Table of Contents

Before you step into any business, you must know its fundamentals. When the world you are venturing into is related to finance and trading, educating oneself becomes imperative. If you are engaged in or wish to trade in the forex market, you need to rely on the same two basics applicable in the stock market: fundamental analysis and technical analysis.

In stocks, traders use a company or an organization’s balance sheet for technical analysis. The charts are used for this purpose. The price is assumed to reflect all new changes. The same concept is followed in the forex market as well. However, the fundamental analysis is different as countries don’t have balance sheets that can give a clear idea to the traders.

What are Forex Fundamentals?

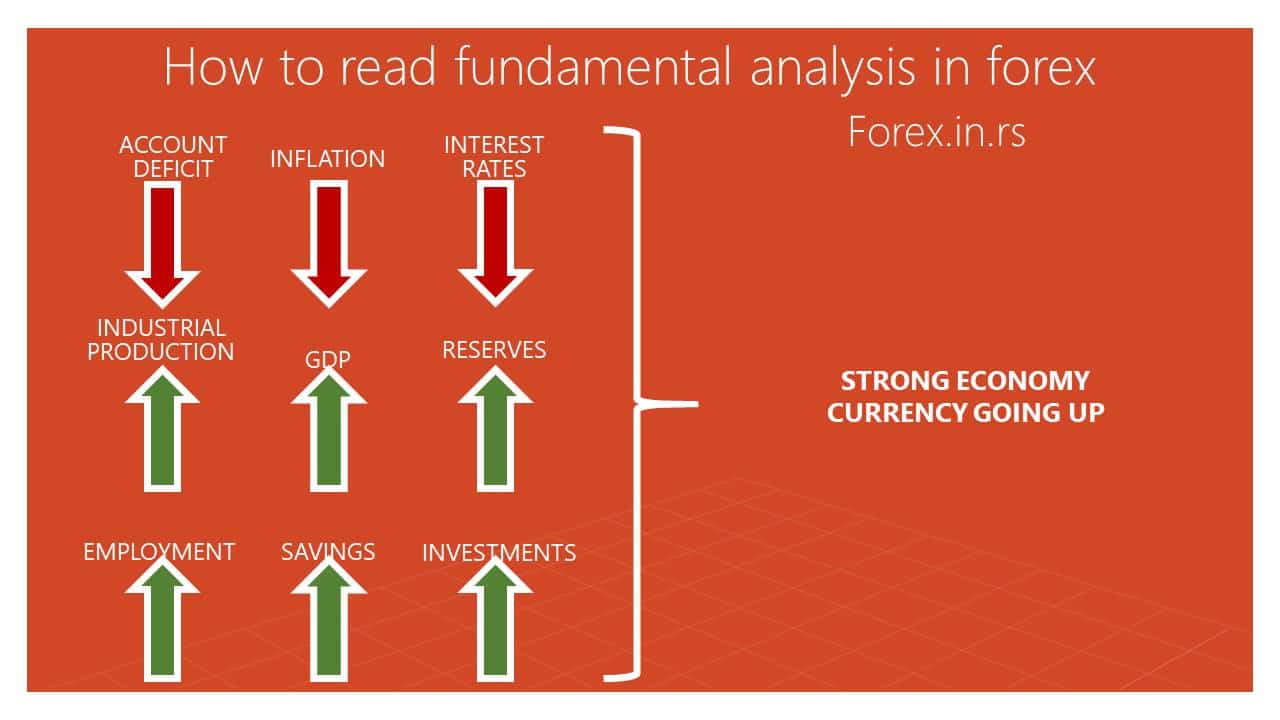

Fundamental analysis in forex trading deals with various economic factors, such as interest rates, employment rate, GDP, international trade, and manufacturing, and their relative impact on the price value of the national currency. In addition, the traders look at the economic conditions that can affect the valuation of a nation’s currency. These factors, also known as the fundamentals of forex trade, play the authority to control the currency movement.

Like in the stock exchange, the technical analysis is the same in the forex trading market. The traders compare the balance sheets of various institutions and organizations and take calculated risks. However, things are different in forex exchange markets as it depends on the value of currencies of different countries, and the government does not hand out balance sheets!

