Table of Contents

In this video breakdown, we dive into Igor’s analysis of the British Pound vs. US Dollar (GBP/USD) trading strategy, which uses a blend of price action, Fibonacci retracement levels, and moving averages while also considering fundamental analysis like upcoming news releases.

Daily Candle Setup

At the beginning of the video, Igor highlights the bearish engulfing pattern formed on the daily chart of GBP/USD. He notes that this pattern is solid, as the high and low of the previous day surpassed those of the day before, signaling a potential reversal. The daily bearish engulfing pattern indicates a strong possibility for continued downward movement, which Igor is planning to capitalize on by entering a short position.

See my video:

- Key Insight: A bearish engulfing pattern is one of the most reliable reversal signals in technical analysis. It suggests that the sellers have overtaken the buyers’ momentum, potentially leading to further price declines.

Using Fibonacci Retracement for Entry

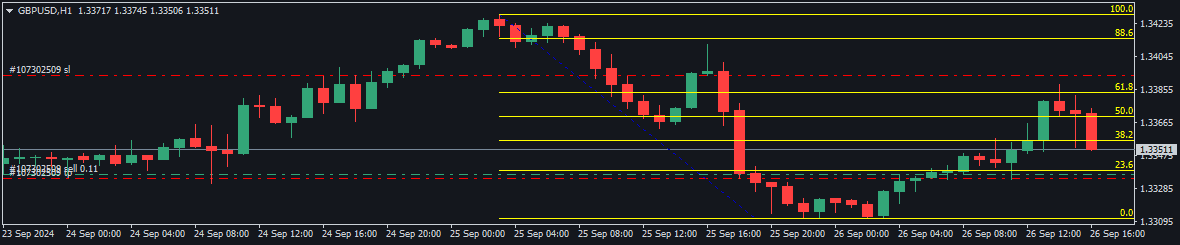

Moving from the daily chart to the 1-hour chart, Igor introduces Fibonacci retracement as a tool to fine-tune the entry point for his trade. In this case, he avoids using ICT concepts like Fair Value Gaps, focusing instead on the simplicity of Fibonacci retracement levels. He highlights the 38.2% retracement level as his favorite for initiating trades.

- Setup: After plotting the Fibonacci retracement from the swing high to the swing low, the price retraced and touched the 38.2% level during the European market open, forming a solid wick rejection.

- Execution: Igor entered a sell order around this level, though he notes that he missed the perfect entry by about seven pips. However, this didn’t deter his strategy, as he still placed the trade close to the ideal level.

Fibonacci Levels Breakdown:

- 38.2%: Igor’s preferred level for entry.

- 50%: An ordinary retracement level coinciding with the 50-period moving average, reinforcing its significance as a resistance point.

- 61.8%: A higher retracement level is often considered for placing stop losses, as a break above this could signal a deeper pullback or reversal.

Placing Stop Losses

Depending on the trader’s risk tolerance, Igor provides multiple ideas for setting a stop loss.

- Low-Risk Option: Set the stop loss slightly above the 50% retracement level (around 1.3378). This is a cautious approach that aligns with a key Fibonacci level and moving average resistance.

- More Aggressive Option: Set the stop loss above the 61.8% level, acknowledging that this level often serves as a decisive point. If this level is breached, the trade’s premise would be invalidated.

Additionally, Igor points out that GBP/USD exhibits volatile movements with frequent spikes, recommending setting the stop loss 10 to 15 pips higher to account for potential false breakouts.

Incorporating Moving Averages

One of the most insightful aspects of Igor’s analysis is the confluence of the Fibonacci retracement and the 50-period moving average. In this case, he emphasizes that the 50-period moving average is a strong resistance level. The fact that the 50% Fibonacci level aligns with the moving average further reinforces this area as a critical zone of interest.

Fundamental Analysis: Monitoring the News

Igor wisely incorporates fundamental analysis by noting the upcoming US GDP data release. While technical analysis gives him a firm conviction for a bearish day, he acknowledges that unexpected news could disrupt the market.

- Risk Management: In anticipation of the news, Igor advises moving the stop loss to break even if the trade is already profitable (about 20-30 pips) before the data release. If the price is near his entry or behaving unpredictably, he suggests closing the trade entirely to avoid unnecessary risk.

Price Action and Trade Monitoring

Igor continues to watch the shorter time frames, particularly the 15-minute chart, to gauge market sentiment during the European session. He notices several consecutive bearish candles, reinforcing his bearish outlook. His strategy involves closely monitoring key support levels and potentially locking profits if the market tests those areas.

He also introduces trendlines as an additional layer of analysis. Drawing a trendline on the higher time frames, Igor identifies potential targets for a pullback to around 1.3190 or even as low as 1.2850, depending on market conditions.

Risk and Trade Management

Igor suggests keeping a broader perspective for swing traders, noting that GBP/USD could see a retracement of a few hundred pips, offering opportunities for more significant moves. However, he always emphasizes the importance of monitoring trades, especially around news events that can cause unexpected volatility.

Summary

- Bearish Engulfing Pattern: The daily bearish engulfing pattern suggests a high probability of a bearish day.

- Fibonacci Retracement: Key retracement levels (38.2%, 50%, and 61.8%) provide a roadmap for entry and stop-loss placement.

- Confluence with Moving Averages: The alignment of the 50-period moving average with the 50% Fibonacci level strengthens the setup.

- News Awareness: Fundamental news, such as the US GDP report, can significantly influence price action, warranting close trade monitoring and adjustments.

- Price Targets: Igor suggests potential pullback targets of 1.3190 or lower, depending on how the market reacts to crucial support levels.

This setup combines a robust technical analysis approach with prudent risk management and an awareness of upcoming economic news, making it a comprehensive strategy for trading GBP/USD. As Igor emphasizes, consistent monitoring and adjusting based on market conditions is critical to long-term success.