Table of Contents

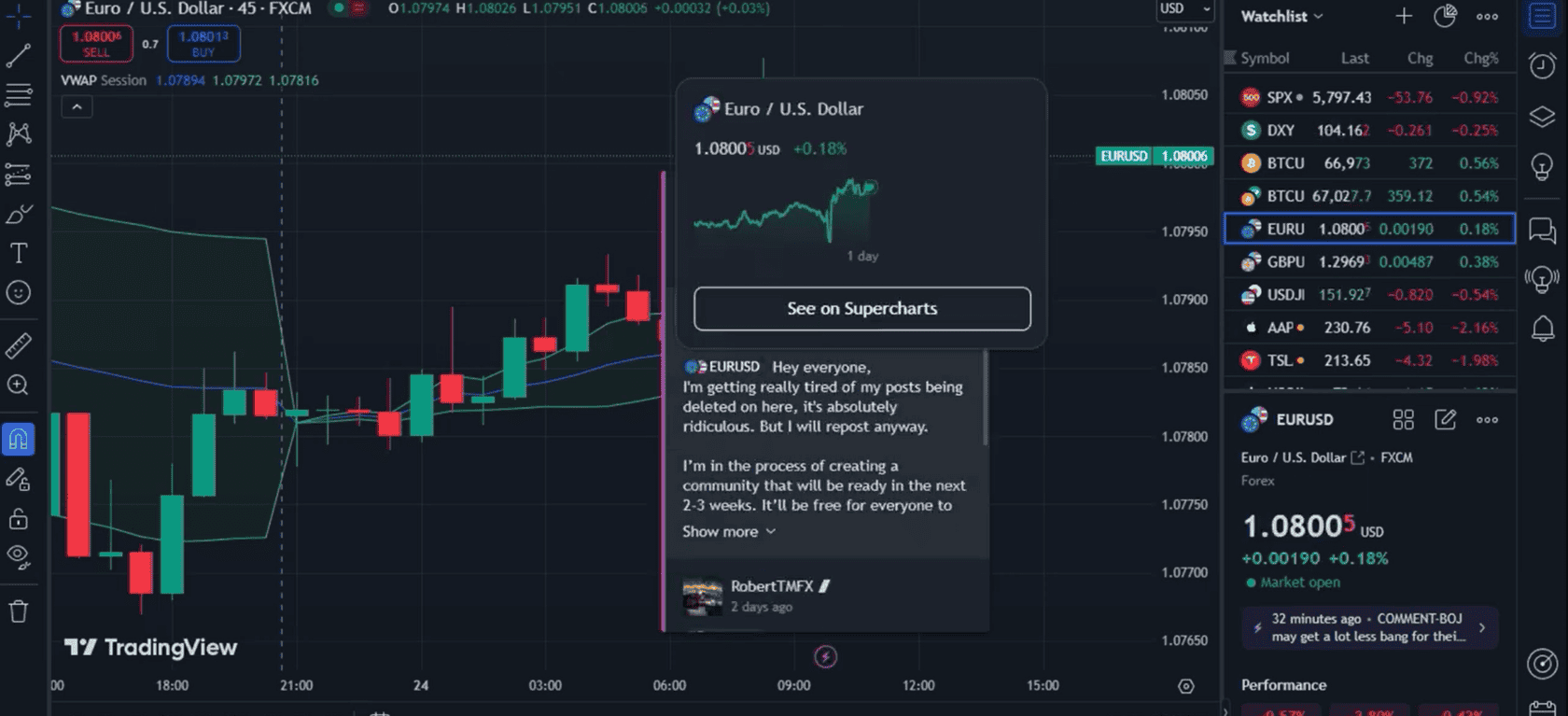

Backtesting is an essential part of developing a successful trading strategy. TradingView, one of the most popular charting platforms, offers advanced backtesting features in its premium plans. This guide will explore how to backtest a trading strategy on TradingView using deep premium backtesting tools.

Why Backtesting Matters

Backtesting allows traders to evaluate a strategy using historical data before risking real capital. It helps understand a strategy’s performance and whether it is worth deploying in live markets.

Premium account backtesting on TradingView offers several advantages. Premium provides access to extended historical data, allowing traders to test strategies over longer periods (20,000 bars of historical data). The backtesting process is faster, enabling quick iteration and refinement of trading strategies. Premium accounts also allow for multiple chart layouts, making comparing and analyzing different strategies easier. Additionally, traders benefit from frequent data updates, ensuring accurate and up-to-date results during backtesting.

From my perspective, the Deep Premium Backtesting feature in TradingView ishigh-speedt. The speed at which backtests are executed allows me to refine and iterate on my trading strategies quickly. This efficiency is particularly beneficial when testing multiple parameters or analyzing market conditions. In my experience, the rapid processing and clear visual representation make TradingView an invaluable tool for serious traders who need reliable and swift backtesting capabilities.

See my video with detailed instructions:

Upgrading to TradingView Premium for Deep Backtesting

To access deep backtesting on TradingView, you need a premium account. This upgrade provides:

- Access to extended historical data

- The ability to test strategies over longer periods

- Advanced analytical tools

If you haven’t upgraded yet, promotional links can provide discounts on premium subscriptions.

Getting Started with Backtesting on TradingView

Step 1: Accessing Indicators and Strategies

- Navigate to the ‘Indicators’ section on your TradingView chart.

- Go to ‘Technical’ to find pre-made strategies.

- Alternatively, explore the ‘Community Scripts’ section by searching for ‘strategy’ to find user-created strategies.

Step 2: Selecting a Strategy

- Choose a strategy such as the ‘Bar Up Down Strategy.’

- Open the ‘Strategy Tester’ panel at the bottom of the screen.

Step 3: Enabling Deep Backtesting

- Use the ‘Deep Backtesting’ mode to access extensive historical data.

- Select a suitable testing period, such as 11 years, for more reliable results.

Analyzing Strategy Performance

Example 1: Bar Up Down Strategy

- Initial backtesting showed poor performance with significant drawdowns.

- This highlights the importance of testing multiple strategies.

Example 2: Celer Channel Strategy

- Tested over 11 years with a profit factor of 1.66.

- However, with only 23 trades in 11 years, the sample size is too small for reliable conclusions.

Extracting Strategy Logic with Source Code

- Access the source code of a strategy by clicking on the three dots in the strategy settings.

- Copy the code and use tools like ChatGPT to extract and simplify trading rules.

Example Trading Rules:

- Buy: Price crosses above the upper Celer Channel.

- Sell: Price crosses below the lower Celer Channel.

Testing Different Time Frames

- Backtesting on various time frames is essential.

- Lower time frames often result in poorer performance due to market noise.

- Higher time frames can provide more stable results but fewer trade opportunities.

Trying Multiple Strategies

Example: Parabolic SAR Strategy

- Over 11 years, generated 2172 trades with a profit factor of 1.2.

- Performed well on daily charts for indices like S&P 500 and DAX.

- Performance varied across time frames and assets, highlighting the need for asset-specific testing.

Best Practices for Effective Backtesting

- Use at least 10 years of historical data.

- Test across various time frames.

- Analyze performance on different asset classes.

- Ensure a strategy is robust across multiple conditions, not just optimized for a single scenario.

Conclusion

Deep premium backtesting on TradingView is a powerful tool for traders. By following a structured approach to selecting, testing, and analyzing strategies, traders can develop robust systems that stand the test of time. Experiment with strategies, time frames, and assets to find what works best for your trading style.