What are forex fundamentals, and what do you mean by their analysis? Fundamental analysis refers to the method of assessing the financial markets to understand price forecasting. While stocks are limited to the profits and losses of an institution, it focuses on a much broader perspective in forex. It considers factors like interest rates, GDP, housing stats, employment ratio, productivity, and other things that directly or indirectly affect the status of a country’s economy.

The price and value are two different things, and they may vary when you are looking at an asset. Fundamental analysis in Forex, and other financial markets, focus on this principle. This is why assets are sometimes overpriced or underpriced in various markets for a short period of time.

Fundamentalists state that even if an asset is mispriced in the short run, its value will not change. Instead, it will return to its correct price eventually. The goal of fundamental analysis is to use the tools to find out the true value of an asset, compare it to the current price, and locate a trading opportunity using their finding.

The process of identifying the value and price of an asset is the key difference between technical and fundamental analysis. In technical analysis, the center of attention is the current price, which is the last thing a fundamentalist would focus on. Fundamental analysis is meant for long-term trading. Its application will not get desired results in day trading, which focuses on short-term price shifts.

The Methodology

Before we jump on reading Forex’s fundamental analysis, it would be wise to learn its methodology. Fundamental analysis in forex does not compare the current data of a single economic indicator like CPI to its previous data. As mentioned earlier, it has a long-term and broader approach. Many economic theories attempt to utilize information sourced from various economic reports and make it comparable to calculate the Forex market risk.

Mong the numerous theories, the most popular one focuses on the notion of parity. This is a condition where currencies should be exchanged and adjusted according to their local economic factors like GDP, Production Index, inflation, interest rates, and more.

Understanding Technical and Fundamental Analysis in Forex

In technical analysis, the traders try to find trading opportunities by studying the price movement. The traders compare the current and historical patterns to prepare conducive data that predicts the future price direction. This data often has line charts that allow the traders to see the price movement clearly. While the term used here is ‘technical,’ this data is open for interpretation.

The fundamental analysis is less focused on the price movement and more concerned with the socio-political and socio-economic elements. These factors have been known to affect exchange rates. Fiscal policies, too, have a major impact on the value and exchange of currencies. Another factor that affects the exchange rate of currencies is the monetary policies of the central bank. Traders also look at the political stability of a country before making any investment. This is why the forex market often sees a change in the investment pattern in the months following any major election. Fundamentals of Forex are not just restricted to these factors. They also give due attention to the natural disasters that can affect the political and economic state.

The Positives and the Negatives

Forex traders are often hooked to the news in anticipation of a new economic report, survey, indicator, or even an independent study released by the government sources of private institutions. There are a plethora of factors that can affect the value of a currency and its exchange rate. Thus, the traders closely study everything that can give them hints about the health of an economy.

Fundamental indicators are published regularly but at a certain interval of time. The fastest frequency could only be weekly publication, but in currency trading, fundamental analysis, new data, in the form of a price quote, is released every second. In some countries, capital accumulates slowly and, therefore, flows gradually and vice versa. This flow of currency is tied to the strength of the economy. If the financial indicators show that a certain economy will hold strong, more transactions will be made around that currency. As it will look more attractive to the traders, more foreign investment will be made in that currency. This will further strengthen the economy, leading to an increased currency flow, and the traders will have higher chances of making gains.

Taking the discussion further, the investors will be converting their capital into the country’s currency in question to invest. This will increase the currency demand, and following the basic rule of demand and supply, the currency’s value will get appreciated. However, the rules of microeconomics are not always linear when they are applied to Forex. We have seen the depreciation of currency even when the economy is healthy. Currencies and company stocks behave differently. Therefore, currencies are not always directly proportional to the health of the economy.

Finding discrepancies and manipulations in company stocks is easy to acquire balance sheets and other private companies’ financial documents. Moreover, as currencies are tools in government officials’ hands, policymakers can easily manipulate them.

Traders and investors look for signs of strength and weakness when economic reports and data are released. The market generally has some ideas or sentiments about the economy of a country. A majority of them lean in one direction. When price changes are made before the indicators’ release, it is known as ‘priced in the market.’ In such a case, there is little commotion after the release of the actual data. Diametrically, if the data varies drastically from what was anticipated or the market is unsure, the trade becomes volatile. Only experienced traders can trade around the time when an indicator is about to release. Rookies are bound to make mistakes during a commotion in the market when practicing fundamental analysis.

