Table of Contents

There are numerous assets traded at the market, and each purchase has its level of volatility. Volatility refers to how frequently the price of an asset changes in a market. The higher the volatility level, the higher the risk of trading such assets. So, it becomes imperative for traders to measure the volatility of the asset they are planning to trade.

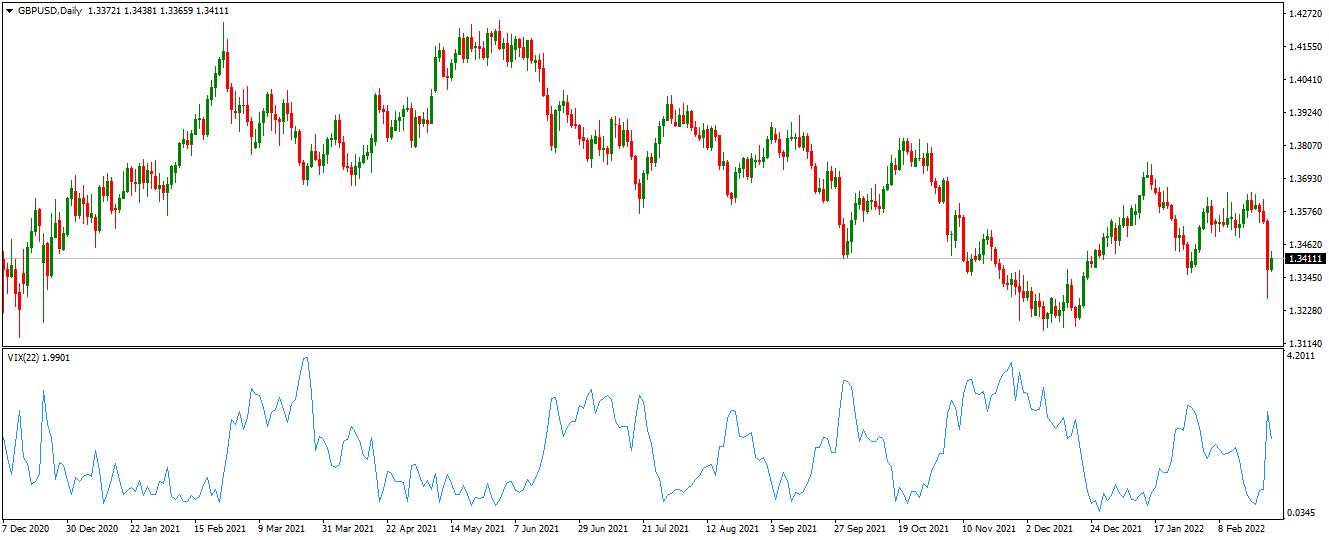

Recently we wrote an article about volatility 75 indexes. For this purpose, an indicator called the Synthetic VIX helps traders measure market volatility. It is a volatility meter that uses a scale of index value to determine volatility. This indicator is highly compatible with the MT4 trading platform and can be used to measure the volatility of Forex currency pairs. Although it was created to measure the volatility of the S&P 500 only, later, it was updated to make it compatible with other tradable assets.

Read this article to learn more about the Synthetic VIX Indicator, how it calculates market volatility, and how it can help a trader create trading plans.

Download Synthetic VIX Indicator

Synthetic VIX indicator shows volatility oscillator on your chart, and you can download it below:

DOWNLOAD SYNTHETIC VIX INDICATOR

How to Calculate Market Volatility?

The Synthetic VIX Indicator calculates the market volatility based on the price data of the previous sessions. It scans the Moving Average of 22-periods to derive the market volatility level of an asset. The formula for calculating the market volatility or the Synthetic VIX value is:

Synthetic VIX value = [(Highest{Close,22} – Low)/(Highest{Close,22})]

In the above formula, the lowest price of the current session is subtracted from the highest price in the last 22 sessions. The result is then divided by the highest close price of the previous 22 sessions to derive the market volatility level. Finally, traders can multiply the value obtained in the above formula by 100 to give the readings a scale.

How To Analyze Market Volatility Using the Synthetic VIX Indicator?

Traders must not confuse the Synthetic VIX Indicator as an indicator used for buy-sell signals. The indicator is created for analyzing market volatility by calculating the price index. However, it can be combined with other technical trading tools to derive more valuable answers about the market.

The value of the VIX ranges between 1.0 and 0.0, with 1.0 being the highest value. When you apply the indicator, you will find that the volatility index value reacts against the actual price movement. For example, if the market is taking a bullish trend, the value of the VIX starts dropping from 1.0. On the contrary, a bearish market movement results in the rise of the VIX from 0.0.

This indicator is beneficial for beginners as market volatility could be confusing at the beginning. It simplifies their learning process by providing straight answers about market volatility. Also, experienced traders can use this indicator in complicated market states. In situations where they get stuck or confused about the market’s behavior, this indicator can help them find a solution to understand the market trend.

Uses of the Synthetic VIX Indicator

The following are uses of the Synthetic VIX indicator.

- It helps in calculating the volatility index of the price in real-time.

- With the help of the index value, traders can also determine the breakouts or bouncebacks of the price.

- This indicator also helps in determining the sentiment of the market as well as of other traders.

- This indicator can easily be combined with other trading tools to formulate a profitable trading plan.

Conclusion

Market volatility influences a market on a large scale. This makes it imperative for traders to use an indicator that can help them determine the market volatility. The Synthetic VIX Indicator helps traders solve this issue. Its straightforward approach and adaptability to almost all types of trading assets, even with the Forex, make it a preference of many traders. Both novice and expert traders can take the help of this indicator in trading. However, prior knowledge of market volatility is crucial to use this indicator smoothly.

Also, traders must understand that the Synthetic VIX Indicator is a tool to calculate the market volatility only and cannot be used to determine buying or selling signals.