Table of Contents

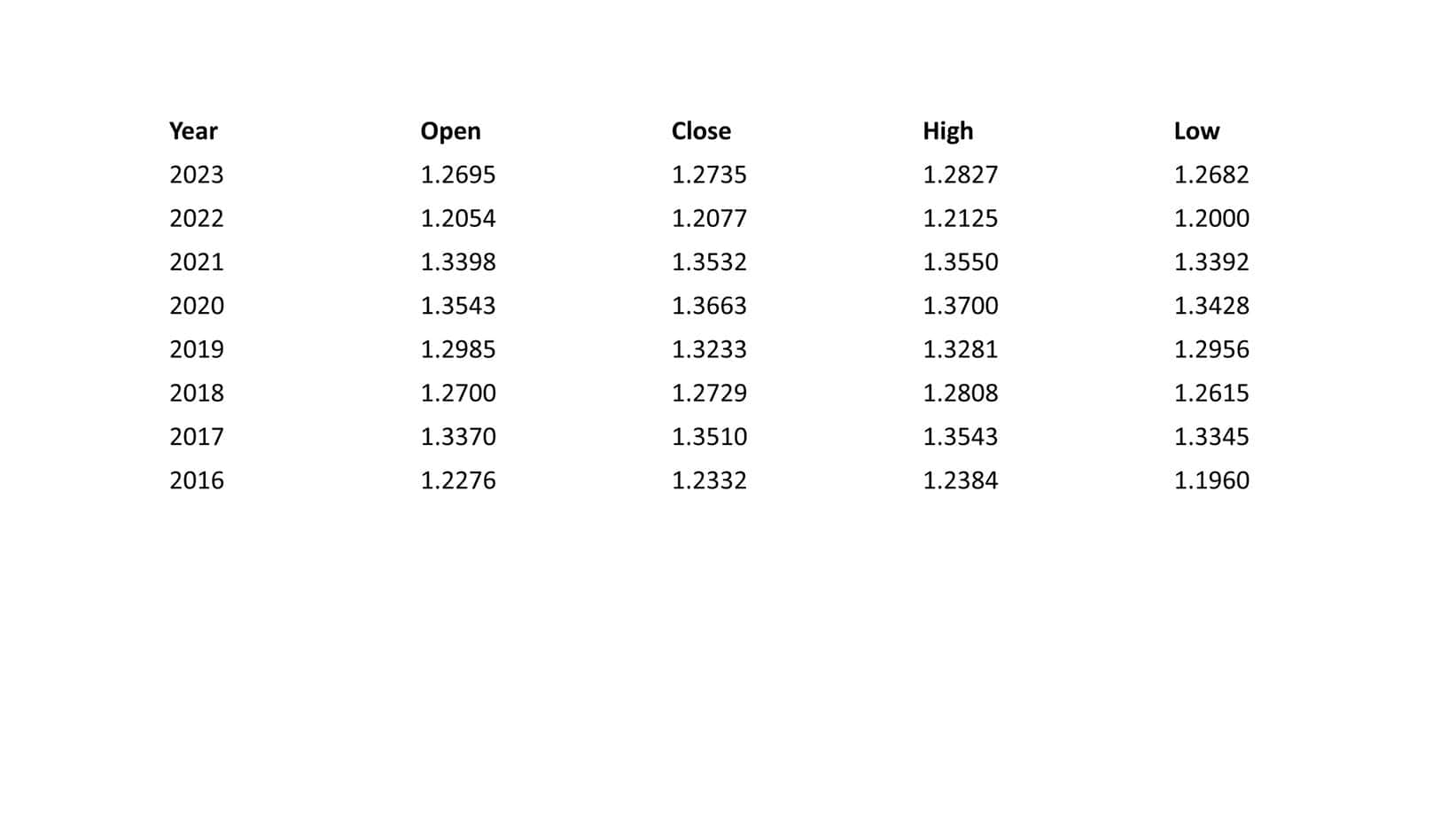

Trading during the holiday season, specifically between Christmas and New Year, presents challenges and opportunities for forex traders. This analysis examines the GBP/USD pair’s performance over the past eight years, focusing on open, close, high, and low prices.

Check my video:

Swing trading with a “buy the dip on support” strategy can be more effective than day trading during the holiday season due to reduced market participation and thinner liquidity. The low trading volume during this period often leads to erratic intraday movements that can create false signals, making day trading more challenging. Swing trading allows traders to focus on higher timeframes, reducing the noise caused by holiday volatility and capitalizing on broader market trends.

By identifying intense support levels and buying dips, traders can position themselves for potential rebounds when liquidity returns to normal after the holidays. This approach requires patience and discipline but minimizes the stress of monitoring unpredictable intraday fluctuations.

Trading During Holidays: An Analysis of GBP/USD Price Movements Between Christmas and New Year

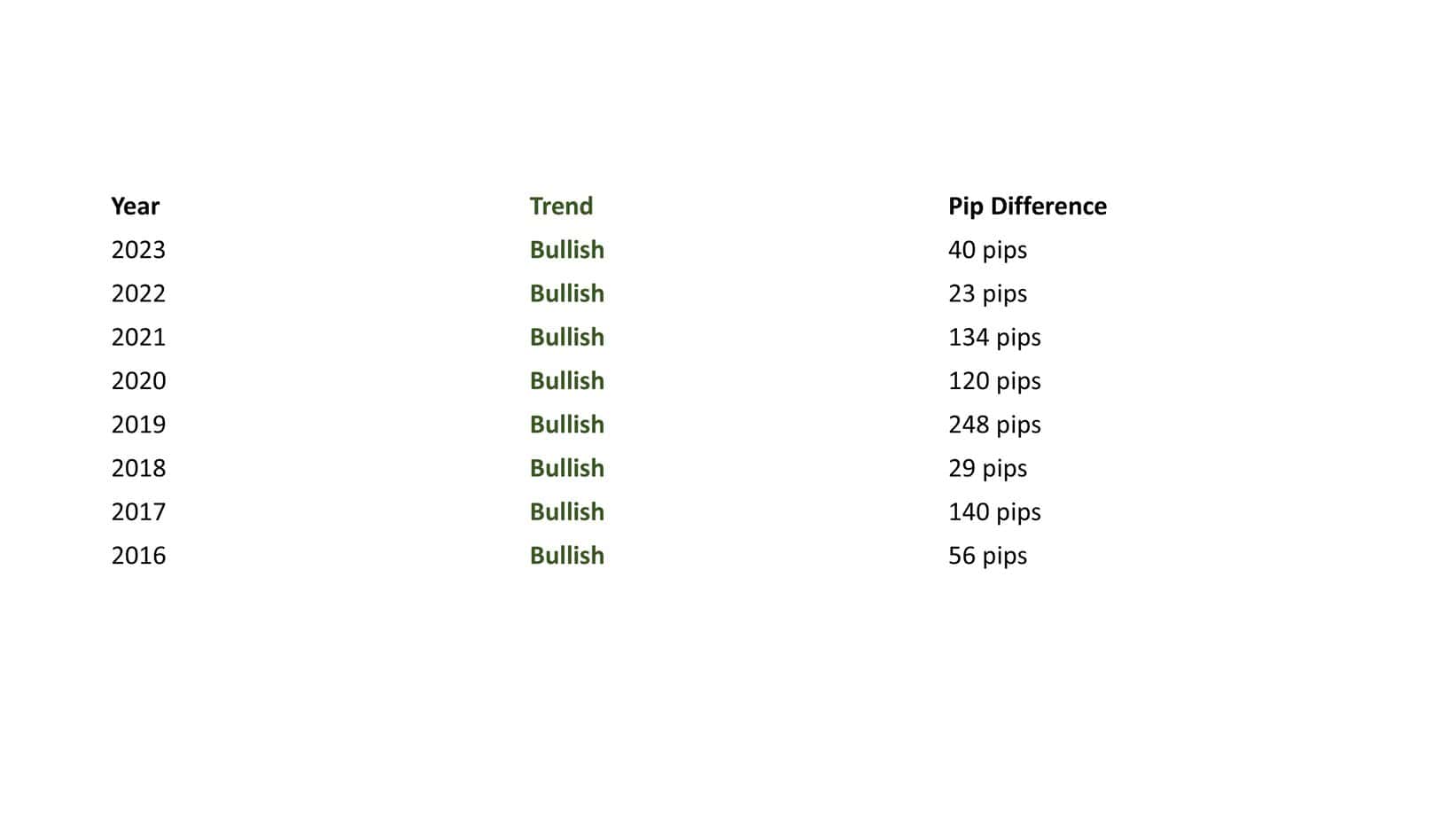

Analyzing historical data from 2016 to 2023 reveals consistent patterns in the GBP/USD pair’s behavior:

- Price Trends: The GBP/USD pair has generally shown a slightly bullish trend during this period.

