Table of Contents

Traders use Pennants to calculate further movements of the market as they are prolonging patterns visible on the forex market. Just as the triangle pattern, the Pennant pattern also has some notable differences worth knowing for traders. This article will help learn pennant chart pattern recognition, what they intend, its cause, and most considerably, how to apply them for more effective trade results.

What is a pennant pattern?

A pennant pattern (flag pattern) is a breakout chart pattern that follows the main price trend and has a rectangular shape resembling a flag. It suggests if the trend would continue for a long time frame or would be reversed in a swift motion.

Pennant Pattern features

Pennant pattern is a breakout chart pattern. It is preferred when a large ascending or descending movement is noted by security. Before any further movement in a similar direction, a detailed alliance is made. The pennant pattern appears to be a minute, evenly arranged triangle, and it is made from several forex candlesticks. Pennant patterns are generally mentioned in two types as bullish or bearish, which depends on the direction of their movement.

While you take a glimpse of the Pennant prolongation pattern, below-written details would be noticed:

- A flagpole: A Pennant pattern regularly commences from a flagpole, thereby differentiating it from such other patterns (like the evenly arranged triangle). The first subsequent and robust movement introducing the evenly arranged triangle is called a flagpole.

- Breakout levels: One breakout will be found at the ending of the flagpole, and the second will happen after the strengthening cycle, where ascending or descending drift will keep going.

- The Pennant itself: The triangular design formed at the time of market consolidation, happening in the midst of the breakout, and the flagpole is called the pennant. The two merging trend lines generate the triangle, called the Pennant.

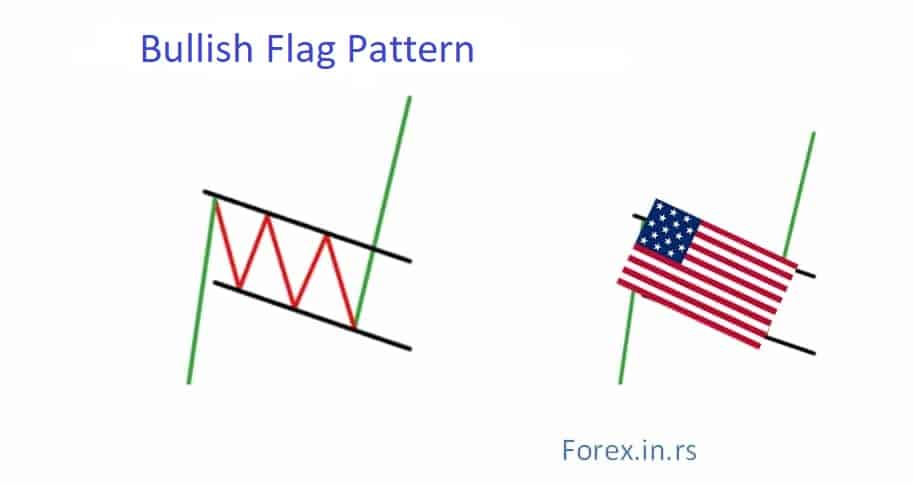

Bullish Pennant Pattern

The bullish pennant chart pattern or bull pennant represents the bullish breakout pattern during the main bullish trend, after a short period of consolidation, formed in an area less than 50% of bullish retracement.

Figure 1: Bullish pennant pattern

Prolonging candlestick patterns, which take place in a solid upward moment, is called Bullish Pennants. The Pennant formation happens when the flagpole rises, a concentrated time span, and then prolongs the rising post to the breakout. Dealers keep looking for discontinuity on to the top of the pennant so that they can have the benefit of the improved bullish power.

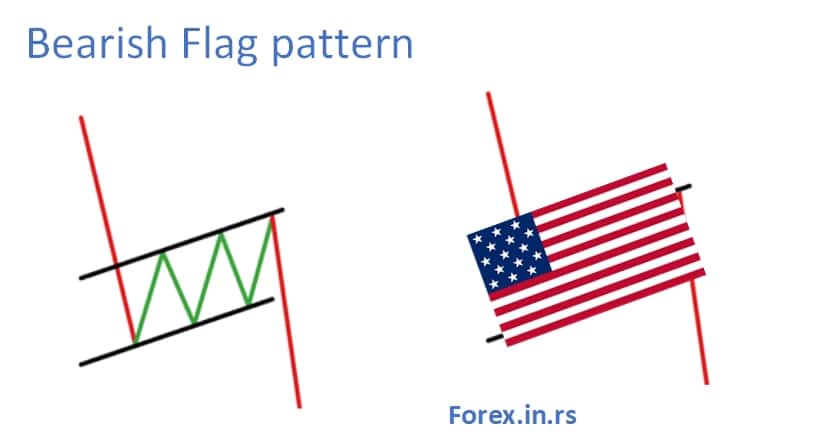

Bearish Pennant Pattern

The bearish pennant or bear pennant represents the bearish breakout pattern during the main bearish trend, after a short period of consolidation, formed in an area less than 50% of bearish retracement.

Figure 2: Bearish pennant pattern

Bearish Pennants and Bullish Pennant are inversely proportional to each other. Pennants formed by prolonging patterns that appear in rigid droops are known as Bearish Pennants. Bearish Pennants always commence from a flagpole – a saturated price drop, chased by a break during descending movement. This break develops a triangle shape, which is called a Pennant. Then comes breakout, and the descending activity prolongs. Traders keep an eye to access precise deals on a gap beneath the pennant.

Difference Between Triangle Pattern and Pennant Pattern

- A Pennant pattern is supposed to be scouted by a solid ascending or descending move that features a flagpole. If the flagpole is not present, it won’t be a pennant but just a simple triangle.

- A shallow retracing has been developed by Pennant (Generally, it is not more than 38% of the flagpole). A deep retracing demonstrates a triangle instead of a Pennant.

- Prolongation of the ascending or descending trend distinguishes a pennant.

- A Pennant is a compressed pattern that is generally concluded within a week or three. It is a triangle pattern that takes more time to develop.

Trading the Bearish Pennants and Bullish Pennants

While trading, the approach is made to Bearish Pennant and Bullish Pennant patterns will be the same, but the Bullish Pennant would have a sustained inclination while the Bearish Pennant will have an un-sustained inclination. The case below shows the way to deal with a Bullish Pennant noticed in NZD/GBP.

After an abrupt and acute price movement, a dealer should examine to access the deal on an affirmation of a breakout. Post to an abrupt and acute price movement, the pennant shows favorable signs for a breakout and prolongation regarding the first movement.

Candlestick closing upon the pennant avails the entrance. In this case, the break changed into a considerable substitute and brought the chance of an endured upward flow.

Observing a quite big move, break-in damage can be located at the shallow of the breakout candle or, more traditional traders can locate a stop underneath the pennant limit to minimize the risk. This technique usually provides a convincing level of shield to the traders.

The Bottom Line

Traders should consistently endorse reasonable risk management because the market is always unpredictable. Because of this, never trade with a principal that you cannot afford to give up.

Measuring the space between commencement of the flagpole and the Pennant can help traders to set the target level, later on, duplicating this gap against the breakout in rates and then pursuing the Pennant.

Hopefully, the knowledge delivered in this article proves to help understand pennant patterns, their types, and trading methods.