Economic Indicators and how to read the fundamental analysis in forex

The value of a currency is based on various factors, the major one being its economic condition. Governments or private organizations release various reports detailing the economic performance of their respective country. These economic reports contain important information that can be used to understand the country’s economic health.

These scheduled reports provide the market with indicators of whether the country’s economy is improving or declining. Like earnings reports, SEC filings, and other releases, these reports affect securities as well. Any deviation from the norm leads to large price and volume movements. Thus, traders keep a close eye on all the reports.

Unemployment numbers and infrastructural development are amongst the few things that are mentioned in these reports. Aspects like housing receive less coverage. Irrespective of with stat is explained in detail, every indicator is important.

Gross Domestic Product (GDP)

Gross Domestic Product or GDP is the value of all final goods and services produced in a country. It is an important indicator of the economic condition of a country. As it represents the total market value of a country’s production, it helps in identifying whether the country is making progress or not. However, this does not show the wholesome picture of an economy, the two reports issued in the months before the traders study the final GDP figures. If these reports are significantly revised, red flags are raised.

Retail Sales

The retail sales report broadly considers the total receipts of all retail sales in a given country. This report is created from a broad sample of retail stores throughout the country. It allows the researchers to understand the purchasing pattern of consumers. It also takes into consideration variables like seasonal shifts and adjusts them accordingly. This report is important for forex traders, too, as it enables them to predict the economy’s direction. If natives of a country purchase more than just commodities for necessities, it’s a sign of economic growth that can add to the currency’s value.

Industrial Production

The rate of production of goods says a lot about the development of a country. The report on industrial production shows the increase and decrease in the production of industries, mines, factories, and various utilities. It also tells about whether or not the factories are working at their full capacity. In short, it shows capacity utilization as well. If there is a steady rise in a country’s production and every sector is producing at its near capacity, it is safe to conclude that it is growing.

Traders who are concerned with the volatile utility industry use this indicator to measure utility production. It is such because whether conditions affect industrial production. If there is a considerable fluctuation between two reports due to weather changes can affect a currency significantly.

Consumer Price Index (CPI)

The CPI or Consumer Price Index highlights the change in consumer goods prices across 200 different categories. The CPI report is studied alongside a nation’s exports. Thus, it gives you a clear idea of whether a country is losing money on its products and services. Traders have to be very vigilant when monitoring the exports of a country. The prices of exports are often unstable as they correspond to a country’s currency’s strength and weakness.

Purchasing Managers Index (PMI), Producer Price Index (PPI), Employment Cost Index (ECI), Durable Goods Report, Employment Cost Index (ECI), and housing stats are other major indicators that the traders can use. In addition to these government-issued reports, private institutions like the Michigan Consumer Confidence Survey issued some reports and independent studies. These combined reports are precious to assess the risk.

How to Use Economic Indicators

The value of a country’s currency depends on its economic conditions. Any change in the economic indicators directly affects the price and the volume of a country’s currency. One must know that while all the economic indicators are part of the fundamental analysis of forex trading, they are not the only factors on which the value of a currency depends. Technical factors, third-party reports, and various other things can bear the currency value.

- Keep the following things in mind while conducting the fundamental analysis in the forex market:

- Always have an economic calendar around you that lists the release date of the indicators. It would help if you also kept an eye on the future as markets move in anticipation of a particular indicator or report expected to be released.

- Analyze which economic indicator is getting the most attention in the market. These indicators often act as catalysts for the upcoming price rise and value movement.

- Understand what the market is expecting from a particular report or indicator and then cross-check if that expectation was met or not. This is more important than the actual data. There is seldom a huge difference between the expectation and reality, but you need to be careful if such is the case.

- Be patient and never jump the gun if you hear something. Many times numbers are revised once they are released. Since forex trading is susceptible to every pip, things can change rather quickly. Wait for the revisions, look at the trend and then proceed.

Conclusion

The forex trading market is no place for an impatient person. Various government reports and independent studies can be used to understand the fundamentals of forex trading. One needs to understand how these economic indicators affect the value of a currency. Take your time, and don’t rush into anything.