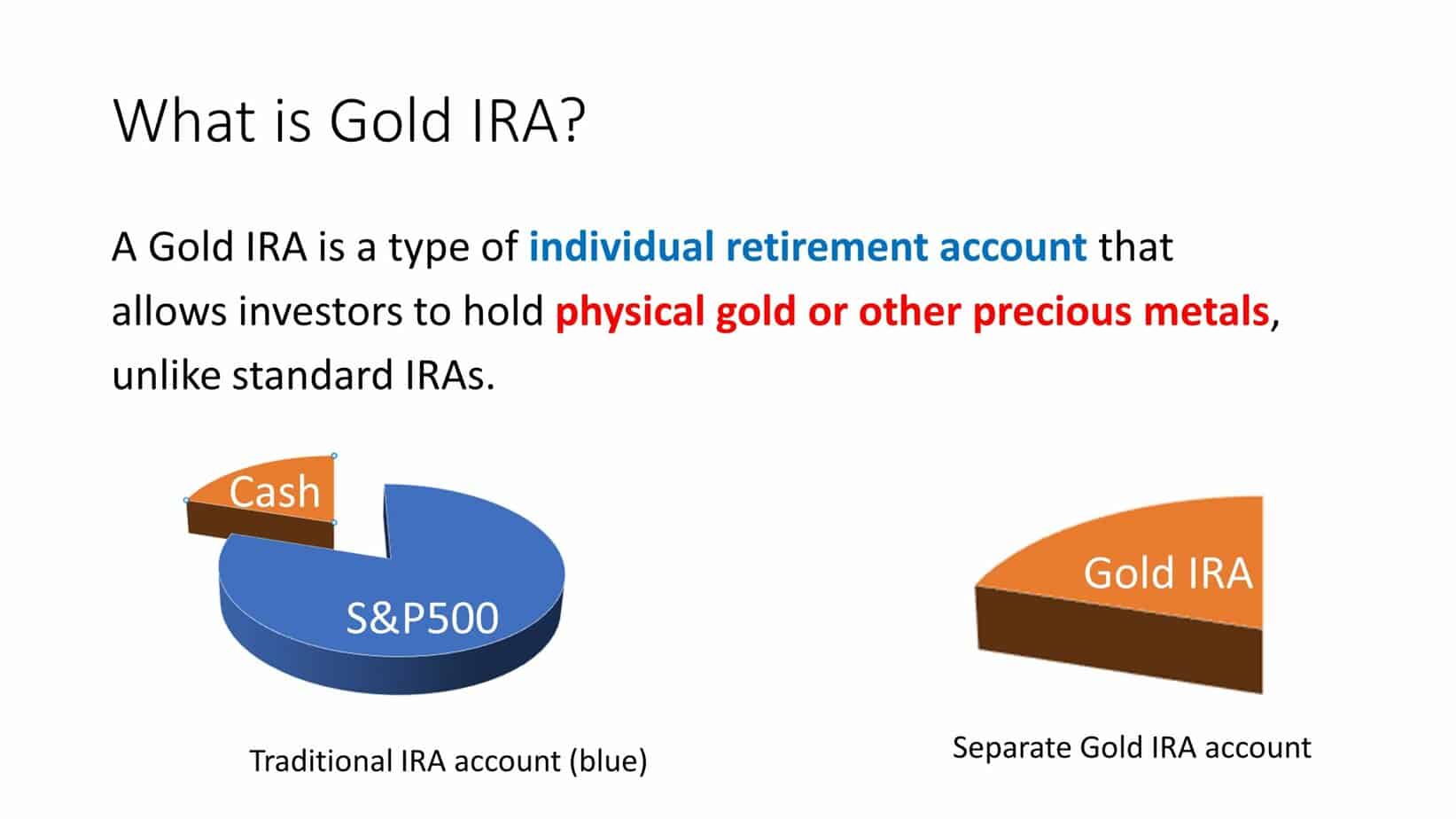

A Precious Metal IRA is an Individual Retirement Account (IRA) that holds physical gold, silver, platinum, and palladium. This type of IRA allows investors to diversify their retirement portfolios with tangible assets and benefit from the potential appreciation in the value of these precious metals over time.

Precious metal IRAs provide many benefits for those looking to save for retirement. The main advantage is that they’re a form of investment insulated mainly from stock market volatility. Gold prices have traditionally risen when other asset classes have dropped in value, and investing in gold can help protect your retirement savings against downturns or recessions. Plus, gold and other precious metals are tangible assets you can pass down to your heirs after retirement.

