Table of Contents

The traders and investors have initiated financial transactions, foreign exchange, and investment through a global decentralized monetary platform for exchanging currencies. This forum highlights and offers exchange rates for foreign currency and local ones. Therefore, Forex trading is all about buying and selling currency, primarily available in pairs. If traders anticipate that the currency is going to deteriorate, then they have the option to sell the pair to participate in the trade and avoid losses. In financial terminology, trade is the act of buying, selling, and purchasing financial tools. In a nutshell, trade is performed after converting the financial order on the exchange, which deals with pay-in and pays of financial assets and securities. The trade concludes after all the settlement steps have been performed.

What is the FX trade life cycle?

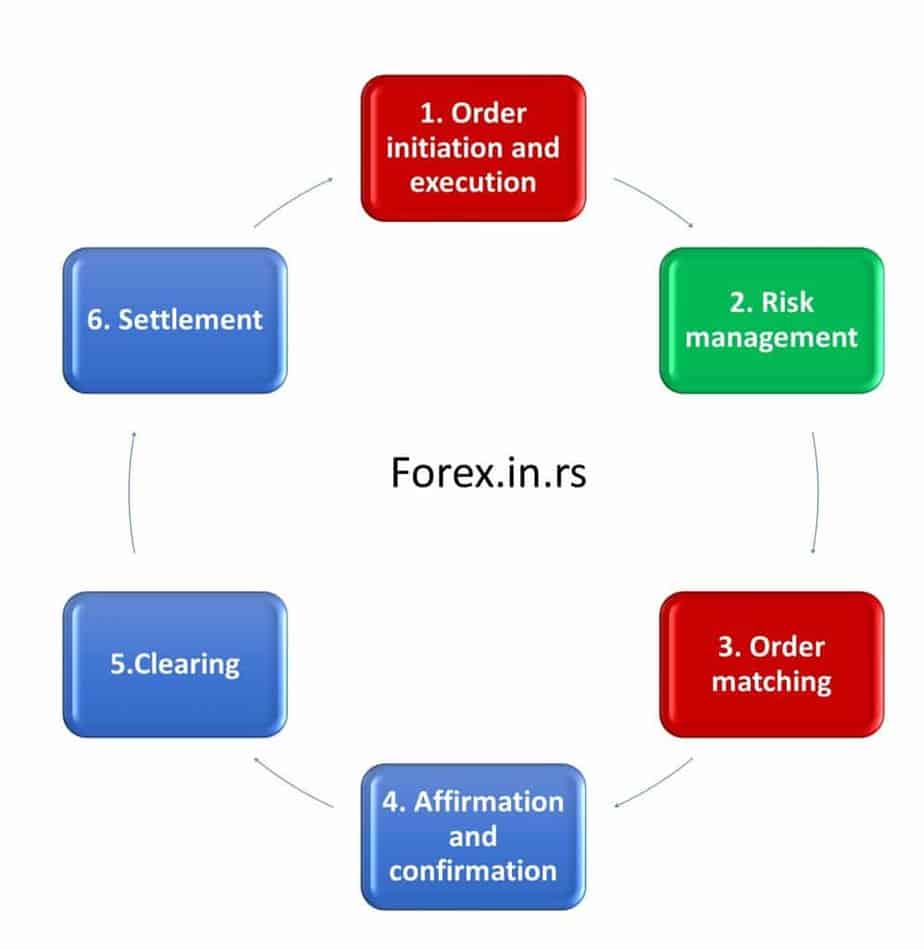

The trade life cycle represents the process from the order receipt and execution to clearing and settling the trade, including Pre-Trade, Trade Execution, Trade Clearing, Trade Settlement, and the final stage of Position and Risk Management.

The red represents the front-office function, the green middle office function, and the blue color represents the back-office function.

What is the FX trade life cycle, and what is the trade life cycle in the stock market?

The trade life cycle in the capital market (stocks, forex, etc.) implies:

- Order initiation and execution as front office action.

- Risk management and order routing as middle office action.

- Order matching and conversion into a trade as a front office function.

- Affirmation and confirmation as back-office action.

- Clearing as back-office action.

- The settlement is a back-office action.

FX Trade Life Cycle Process

Pre-trade Preparation:

- Develop systems, processes, and protocols for trading compliance with laws and regulatory requirements.

- Capture and preserve data related to all trading and its lifecycle.

- Execute appropriate legal agreements like ISDA documentation for OTC derivative trades.

- Understand counterparty credit risk to ensure suitable counterparties.

- Collect and manage appropriate collateral.

- Understand and manage risks associated with positions.

- Implement appropriate controls throughout the trade lifecycle.

Middle and Back Office Trade Lifecycle:

- Trade Execution:

- Enrollment of clients in an institution’s system.

- Proper client authority is necessary to authorize the institution to place trades.

- Motivation for trading might include the need for cash, hedging, diversification, or specific market views.

- Trade orders vary in nature: some may require specific prices, immediate execution, or execution within a certain time frame.

- The institution executes the trade and informs the client.

- Trades can be executed on exchanges or off-venue/over-the-counter.

- Trade Clearing:

- Definition: Process where trade counterparties and their agents verify transaction details and prepare for settlement.

- Three dates:

- Trade Date: Counterparties agree to trade.

- Value Date: Contractual obligation to exchange.

- Settlement Date: Actual exchange of cash for securities.

- Trade Clearing Process Steps:

- Trade Capture: Initial recording of executed trades.