- Choppy Markets: Despite the bullish tendency, price action was often choppy and difficult to trade in smaller timeframes, such as the 30-minute chart.

- Swing Trading Opportunities: Swing trading appears to be the most effective strategy, capitalizing on significant price movements rather than intra-day volatility.

Yearly Breakdown of Price Movements

2023

- Open: 1.2695

- Close: 1.2735

- High: 1.2827

- Low: 1.2682

The GBP/USD saw a slight bullish movement, with a 40-pip increase between the open and close. The high of 1.2827 and low of 1.2682 highlight the limited range, indicating restrained market activity typical of the holiday season.

2022

- Open: 1.2054

- Close: 1.2077

- High: 1.2125

- Low: 1.2

The pair closed slightly higher with a modest 23-pip increase. A narrow range between the high and low (125 pips) demonstrates low volatility, which could frustrate day traders seeking significant price movements.

2021

- Open: 1.3398

- Close: 1.3532

- High: 1.355

- Low: 1.3392

The GBP/USD experienced a more pronounced bullish trend with a 134-pip increase from open to close. The high and low suggest some opportunities for swing trades but also reflect the difficulty of timing entries and exits during choppy conditions.

2020

- Open: 1.3543

- Close: 1.3663

- High: 1.37

- Low: 1.3428

With a robust 120-pip gain from open to close and a high of 1.37, 2020 was a favorable year for swing traders. The range also indicates significant opportunities to capitalize on price movements despite market irregularities.

2019

- Open: 1.2985

- Close: 1.3233

- High: 1.3281

- Low: 1.2956

This year displayed the most significant gain in the dataset, with a 248-pip increase. The high of 1.3281 and low of 1.2956 further emphasize the bullish trend, making it an excellent year for end-of-year swing trading strategies.

2018

- Open: 1.2700

- Close: 1.2729

- High: 1.2808

- Low: 1.2615

2018 was characterized by a modest 29-pip increase. The high of 1.2808 and low of 1.2615 suggest limited opportunities, and traders likely faced challenges due to the narrow range.

2017

- Open: 1.33702

- Close: 1.351

- High: 1.3543

- Low: 1.3345

A strong bullish trend emerged in 2017, with a 140-pip gain. Swing trading during this period was highly profitable as the pair maintained an upward trajectory.

2016

- Open: 1.2276

- Close: 1.2332

- High: 1.2384

- Low: 1.196

Although the GBP/USD ended the period slightly higher with a 56-pip gain, the significant low of 1.196 early in the week made it a challenging year for traders. Those who entered at the lows and held positions saw favorable returns.

Trading Strategies

- Swing Trading:

- Focus on entering trades near the lows and holding them until the end of the holiday week.

- Avoid over-trading during choppy periods and rely on higher timeframes to identify key levels.

- Risk Management:

- Given the lower liquidity and potential for false breakouts, use conservative stop-loss levels.

- Avoid over-leveraging, as thin markets can result in exaggerated price movements.

- Avoid Day Trading:

- Intra-day volatility and false signals can lead to losses, making this approach unsuitable during the holiday season.

Trading during the holidays, especially between Christmas and New Year, is characterized by unique market conditions that require careful navigation. Historically, this period saw reduced trading volume as institutional traders and significant market participants took time off, leading to thinner liquidity. This reduced liquidity can increase price volatility, making markets susceptible to sudden spikes or erratic movements, particularly in pairs like GBP/USD. While some traders prefer to avoid the market during this time, others see opportunities to capture short-term price fluctuations in these volatile conditions. For the GBP/USD pair, the holiday season has historically displayed mixed performance, with both bullish and bearish trends depending on broader macroeconomic factors. Traders should pay close attention to key support and resistance levels, as the lack of liquidity often amplifies the impact of these technical zones, offering potential trading opportunities or risks of false breakouts.

Conclusion

Trading the GBP/USD during the holiday period between Christmas and New Year requires a strategic approach. Historical data suggests that while a slightly bullish trend is common, market conditions are often choppy and unpredictable. Backed by sound risk management, swing trading offers the best potential for success during this time. Traders should remain cautious and focus on broader trends to effectively navigate this unique trading environment.