Platinum is a rare and precious metal used throughout history for its aesthetic and monetary value. It is often referred to as the “King of Metals” due to its rarity, strength, and malleability. Its color is white-silver which makes it highly sought after when crafting jewelry or other decorative items. The price of platinum has increased in recent years, making it a wise investment for many people looking to diversify their portfolios.

What Impacts the Platinum Price?

On the Platinum price, there are the following impacts:

- Geopolitical impacts (export of Platinum)

- Worldwide Recession (weak import, jewelry selling decline, etc.)

- Automotive industry ( industrial applications – catalytic converters)

- The medical industry and laboratory equipment industry.

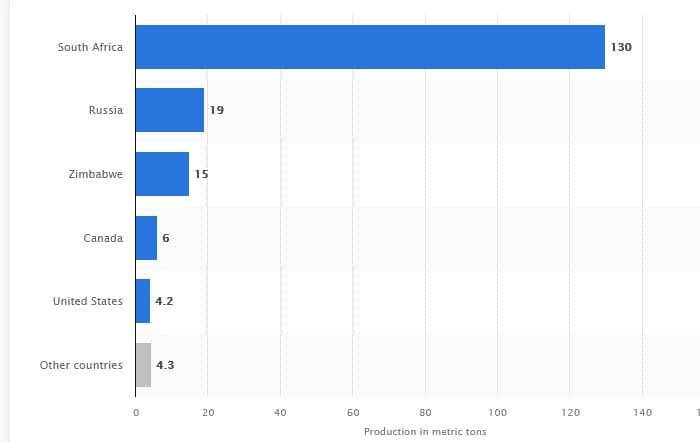

Geopolitical instability has also played an increasingly important role in determining platinum’s spot price. South Africa is one of the world’s leading producers of this rare metal, so any significant political developments in that country can cause sudden shifts in pricing markets, either up or down, depending on how investors view it. Other African countries, such as Zimbabwe, can also influence pricing if they contain large reserves within their borders. In addition to this risk factor, governments across multiple countries have been known to introduce taxes or impose restrictions on mining operations which can affect the availability of some supplies and thus harm any given market price at any given time.

The most critical country in platinum production is South Africa which has more than 130 metric tons of platinum:

Platinum has been used for centuries for its distinct properties, such as corrosion resistance, electrical conductivity, and high strength-to-weight ratio. Ancient cultures once used it as a currency because of its scarcity and intrinsic worth. Today, platinum is still widely used in jewelry and coinage production; however, the primary use of this precious metal is in industrial applications such as catalytic converters. Catalytic converters are used in automobiles to reduce air pollution caused by combustion engines.

Platinum prices mainly depend on global market forces, including supply and demand, political unrest, economic stability, speculation, etc. Platinum prices tend to rise during geopolitical turmoil or currency devaluation because investors often consider platinum a haven asset, as with gold or silver investing, individuals can purchase physical platinum bars or coins or invest in ETFs that track the metal’s spot price. However, due to its higher value per ounce than other metals, such as gold or silver, investors may want to consider taking out insurance policies if they decide to hold physical bullion.

Besides being valuable for its monetary worth, platinum has several important uses in industry and science due to its chemical properties. Aside from being the most influential metal for reducing pollutants from vehicle exhaust gases (as mentioned above), it is also used in medical devices such as pacemakers; laboratory equipment such as beakers; jewelry casting; dental prosthetics; fuel cells; electronics components, etc., showing just how versatile this metal is across multiple sectors.

Platinum plays an important role economically, technologically, and medically – making it an attractive asset class for investors looking for long-term investment returns. It’s wise, then, that individuals doing research into precious metal investing should take into account not only the current market forces behind pricing but also factors like industrial usage and technological advancements that may affect supply/demand dynamics over time when making their decisions about whether they should purchase physical bullion or ETFs tracking the spot price of platinum or gold, etc. With any commodities investing like this one, though – driven by market volatility – caution must be taken when entering this type of venture so that potential risks can be minimized while profits can be maximized simultaneously!

Platinum prices are significantly impacted by several factors, from geopolitical conditions in countries where the metal is mined to supply and demand dynamics. The primary source of platinum demand is automotive catalysts used to reduce emissions, followed by jewelry, petroleum refining catalysts, and the computer industry. These demand sources have been altered dramatically due to the global COVID-19 pandemic. Vehicle production dropped significantly as showroom closures were enforced worldwide, decreasing autocatalysts’ use (which accounts for one-third of platinum demand) and pushing prices down. At the same time, supplies dropped by 5.5% while demand increased by 21.6%.

The market forces that impact platinum prices also vary considerably from other precious metals like gold or silver. Seasonal trends come into play more prominently with platinum as well. For example, colder winter climates typically spur vehicle production, driving up demand for autocatalysts and raising platinum prices simultaneously. On the other hand, summer months often see lessened auto sales due to the vacation season leading to lower demands and expenses for platinum.

Please read our article “What are Precious Metals.” If you want to know more about how to invest in precious metals, read our extended version article.

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: