Table of Contents

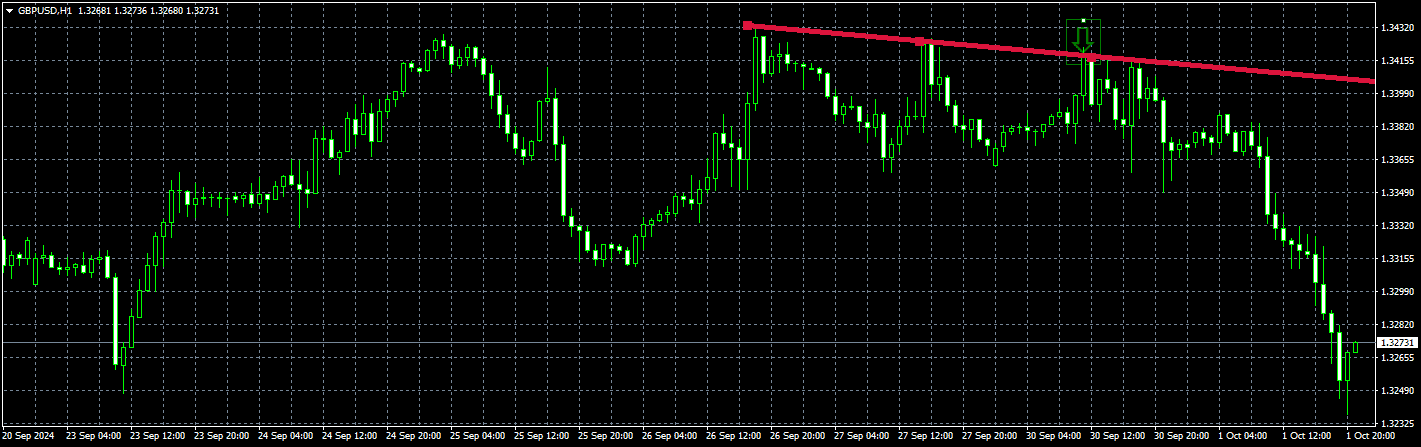

Yesterday, I published a video about my idea to short GBPUSD at 1.342, which reached 1.326, risking 15 pips. I made a huge profit.

See my video of the moment when I made the trade:

Now I am asking myself: Is it possible to predict which day in a month or week has the most significant chance of such a huge drop or bounce?

Forex trading strategies are often built around identifying patterns that can provide traders with a statistical edge. One strategy involves trading based on historical data to optimize profitability at specific times or days in the month. In this case study, we examine the performance of a custom-built Expert Advisor (EA) designed to open positions at midnight and close them at the end of the day, analyzing which days in the month yielded the highest gains.

Objective of the Study

The primary goal of this experiment was to determine which days of the month, from 1 to 31, had the most significant impact on profitability. To qualify as a “profitable day,” the gain must have exceeded 1.5 times the Average True Range (ATR) in a bullish or bearish direction. The ATR is a critical indicator in forex that measures volatility, and using a multiplier of 1.5 ensures that the strategy focuses on solid moves.

I took 7 US forex pairs in 8 years because I didn’t want too long a history.

Methodology

- Trading Strategy: The EA was programmed to open a position at midnight and close it at the end of the trading day (23:59), capturing daily price movements.

- Evaluation Criteria: A profitable day was defined as any day where the price movement exceeded 1.5 times the ATR in either direction (bullish or bearish).

- Period of Study: Data was collected over an unspecified number of months, with the results representing the cumulative number of times a given day of the month met the profitability criteria.

Results Overview

The table below shows how many times each day of the month met the gain requirement of at least 1.5 ATR during the analysis period.

| Day | Count |

|---|---|

| 1 | 39 |

| 2 | 14 |

| 3 | 35 |

| 4 | 28 |

| 5 | 8 |

| 6 | 21 |

| 7 | 14 |

| 8 | 7 |

| 9 | 7 |

| 10 | 35 |

| 11 | 21 |

| 12 | 42 |

| 13 | 42 |

| 14 | 35 |

| 15 | 42 |

| 16 | 17 |

| 17 | 35 |

| 18 | 28 |

| 19 | 21 |

| 20 | 35 |

| 21 | 42 |

| 22 | 21 |

| 23 | 28 |

| 24 | 21 |

| 25 | 37 |

| 26 | 28 |

| 27 | 14 |

| 28 | 28 |

| 29 | 38 |

| 30 | 14 |

Key Insights

- Most Profitable Days:

- In the months of the 12th, 13th, 15th, and 21st days, they consistently delivered profitable outcomes, each achieving 42. This indicates that these days offer the highest chances of capturing a move greater than 1.5 ATR, making them prime candidates for trading.

- Day 1 was also highly profitable, with a count of 39, followed closely by Day 29 (38) and Day 25 (37).

- Moderately Profitable Days:

- Several days, including Days 3, 10, 14, 17, and 20, showed decent profitability, with counts in the mid-30s. These are days worth paying attention to as they still offer favorable opportunities for price movements exceeding the ATR threshold.

- Least Profitable Days:

- The least profitable days were Days 5, 8, and 9, with counts of 8, 7, and 7, respectively. These days, they consistently underperformed and might not be optimal for trading with this particular strategy. Traders might want to exercise caution or avoid trading on these days to minimize risk.

- Clusters of Profitability:

- One interesting observation is the clustering of profitability around mid-month. Days 12 through 15 and 21 through 25 consistently delivered high counts, suggesting that the market tends to experience significant volatility during these periods.

- Monthly End Surge:

- Both Days 25 and 29 exhibited strong performances toward the end of the month. This may be due to market factors such as monthly rebalancing, economic report releases, or position adjustments by institutional traders.

| Day of the Week | Count |

|---|---|

| Monday | 196 |

| Tuesday | 197 |

| Wednsday | 203 |

| Thursday | 168 |

| Friday | 133 |

Based on the data, the most significant gains, where the price moves at least 1.5 times the daily Average True Range (ATR), tend to occur midweek. Wednesday has the highest count of such movements, with 203 instances, followed closely by Tuesday at 197 and Monday at 196. This suggests that midweek trading days are generally more volatile, possibly due to key market events or economic reports released during this time.

On the other hand, Thursday shows a slight drop in volatility, with 168 big movement days, and Friday has the fewest, with only 133. This could be attributed to traders preparing for the weekend, reducing market activity and fewer significant price moves. Therefore, the middle exploring day offers the most favorable conditions and may be beneficial for large price swings based on this strategy.

Conclusion

The findings from this case study provide actionable insights into the most profitable days of the month for forex trading based on this particular strategy. Days such as the 12th, 13th, 15th, and 21st consistently outperformed others, offering substantial opportunities for traders to capture significant market movements.

For traders looking to refine their trading strategies, this analysis suggests focusing on mid-month periods and the last few days for the highest chances of success. Conversely, days like the 5th, 8th, and 9th may be best avoided, as they historically yielded the fewest profitable movements.

Further Considerations

- Refining the Strategy: To refine this strategy further, exploring other volatility indicators in combination with ATR may be beneficial.

- Broader Market Impact: Understanding the macroeconomic factors driving these specific days’ movements could enhance the strategy’s effectiveness.

This study is a solid foundation for optimizing daily trading strategies and emphasizes the importance of data-driven decision-making in forex trading.