Some terms that traders use are pretty uncommon. For example, I remember hearing “Cable,” and I didn’t know that traders talked about GBPUSD. Today, I will show one example of a term that a small number of traders use: “Barcoding.”

What Does Barcoding Mean in Stocks?

Barcoding means a price stabilization period in trading. Usually, after a big move, either a bullish or bearish trend price fluctuates in a narrow range, making consolidation before the next move. Barcoding represents a consolidation period in sideway market condition trading.

The barcode pattern looks like consolidation, so this term was created based on that assumption.

“Stock barcoding” is not widely used or recognized in finance or investing. During such periods, the stock or market is said to be trading sideways or moving in a horizontal direction, forming a pattern that resembles a bar code. This is often referred to as a consolidation phase or a period of price stabilization, where buyers and sellers are in a state of equilibrium, and there is no clear direction for the stock or market.

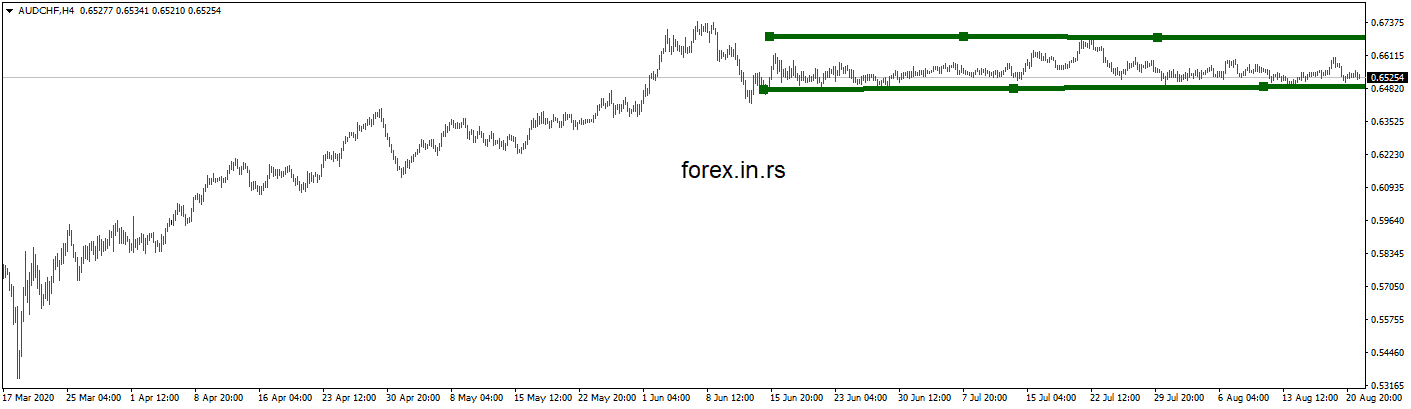

Look at this example of sideway trading:

Investors may find this price action frustrating or confusing, as it can be challenging to identify profitable trading opportunities. However, it can also allow investors to accumulate shares at a lower price in anticipation of a potential breakout or trend reversal in the future.

It’s worth noting that this type of price action is a natural part of the stock market cycle. Stocks or markets can remain in a consolidation phase for extended periods before eventually breaking out in either direction. Therefore, it’s essential to exercise patience and discipline when investing during these periods and to have a well-defined investment strategy considering the potential risks and rewards of the current market conditions.

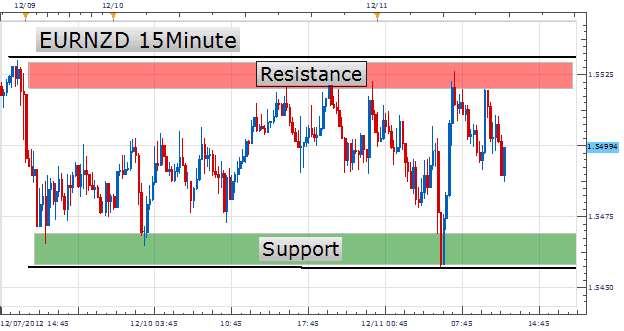

Here is an example of sideway trading (EURNZD barcoding) for EURNZD assets:

Several different factors can contribute to a barcoding phase in the stock market. One of the primary factors is the completion of a significant price move that has already exhausted the majority of buyers or sellers. In such situations, traders can expect a period of consolidation, where prices will fluctuate within a narrow range before moving in a new direction.

Another common factor that can lead to a barcoding period is the markets entering a condition of indecision. This often occurs when investors are waiting for important news or data that could affect the price movement of assets in the market. As a result, the market lacks a clear direction or trend during such periods, making prices relatively stable.

