Table of Contents

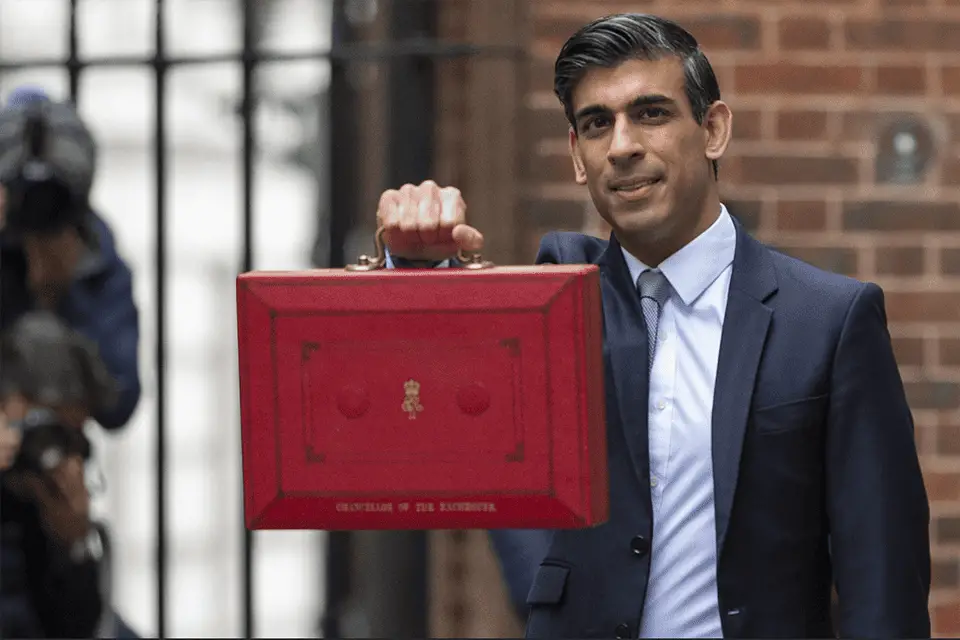

The UK Budget 2024 presents significant financial decisions that have shaped the country’s economic landscape for years. Faced with rising inflation, increasing public debt, and economic stagnation, the government is tasked with balancing immediate financial needs and long-term recovery efforts. The budget will likely focus on income tax thresholds, national insurance contributions, and sectoral budget allocations, especially for vital services like the NHS. In this article, we’ll explore the government’s key challenges, the potential impact of freezing income tax thresholds, and what this means for the average citizen.

The Challenge of Frozen Income Tax Thresholds

One of the most anticipated elements of the budget is the decision regarding income tax thresholds. For several years, income tax bands have been frozen, meaning the personal allowance and tax thresholds have not increased in line with inflation. This decision has significant implications for taxpayers, leading to what is commonly known as “fiscal drag.”

Fiscal drag occurs when inflation and wage increases push individuals into higher tax brackets without a corresponding increase in purchasing power. As a result, more taxpayers end up in higher tax bands, paying more tax even though their real incomes haven’t substantially improved. The income tax thresholds, currently frozen until 2028, are expected to be extended further to 2030 as part of the 2024 budget.

The basic rate threshold in the UK sits at £12,750, and the higher rate starts at £50,271, with additional rate taxpayers earning over £125,140. Due to the freeze, wages that rise in line with inflation can push individuals into these higher tax bands, forcing them to pay more tax despite no significant real-term income boost. The policy effectively acts as a stealth tax, generating additional revenue for the government while avoiding the politically unpopular move of raising tax rates.

Impact on Households and Public Sentiment

The freezing of income tax thresholds disproportionately affects middle-income earners, many of whom will find themselves in the higher tax bracket as wages rise to match inflation. This process results in millions of people contributing a more significant portion of their income to taxes without seeing a tangible improvement in their financial well-being.

For individuals earning between £50,271 and £125,140, the higher 40% tax rate can become a significant burden, particularly during rising living costs. Essential expenses, including energy bills, housing, and food, continue to increase, placing further financial pressure on households with stagnant wage growth. The lack of real wage increases and the tax drag effect will likely fuel public dissatisfaction, particularly among working-class and middle-income groups.

This creates political challenges for the government. While freezing thresholds is an efficient way to raise revenue without increasing tax rates, many will likely see it as an unfair mechanism that punishes average earners. The government’s rationale is that this measure will help pay down public debt and support funding for essential services like the NHS, but that argument may not sit well with individuals feeling the squeeze of higher taxes.

Budget Implications for the NHS and Public Services

The 2024 budget is expected to strongly emphasize the NHS, with health services being a priority for the current government. However, even though the NHS may receive favorable treatment regarding budget allocations, strings will still be attached. The government will likely tie any increase in health spending to reforms aimed at boosting productivity and improving patient outcomes.

The NHS faces a long-standing crisis, exacerbated by the COVID-19 pandemic, with staffing, wait times, and overall service delivery issues. The health secretary has indicated that reforms are essential to use resources efficiently. The government hopes to avoid simply throwing money at the problem and instead focus on sustainable improvements that benefit patients and staff.

Despite the NHS being a priority, other public services may not fare as well. Sectors like justice, education, and local government are expected to face continued cuts as the government attempts to save billions through tax freezes and budget reductions. These cuts could exacerbate challenges in these sectors, such as overcrowded courts, understaffed schools, and struggling local councils.

National Insurance and Business Contributions

Another critical aspect of the 2024 budget will likely be changes to national insurance contributions, particularly for employers. The chancellor is expected to announce an increase in national insurance for higher earners and employers as part of the effort to raise £40 billion. While this would help the government address its fiscal shortfall, it could have knock-on effects on businesses and job creation.

Increased national insurance contributions could strain businesses, particularly small and medium-sized enterprises (SMEs), which may struggle to absorb the higher costs. These businesses are often the backbone of local economies and job creation, and higher taxes on employers could lead to reduced hiring, slower wage growth, or even layoffs in specific sectors.

Additionally, higher national insurance for higher earners could increase the overall tax burden on individuals, especially those already affected by the frozen income tax thresholds. As higher tax liabilities absorb wage increases, individuals may find themselves with less disposable income, further dampening consumer spending and economic growth.

The Broader Economic Picture

The 2024 budget takes place against a backdrop of economic uncertainty. The UK is grappling with high inflation, stagnant growth, and mounting public debt. The Office for Budget Responsibility (OBR) has warned that public debt could exceed 100% of GDP in the coming years if decisive action is not taken to reduce the deficit.

In this context, the government’s decision to freeze income tax thresholds, raise national insurance contributions, and cut public spending reflects the need to address fiscal challenges head-on. However, these measures may also hamper economic recovery by reducing household incomes and constraining business activity.

Opposition parties and public sector unions are likely to criticize the government, arguing that the budget should focus on stimulating growth and protecting essential services. While the government maintains that difficult choices are necessary to restore fiscal stability, the long-term effects of these decisions remain uncertain.

Conclusion: Navigating Difficult Choices

The UK Budget 2024 is a defining moment for the country’s economy, with decisions that will affect individuals, businesses, and public services for years to come. Freezing income tax thresholds, raising national insurance contributions, and prioritizing spending on the NHS are all part of the government’s strategy to stabilize public finances while addressing urgent needs.

However, these measures are not without consequences. Fiscal drag, higher taxes, and spending cuts could lead to public dissatisfaction, while the impact on businesses may slow economic recovery. Ultimately, the success of the 2024 budget will depend on whether the government can strike the right balance between addressing short-term fiscal pressures and fostering long-term economic growth. The choices made in this budget will shape the UK’s economic landscape for years to come.