Picking up a stock depends on your experience level, available capital, trading style, etc. You may have different preferences for trading altogether like position trading, swing trading, short or long-term trading, or may have the intention of investment. Thus, to choose the best share, the best you can do is add this into your trading plan and risk management in place. It would help if you made your trading plan to change, transform it on the way as you learn and grow.

The first thing you have to do is to know your risk appetite. You can use the risk to reward ratio for it. It is the rate that states how much risk you are willing to take to get the desired outcome. For example, the risk to reward ratio of 1:2 means, for each $2, you are willing to risk $1.

Also, regardless of your trading personality, you need to plan a strategy for selecting stocks for future trading or picking swing trade stocks; it can be anything!

What Time of the Day is Best to Buy Stocks?

The best time of the day to buy stocks is from 30 minutes to 1 hour after the stock exchange opening. In this period, the opening price range is formed, and it is the period of the biggest liquidity and volatility for trading assets. Usually, the best time to buy stocks is Tuesday after the opening range (one hour after markets open).

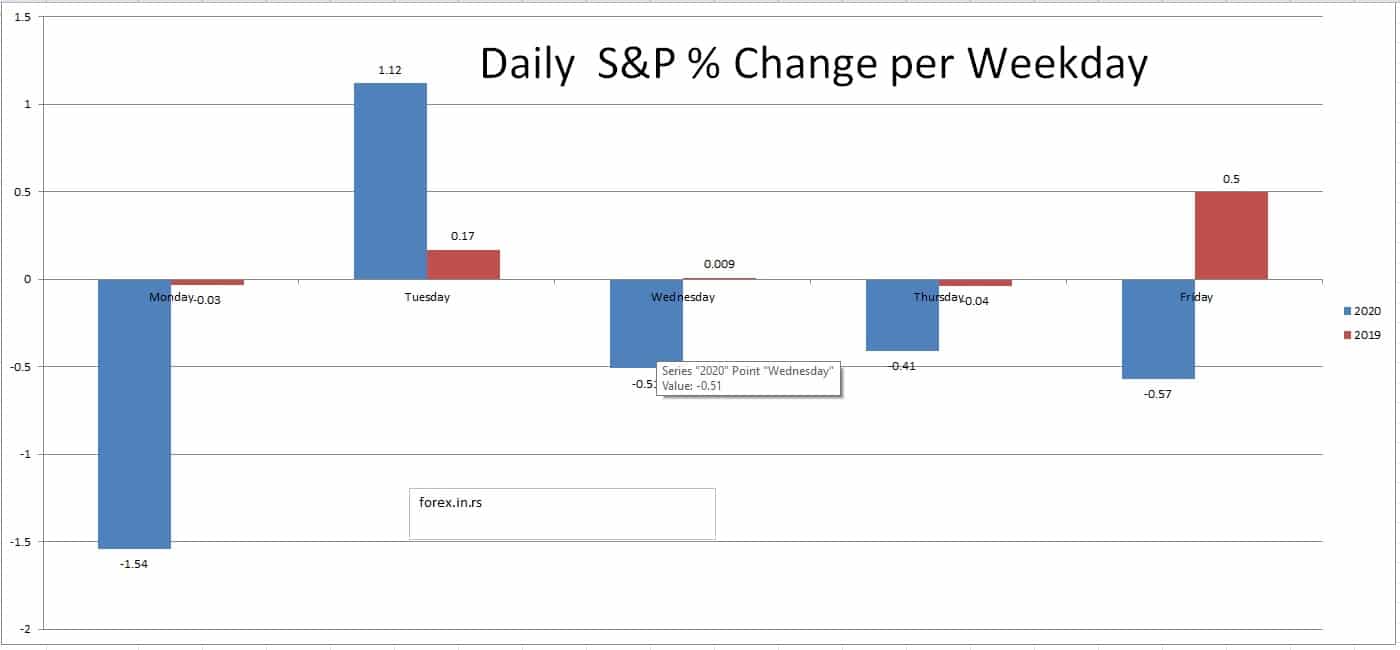

Below is the presented S&P 500 percentage change per weekday in 2020 and 2019. Here we can see that the best weekday for stock buying is Tuesday. On Monday prices very often correct from the Friday trend and during Tuesday price usually starts the weekly trend.

Tuesday was the best day to buy stocks and catch a trend in 2019 and 2020

Let us see one example of stocks opening range:

In the first hour in the stock market, the price oscillates between the green and red areas. A trader can sell a stock when the price breaks opening range support (red area).

Usually, the best time to enter into a trade is when several triggers occur, such as technical price level reach previous support or resistance, fundamental news, company news, etc.

Choose Stock Based on Your Personality Type

Choosing stocks based on your personality or age works the best, i.e., if you are 20-22 years of age, you might be knowing about a new game or advanced technological tools. Your mind would be sharp and observant of things that others can’t notice. You can take the risk as you are young and have different priorities at the moment. On the contrary, if you are a 60 years old individual, you have different goals. You may prefer having stocks that have stable returns and are less volatile.

Thus, the decision you take should be deeply analyzed. You need to know the stability and overall volatility of the stock and the market. You can use the available level I or II information or learn to use tools to have a more precise decision.

Best time to buy stocks and Risk Management

As stated above, you need to have a risk management strategy if you want to be in this game for the long term. You must preserve your money while having the risk under control while choosing the best share.

There are so many stocks in the market, having diverse price sensitivity, volatility, price, etc. Thus, first, choose the risk you are willing to take according to your skills, knowledge, and experience. With time, you can increase your risk appetite.

The most common mistake that novice traders make is to go with the flow and see how the trading goes! That is the worst thing you can do to yourself as a trader. Take systematic and calculated steps and risks, as, without that, trading is nothing but gambling! Make a plan and stick to it.

Simplicity is the Best Policy

Yes, be simple, trade simple. Do not ride on all the horses at once. If you want to invest for the long term, pick one stock, study the stock, and analyze it. The stock has its own individuality, which you need to learn before investing in it.

It would help if you analyzed the charts on different time frames like hourly, daily, weekly, monthly, etc. With time, add stocks one by one in your learning pattern, and when you are sure of moving ahead, start to build your portfolio. This will help you learn the stock behaviors closely.

In the end, pick stocks aligning with your trading strategy and overall expectations.

Stick to your trading strategy for the day; if you feel like changing or modifying it, at least wait till the day closes. Make rules for yourself and be loyal to them. Following are a few examples of the rules that you can stick to for the day of trading after choosing the stock!