I wrote several articles about this topic. To read about the best Islamic account broker, visit my review. I explained that HF Markets’ broker is Halal. Additionally, I explained in detail what Riba is. I tried to share my opinion about whether forex is halal or haram (personal view) and whether stocks are trading haram. I also tried to answer a similar question about whether investing in stocks is haram or halal (long-term). For Islamic readers, I wrote about Murabaha financing, too.

Of course, to learn about forex Islamic accounts, read my article.

How Does an Islamic Trading Account Work?

Sharia, or Islamic law, applies to Muslims and prohibits them from earning interest on the money they invest or keep in a bank. Since many Muslims are interested in Forex investing, some brokers now offer Islamic Forex accounts that comply with Sharia law. Forex trading without interest is possible in this Islamic account, also called a no-riba forex account.

The broker is considered Sharia-compliant if he does not charge the trader the common interest on open forex trades or pay the trader the common interest on open forex trades.

Many forex brokers offer a particular type of account with no interest payments or charges. This can affect the forex trader’s trading cost since, typically, the forex broker will profit from the interest payment from a trade account. In some cases, to compensate for the loss of the interest income, the broker may charge spreads or commissions for the Islamic account, which are slightly higher. However, since forex brokers are interested in increasing their market share in Islamic countries, they often do not charge higher commissions on forex accounts. So, forex traders benefit from opening an Islamic account.

Using an Islamic account will affect the cost of trading. The forex trader will find it easy to adopt a long-term trading style, especially if the trader is following the trends. There is no additional cost in waiting long to make the maximum profit since the trader does not have to pay any interest. Usually, an Islamic account has no other restrictions on the trades made. However, it has been noticed that a few forex brokers are known to force forex traders to close the trades opened for a long term in an Islamic account after a specified period. Hence, before opening an Islamic account, it is advisable to check the broker’s rules to close long-term trades.

What is the best Islamic forex broker?

The best Islamic forex broker is Avatrade because of its excellent Arabic support, tight spreads, various Islamic accounts (no overnight swap), and reliable MT4 platform. As a result, Avatrade has built a strong brand and outstanding reputation in the Middle East.

Best Islamic Forex Brokers List

| Forex broker Review | Visit | Min. lot size | Max. leverage | Min. deposit |

|---|---|---|---|---|

Avatrade | VISIT AVATRADE | 0.01 | 1:400 | $1 |

HFM | VISIT HFM | 0.01 | 1:1000 | $1 |

Instaforex | VISIT INSTAFOREX | 0.0001 | 1:1000 | $10 |

FxPro | VISIT FXPRO | 0.01 | 1:500 | $100 |

IC Markets | VISIT IC MARKETS | 0.01 | 1:500 | $200 |

XM.com | VISIT XM | 0.01 | 1:888 | $5 |

| VISIT EXNESS | 0.01 | 1:2000 | $10 | |

| Octafx review | VISIT OCTAFX | 0.01 | 1:400 | $50 |

Please see my video about Islamic accounts:

The best Islamic forex brokers that offer Islamic accounts are:

- Hf Markets

- IC Markets

- Avatrade

- OctaFX

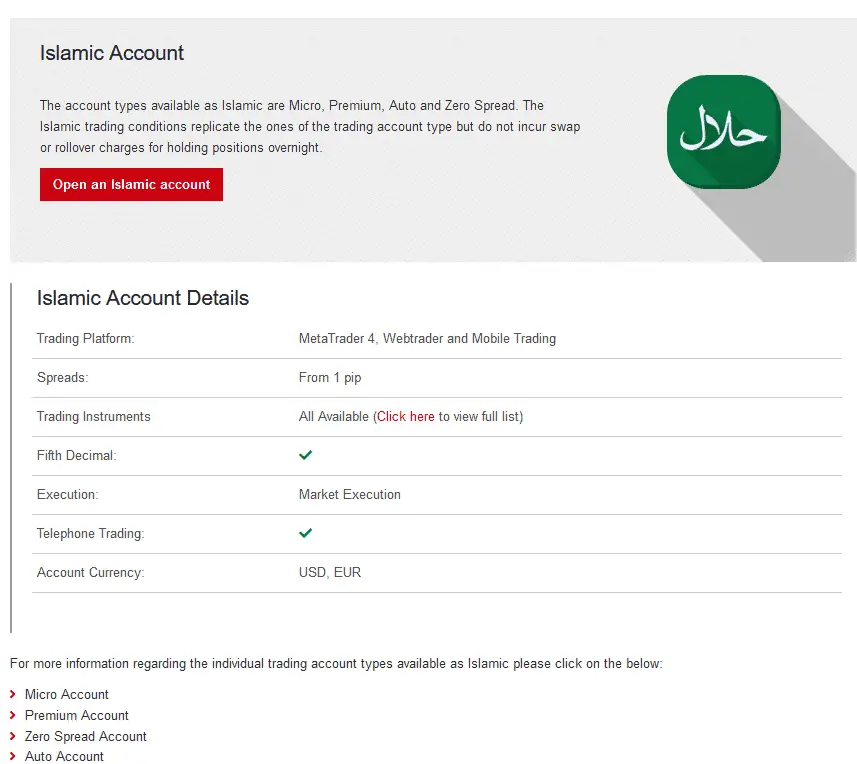

Hotforex Islamic accounts represent trading accounts offered by Hotforex brokers, which do not incur overnight swap or rollover charges for holding positions. Spreads are from 1 pip; the account can be USD or EUR.

If you’re a Muslim searching for the best available trading account in the Islamic world, then IC Markets is your ideal account.

According to Islamic customers, charging or receiving interest isn’t allowed. IC Markets are good for offering trading accounts with the swap-free choice to cater to great global Islamic finance demand where the interest isn’t part of a broker’s business model.

The IC Markets swap-free Islamic forex accounts to ensure clients are billed a flat rate fee for financing rather than paying interest. So whether you’re looking to trade on indices markets, commodities, or forex, you’ll remain assured that you won’t need to pay any interest on an Islamic account with IC Markets.

With IC Markets, swap-free forex trading becomes quite simple for the clients. This lets you change the Standard account and Raw Spread Types for swapping for free. In addition, you can trade on the MetaTrader 4 (MT 4), web trader or MetaTrader 5 (MT5), and cTrader platform through the IC Markets trading account.

Holding periods and rates are subject to change and reflect high-risk conditions in the market at a particular time.

With IC Markets, you get some of the best conditions for trading with ASIC-regulated brokers. Thus, clients are assured that all their trades are locked through the state-of-the-art infrastructure set up for trading.

- Minimum deposit of $200

- Allows bank transfers, credit cards, and PayPal

- Has over 60,000 users.

- Has demo, mini, standard, zero spread, raw spread, and Islamic accounts.

- Variable spreads.

- Supports several platforms.

- It only offers email support.

The global forex trading giant Avatrade has its Islamic account for trading, living up to the company’s reputation. After offering clients trading options on fixed spreads, they always work according to all strategies.

Avatrade’s company ethos respects the beliefs of their clients and, therefore, ensures correct Islamic regulations are followed.

After opening a standard account, the account manager helps you change to a swap-free trading account while ensuring that the trading account remains compliant with the Sharia law. Islamic account requests are generally processed in one or two business days.

* Minimum deposit of $250

* All payment options

* Over 200,000 users.

* Offers a demo, mini, micro, standard, and Islamic account.

* Both fixed and variable spreads.

* Supported by all trading platforms

* Has both live, phone, and email support.

- Minimum balance of $5

- No Paypal

- Over 30,000 users.

- Provides demo, micro, mini, standard, zero spread, and Islamic accounts.

- Variable spreads.

- Offers no live customer support.

- Supports mobile apps.

We have examined some of the viable options for Islamic forex trading. Before settling on one, consider all the factors and specs we considered.