- Trade Enrichment: Applying additional information to facilitate subsequent trade stages.

- Trade Validation: Final check on gathered trade information.

- Trade Confirmation and Affirmation: Verifying and agreeing on trade details.

- Trade Reporting: Reporting the transaction using an approved mechanism.

- Settlement Instructions: Preparing the instructions for settlement.

- Trade Settlement:

- Completion of the transaction.

- Settlement methods:

- Delivery-versus-Payment (DvP): Securities are delivered only if payment is made and vice versa.

- Free-of-Payment (FOP): Delivery of securities and payment happen separately.

- Position & Risk Management:

- Ongoing management of an institution’s positions in its portfolio.

- Activities include managing corporate actions, counterparty credit risk, measuring profit/loss, cash reconciliations, measuring risk, and reporting.

The trade lifecycle begins with the client instructing an institution, such as a hedge fund or financial institution, to execute a trade on their behalf, like buying company shares. During the trade clearing stage, the executed trade is captured, validated, and matched using services like Central Trade Matching. Post-matching instructions are relayed to custodians, who handle cash and securities accounts, ensuring ample time for trade settlement to avoid failures; they may also utilize sub-custodians for local expertise. The final step, Delivery versus Payment, ensures simultaneous exchange of payment and shares through the respective custodians, with status updates provided throughout, culminating the trade’s entire lifecycle.

Discussion

A trade cycle is defined as the entire steps involved from the conception of the trade, starting from the point of order receipt towards the settlement of the trade, including the trade execution. The trade lifecycle is categorized into two parts. One is trading activity, and the other is operational activity. The former highlights the strategies and procedures involved in acquiring trade data from the investor through the front office and utilizing that trade to produce operational activity. Trade activity has two parts, which include straight execution and capture.

The trading business channel deals with the sellers and buyers that execute the trade process. This is categorized under trade execution and business tax form, through which Trait is further divided into driven and order-driven markets. The concept of trade lifecycle involves the strategies, concepts, competence, and multiple stages essential for a successful trade. A proper interest structure needs to be acknowledged to fit the puzzles of a potential trade, especially the trade lifecycles for trillions and millions of daily trades.

A trade life cycle begins after an investor or a creator has established potential trading goals. An investor is expected to offer and deliver potential growth schemes and investment opportunities. Once the investment decision has been made, the entire trajectory of the weight cycle depends on the investor and their final decision. After going through potential investment growth opportunities, the investor connects with the broker firm and their respective financial institution’s ranks. The investor would request to purchase financial security or assets from the bank with the quoted price. This process is known as a buy order, where the investors price the assets given through a financial institution. This leads to stage two, where investor’s requirements are evaluated and analyzed by the front office sales traders, usually at the brokerage firm. The investor’s requirements are transferred to the risk management department experts, and after getting a positive response, the traders are then ready to execute the order.

The third stage involves risk management, where the team meticulously analyzes, monitors, and regulates potential and existing risks associated with the investor’s orders. After their decision has been prepared, the risk management team decides if the order needs to be progressed. Among another essential specification list, a management team will also ensure the probability and presence of stocks required to compensate for the security.

The investor is checked, and the financial assets of the respective investors are methodically verified to avoid deception or scams. The risk management has to ensure that the orders are well-suited for the established considerations and are under the standard capital determinants. There are managers available in the brokerage house who carefully investigate the client’s order, and once they have given the outcome, the trade cannot move to the next step. Once the risk management team has conducted a detailed assessment, the trade process is ready to move to the next stage. Stage four is when the management team has acknowledged the investor’s orders. The brokerage firm will eventually deliver it to the stock exchange after the phases have been finalized.

The stock exchange is responsible for linking security buy and sell orders. Once the connection has been established, the trade reaches its final and concluding stage. The exchange delivers the information regarding the trade to the brokerage office. This step is performed to confirm the details regarding the trade, and insights are revealed to the investor’s custodian. Once the trade order has been subjected to scrutiny by the foreign exchange, the matchmaking begins for the order. The process of matching assets with the order demands the availability of someone on the other side of the trade looking to sell that particular asset. The foreign exchange is responsible for keeping an eye on the potential match or another half for the trade to materialize. Once a successful match has been attained, the materialization of trade transpires, and the post-wait process begins.

After confirming the trade and post-trade liabilities, the trade reaches its clearance and settlement. Once the trade reaches the clearinghouse, the expectations and demands from each trade side are analyzed. The trading house is responsible for providing information to both sides about the requirements. The clearinghouse ensures the application of the rules and the acquisition of obligations from both sides.

The trade lifecycle commences with an order the investor places and concludes around trade validation and confirmation. The completion process is tedious and requires multiple stages for a successful trade. The trade process may appear less complex, but the realization of trade is far more complicated. In simple words, a trade life cycle process is a set of rules, procedures, and events that happen after the buy and sell of any financial or capital instrument.

Conclusion

The trade life cycle in the capital market domain incorporates millions of trades daily. This mechanism is insured to provide and generate functional and seamless trade finalization to fulfill the obligations and demands of buyers and sellers. The Forex market rate is not a simple process, consisting of tiresome and time-consuming steps.

Summary:

- Trading involves an intricate process from start to finish.

- All parties involved must ensure careful and thorough procedures are in place before, during, and after the trade.

- The diagram illustrates the trade lifecycle and critical participants, showcasing a perfect settlement scenario.