: Risking 0.25% with 5 Standard Lots

Prop firms often have more conservative risk management strategies. The dynamics change if a trader is limited to risking 0.25% of their capital on a single trade.

- Required Account Size for 5 Lots: Assuming the same trade volume (5 standard lots) but at a 0.25% risk level, we need to calculate the necessary account size to adhere to this stricter risk management rule.

Given that the risk per Trade is 0.25% and using the same approach as before (but now for a smaller percentage of the account), the calculation for the required account size to trade five lots under these conditions will show a significant increase in the required capital. This ensures that the maximum loss (now limited to 0.25% of the account size) on a trade does not exceed the trader’s risk tolerance threshold.

Calculation:

- Risk per Trade at 0.25%: The trader can only risk $1,000 (the same dollar amount as in the personal account example) if they want to keep the risk management consistent in dollar terms. However, since $1,000 represents 0.25% of the account size in this scenario, the total account size needs to be more significant to accommodate the same volume (5 lots) of trading.

To find the necessary account size for trading five lots at a risk of 0.25%, the formula is:

Given a $1,000 risk is now 0.25% of the account, the calculation would give us the new required account size for trading at a prop firm under these conservative risk management guidelines.

Calculate the required account size to maintain a 0.25% risk level while trading five standard lots.

To trade five standard lots while adhering to a 0.25% risk per Trade guideline, a trader working for a prop firm would need an account size of $400,000. Given the tighter risk management constraint, this ensures that the maximum loss from any single trade does not exceed the firm’s prescribed risk tolerance level.

Trader at Leanta Capital

Igor has been a trader since 2007. Currently, Igor works for several prop trading companies.

He is an expert in financial niche, long-term trading, and weekly technical levels.

The primary field of Igor's research is the application of machine learning in algorithmic trading.

Education: Computer Engineering and Ph.D. in machine learning.

Igor regularly publishes trading-related videos on the

Fxigor Youtube channel.

To contact Igor write on:

igor@forex.in.rs