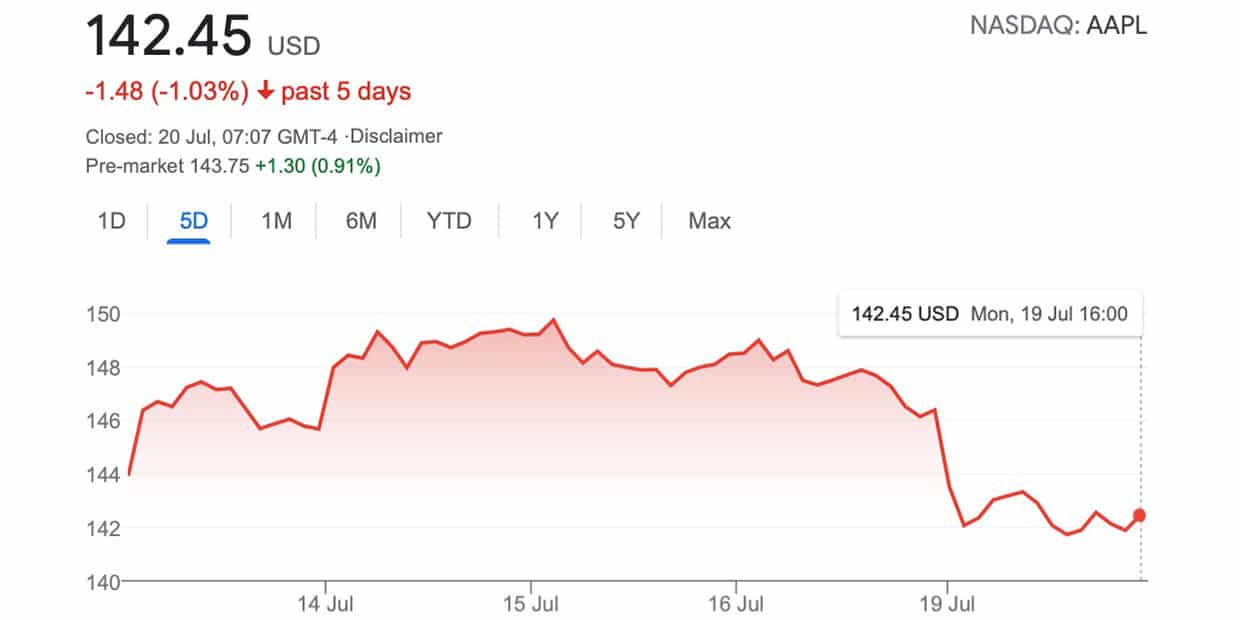

APPLE Stocks trading in the Barcoding period

Suppose the price of AAPL has been trading between $150 and $1146 for several days, with no clear trend in either direction. The price has increased within this range without breaking out to new highs or lows.

As an investor, you may trade this consolidation period in several ways. One approach could be to buy AAPL when the price approaches the lower end of the range ($145), anticipating a potential reversal or breakout to the upside. Similarly, you could sell AAPL when the price approaches the upper end of the range ($150), anticipating a potential reversal or breakout to the downside.

Another approach could be to wait for a clear breakout from the consolidation range before taking a position. For example, if the price breaks above $160, this could be a signal to buy AAPL, with a potential target of $160 (which is two times the range of the consolidation period). Conversely, if the price breaks below $150, this could be a signal to sell AAPL, with a potential target of $140 (also two times the range of the consolidation period).

See the example when the price after consolidation from $150 -$146 tight range goes bearish to 142:

Stocks barcoding ranges from $150 up to $146

It’s worth noting that trading during a consolidation period can be challenging. The price can remain within the range for an extended period without clearly indicating which direction it will break out. Therefore, it’s essential to exercise patience and discipline when trading during these periods and to have a well-defined trading plan considering the potential risks and rewards of the current market conditions.

Barcoding can be identified through technical analysis by looking at charts and identifying a period of sideways price action with little or no significant price movement. In such instances, traders can expect the market to remain in this phase until a significant change in sentiment, such as news or data releases, could tip the balance in favor of buyers or sellers.

Traders can take advantage of barcoding periods to make informed trading decisions. During this time, investors can analyze the market and identify assets that show a high probability of price movement in either direction. In addition, investors can employ various trading strategies, such as range trading, to capitalize on a barcoding period.

In conclusion, barcoding is a concept in stock (or any asset) trading that can help traders identify market price consolidation periods. The phase, characterized by limited price movement in a narrow range, indicates a significant opportunity for investors to evaluate market conditions and plan their trading strategies. Identifying barcoding patterns and using this knowledge to make informed trading decisions can help traders take advantage of price trends in the market, increasing their potential for profitability.