GET GOLD IRA GUIDE

What is a Precious Metal IRA?

- A Precious Metal IRA (Individual Retirement Account) is a type of retirement account that allows individuals to invest in precious metals such as gold, silver, platinum, and palladium.

- It is a self-directed IRA that permits the account holder to purchase and hold precious physical metals within their retirement account.

- Precious Metal IRAs are regulated by the Internal Revenue Service (IRS) and must meet specific requirements and standards.

- The value of the precious metals held within the IRA is subject to market fluctuations and can provide diversification benefits to a retirement portfolio.

- Precious Metal IRAs offer investors a way to hedge against inflation, currency devaluation, and geopolitical risks.

- The IRS allows certain types of precious metal coins and bars to be held within the IRA, and the metals must meet certain purity and quality standards.

- Precious Metal IRAs are not insured by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Investors must carefully research and choose a reputable custodian to hold their metals.

- The tax treatment of a Precious Metal IRA is similar to that of a traditional IRA, with tax-deductible contributions and withdrawals subject to taxes and penalties.

In addition to the possible protection against stock market losses, investors who invest in a precious metal IRA may also benefit from tax-advantaged gains. Investing in this type of account allows you to defer taxes on any profits until you begin taking distributions from your account, at which point capital gains are taxed at more favorable long-term rates.

When it comes to setting up a precious metal IRA, the process is relatively straightforward. First, you must open an account with an approved depository custodian and fund it with either cash or assets in another qualified plan such as a 401(k). You then designate what types of gold or other precious metals you want to buy as part of your retirement portfolio. Your custodian will purchase the requested metals on your behalf and store them in an approved storage facility.

The gold coins allowed for inclusion within a Precious Metal IRA typically include Augusta Precious Metals, American Gold Eagles, American Gold Buffalos, Canadian Maple Leafs, Austrian Philharmonics, and South African Krugerrands eligible by the IRS due to their purity levels. Silver coins such as American Silver Eagles may also be included in some cases.

When selecting which types of assets to include in your Precious Metal IRA portfolio, it is essential to remember that not all investment options offer equal returns or security over time, so it’s necessary to do research before committing funds to any one asset class or sector of the market. Additionally, investors should understand fees associated with setting up and maintaining a Precious Metal IRA, including annual storage fees paid directly to the account custodian managing the account and potentially higher premium costs associated with purchasing certain rarer coins or bars compared to standard bullion products.

- Step 1: Determine why you are investing in precious metals. Consider whether you want to maintain the value of your retirement account or seek potential growth. Evaluate how much risk you are willing to take on.

- Step 2: Contact a trusted financial advisor about setting up an IRA that allows for precious metal investment. Ensure that your includes invested assets credited to dealers and safeguards against fraud and counterfeiting.

- Step 3: Research the different types of precious metals available for purchase, such as gold, silver, platinum, and palladium. Consider the advantages and disadvantages of each option. If you decide to pursue gold, determine what type of gold (coins, bars) you want to invest in.

- Step 4: Consult with your financial advisor about the type of accounts best for precious metal investments within an IRA. This may include an individual retirement account (IRA), Roth IRA, or SEP-IRA. Depending on the custodian’s rules, restrictions may apply regarding which types of precious metals can be held in these accounts.

- Step 5: Select a financial institution or broker that offers precious metal retirement accounts, such as a self-directed IRA custodian or broker-dealer specializing in buying and selling physical gold or silver coins and bars inside IRAs.

- Step 6: Open a retirement account with the selected institution/custodian or transfer existing funds if applicable. Before making any purchases, check fees associated with opening/managing an account and buying/selling/holding metals; these charges could eat into your profits if not considered when planning your investments!

- Step 7: Buy your desired precious metal products through the selected institution’s platform either by transferring funds from another bank account or through their online trading tool; ensure that all instructions regarding purchasing process are correctly followed so no mistakes are made in terms of order size/price, etc.

- Step 8: Once the purchase is completed, successfully review incoming documents from the institution confirming the transaction; this should show detailed information such as the date purchased, the quantity bought & current value being held under your name within their system (i.e., physical gold coins).

- Step 9: Monitor market prices regularly – this can be done manually by keeping track of gold or silver spot prices or automatically using tools provided by some institutions – so that any changes can be taken advantage of quickly if needed; also remember taxes due on sales must be paid before the end of the tax year! Lastly, keep paperwork related to all transactions safe for future reference.

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: