Table of Contents

The economy is a complex and interconnected system that can be influenced by various factors, including changes in interest rates, tax policy, and consumer spending. When the economy is experiencing growth and prosperity, it is generally considered to be in good shape. However, when the economy goes into recession, it can hurt businesses and consumers alike.

In today’s globalized world, economic recessions can occur due to various factors. Some of these include shifts in consumer preferences, rapid technological advancements that disrupt traditional business models, or external shocks like political instability or natural disasters. Despite these challenges, there are steps that policymakers and businesses can take to help minimize the effects of the recession on the economy as a whole.

At its core, a practical approach to managing economic recessions must focus on creating an environment where businesses and consumers feel confident about investing their time and money. This may involve providing targeted tax breaks for specific industries or regions, implementing policies encouraging innovation and growth in key sectors, or taking other steps to improve overall economic conditions. By working together to strengthen the economy’s foundation during the recession, we can build a more resilient and prosperous future for ourselves and future generations.

In this article, we will write about the basic recession meaning. If you want to know more about how to buy precious metals during the recession, read my article.

If you live in the US and want to protect your IRA during the recession, visit the website and download a free pdf. However, if you live outside the US, you can trade gold and silver during a recession using an HFM broker.

We suggest you visit our page, Best Forex brokers, if you are a non-US resident.

What is a recession?

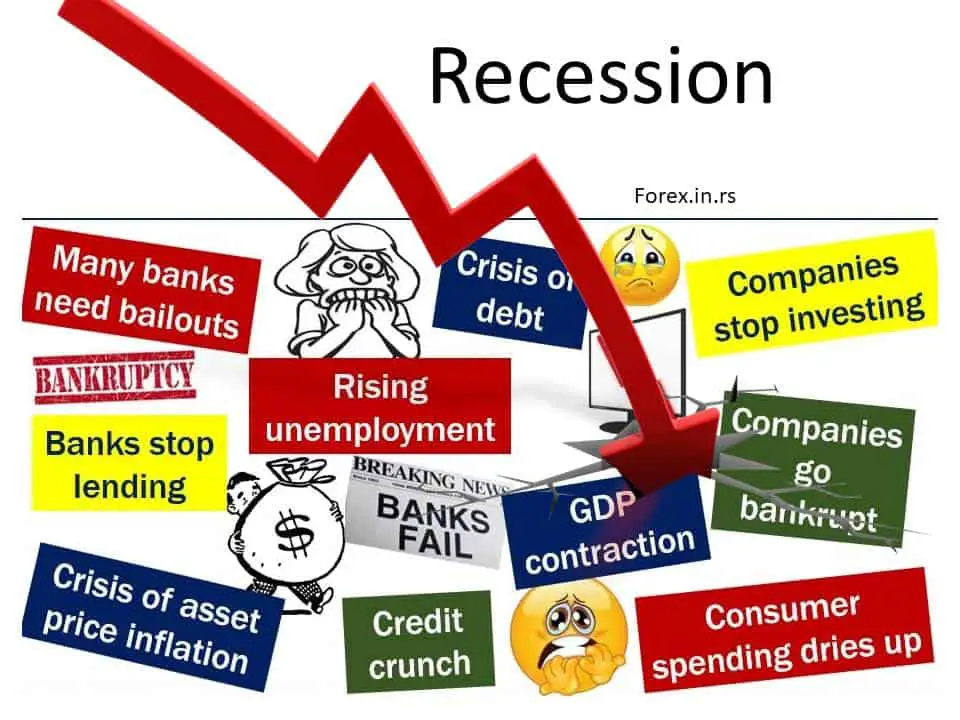

A recession is a period of slow or negative economic growth characterized by declining consumer spending and investment, rising unemployment, and falling prices. Recession can occur due to natural factors like increased competition from similar products or as an intentional government policy to help restart economic growth during times of low demand. While a recession may be difficult for individuals and businesses, it can also rebalance the economy by reallocating resources to more efficient uses.

Despite some positive signs in recent months, such as increased consumer spending and improved housing sales, many experts fear that the global economy is still fragile and could be vulnerable to further shocks. If these fears are realized, it could mean more hardship for businesses and workers worldwide, as well as increasing pressure on policymakers to address this ongoing crisis.

How to stop the recession?

- The first step in stopping recession and slowing down inflation is identifying key indicators indicating the economy’s health. These may include unemployment, wage growth, consumer spending, industrial output, and business investment.

- Once these key economic indicators have been identified, economists can develop strategies for stimulating economic growth and mitigating inflationary pressures. For example, this may involve implementing tax cuts or investing in public infrastructure projects.

- Another critical step is to monitor the impact of these policies over time and make adjustments as needed. This may involve tweaking tax rates or stimulus packages based on changes in labor market conditions or other factors.

- Finally, economists must also work closely with policymakers at all levels of government to ensure that their recommendations are implemented effectively and efficiently. This often involves communicating with lawmakers about the potential impacts of new policies on macroeconomic conditions and advising them on how to respond to changing economic conditions.

As we continue to navigate through this challenging economic environment, it is essential for individuals and businesses alike to remain diligent and focused on finding ways to weather this storm. By working together and utilizing effective strategies for coping with recessionary pressures, we can help ensure that our economies and communities emerge more vital than ever on the other side.

The most common way that recessions are categorized is by the shape of their recovery, which can vary widely depending on the factors that caused them in the first place. Some of these factors may include changes in interest rates, shifts in consumer spending habits, or disruptions to supply chains.

Despite the challenges associated with recessions, several vital facts are essential to understand. One is that they tend to be temporary phenomena, usually resolving over time as businesses and consumers adjust to the new economic landscape. Another critical fact is that different sectors of the economy may be affected quite differently during a recession. For example, while manufacturing and housing may take a significant hit during a recession, other sectors like technology or healthcare may remain relatively stable.

Overall, it is essential to remember that recessions are part of the average economic cycle and can often provide opportunities for businesses and individuals to grow and thrive amidst changing market conditions. It is essential to stay informed about current trends in your industry or sector to best prepare for a recession and take advantage of any opportunities it might present.

Consumers and recession

When it comes to recessions, one of the most important factors is the role of consumers. In a recession, consumers can play a crucial role in whether or not an economy continues to slide into negative territory by spending more money or cutting back on spending habits.

There are a few different reasons why this is the case. For one thing, when consumers lose confidence in the economy and begin to save more money, they may reduce their spending on goods and services. This can significantly impact businesses, as they depend on consumer spending to keep their operations going.

As a result of this reduced spending power, businesses may need to cut back on their spending as well – which can include things like lowering wages and trimming their workforces – to keep up with lower revenue levels from customers. This often leads to rising unemployment and less overall income for consumers, further contributing to the business cycle’s downward portion.

Another potential factor contributing to the recession cycle is inefficient spending practices among consumers or businesses. For instance, if consumers take on too much debt that they cannot realistically pay back when times get tough, this can create an unsustainable cycle of overspending and financial problems that can lead to lower consumption levels.

Similarly, suppose businesses expand into new territories or products that might not be supported by changing economic conditions or cannot sustain themselves during periods of slower growth or contraction. In that case, this also puts them at risk for financial failure and the loss of jobs for employees. This frivolous or unsustainable behavior among consumers or businesses is often a significant contributor to economic downturns.

Currency pairs and recession

Currency pairs can play an essential role in an economic recession, as they can help investors to hedge against potential losses. During periods of economic turmoil, specific currency pairs may be more sensitive to market changes or economic conditions than others.

One key factor when trading during a recession is the underlying currencies’ value. For example, suppose one currency is seen as being particularly vulnerable during a downturn due to factors like high debt levels or high inflation. In that case, investors may choose to short that currency and purchase another currency instead. This can help them mitigate risk and better protect their investments during economic uncertainty.

In addition to assessing the value of different currencies during a recession, paying attention to how interest rates may impact these currencies is also essential. When central banks cut interest rates to stimulate the economy and encourage lending, this typically leads to lower exchange rates for that currency. Therefore, those trading currency pairs may want to keep an eye on interest rates to make more informed decisions about where they invest their money.

Overall, trading currency pairs during an economic downturn can be risky but potentially lucrative. By researching and understanding how different market conditions could impact your investments, you can take steps to minimize your risks and maximize your potential gains during these volatile times.

I think currency pairs depend on interest rate politics during a recession. If governments try to increase the interest rate to slow inflation, that currency pair will increase in price.

Great Depression Recession

The Great Depression was one of the most devastating recessions in US history. This economic downturn began in the late 1920s, triggered by a series of events that included a stock market crash and high unemployment rates.

During this period, many Americans found it difficult to find jobs or make ends meet, and many lost their homes and businesses due to the recession. The Great Depression’s long-lasting effects on the US economy contributed to rising poverty rates, increased income inequality, and decreased economic growth.

Despite these challenges, many Americans banded together during the Great Depression to support one another and help struggling families get back on their feet. Some organizations provided food and housing assistance to those in need, while others worked to create more robust social safety nets for those struggling with unemployment or poverty.

Today, we continue to learn from the lessons of the Great Depression – both positive and negative – as we work to improve our economy and build a more resilient society. Even though the US has experienced other recessions since then, none have been quite as severe or widespread as the Great Depression. And with strong leadership at all levels of government and society, there is hope that we can prevent future recessions from becoming as disastrous as this one was.

2008 financial crisis

Some economists believe that the current recession, which began in late 2008, maybe the worst since the Great Depression of the 1930s.

The 2008 financial crisis was caused by several factors, including cheap credit and lax lending standards. These conditions led to a housing bubble that eventually burst, leaving the banks holding trillions of dollars of worthless investments in subprime mortgages. The Great Recession affected millions worldwide, costing many their jobs, savings, and homes.

One of the key drivers of the financial crisis was easy to access to credit. Many banks offered low-interest loans and offered credit cards to consumers with poor or no credit history, often without requiring any collateral. This made it easy for people to borrow money to purchase homes and other assets such as cars or even stocks.

However, this cheap credit came at a cost. To make these loans profitable, many banks relaxed their lending standards and ignored signs that borrowers may be unable to repay them. They allowed borrowers to take out large home loans they could not afford or approved home refinancing that put homeowners at risk of losing their houses if they fell behind on payments.

Other factors also contributed to the crisis, including questionable mortgage practices such as predatory lending and irresponsible investing by financial institutions that involved risky financial products like derivatives and collateralized debt obligations (CDOs). These factors contributed to an economic bubble fueled by speculation and greed that ultimately burst in 2008.

As a result of the financial crisis, millions lost their jobs and homes when the economy went into recession. The effects were felt worldwide, causing upheaval in developed countries like the United States and emerging markets like China and India. Though measures have since been taken to stabilize the economy and prevent another crash from happening again in the future, many are still affected by the consequences of this devastating crash nearly a decade later.

The recession of 2008 was one of the most severe economic downturns in recent history, causing widespread job losses, falling wages, and increased unemployment.

At the time, economists were unsure why this recession hit so hard or had come on so suddenly. Some blamed rising oil prices, while others pointed to the general decline in housing prices, which had been steadily dropping since 2006. Whatever the cause, the result was a period of instability and uncertainty that affected businesses and consumers alike. Many companies were forced to shut down or lay off workers to stay afloat, while families struggled with ever-increasing bills and mounting debt.

Despite these challenges, many people also saw this period as an opportunity for change and renewal. Amidst all the fear and worry over layoffs and financial hardship, a renewed focus emerged on entrepreneurship and self-sufficiency.

Almost ten years later, the economy has largely recovered from that recession. Although there are lingering effects in some sectors of the economy – particularly those tied to housing – most people have moved on from this challenging time. They are looking forward to brighter days ahead.

What is the Difference Between a Recession and a Depression?

A recession is a period of economic decline, defined as two or more consecutive quarters of negative growth. While a recession is usually associated with a severe downturn in the overall economy, it can also occur within a single sector of the economy – such as in housing, energy, or retail.

In contrast, depression is an even more severe economic downturn characterized by long periods of falling output and high unemployment rates that persist for several years. Because of its scale and duration, a depression affects multiple sectors and countries worldwide, resulting in widespread adverse economic outcomes.

While there is no definitive definition of depression, many economists use the terms interchangeably to refer to severe recessions that are protracted or extend beyond two or three years. With that said, some analysts believe there should be apparent differences between these terms based on the severity and duration of an economic contraction.

For example, while most economists would consider the Great Depression to be an example of a full-blown depression, they may only characterize lesser recessions as “severe” or “protracted” recessions instead. This distinction can also apply when measuring recessions across different economies. So while some countries may experience milder recessions over shorter periods than others, all recessions are considered adverse events that negatively affect growth and employment in those countries.

Despite these distinctions between different levels of economic contraction, it is essential to note that even minor recessions can have lasting effects on workers and businesses due to reduced consumer demand and high unemployment rates during these difficult periods. This means that individuals and companies should take steps to mitigate any potential risks before and after an economic contraction occurs by developing financial plans for restructuring debt obligations or creating new business models for accelerated growth during future upturns in the business cycle.

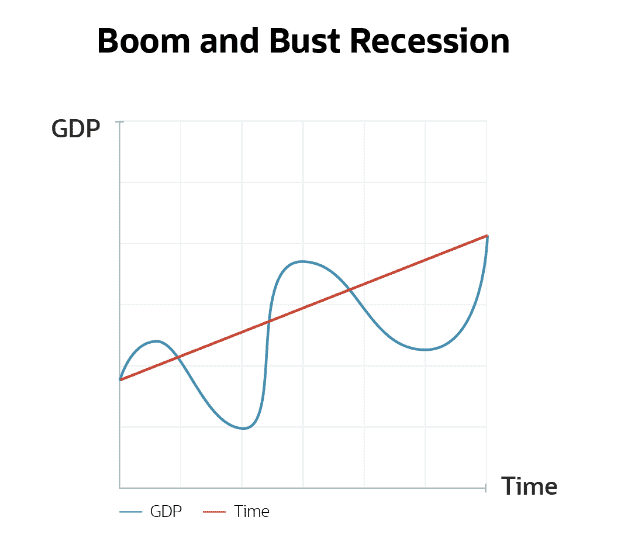

Boom and bust recession

A boom and bust recession is a period of economic expansion followed by contraction, where the economy moves between periods of high growth and decline. This cycle is often driven by various factors, such as changes in interest rates, government policies, or shifts in consumer demand.

During a boom phase, businesses tend to experience high levels of growth as consumers spend more money on goods and services. However, this also leads to inflation, as demand outpaces supply for many products and services. To counteract this and help slow down economic growth, central banks or other government agencies may implement policies to cool off the economy by raising interest rates or tightening lending standards.

In a bust phase, businesses typically experience lower levels of growth and profitability. Consumers may scale back their spending due to concerns about the economy or unmet financial obligations. As a result, unemployment and other negative economic indicators may rise during this period.

Several factors can contribute to boom and bust recession cycles, including changes in the business environment or government policies such as taxation. However, some economists also argue that these cycles may be driven by natural economic fluctuations that occur over time due to market forces. To better manage these cycles and ensure long-term economic growth, policymakers must understand their underlying causes and potential impacts on businesses and consumers.

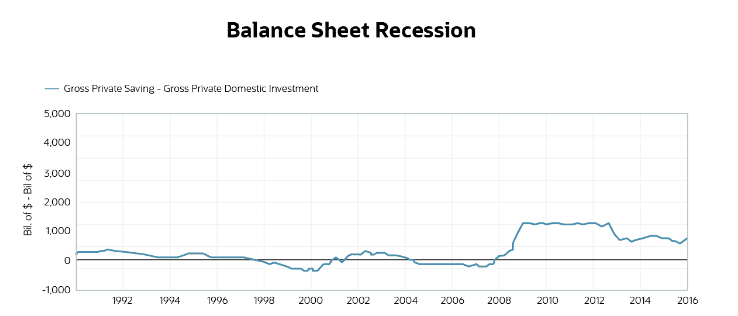

Balance Sheet Recession

A balance sheet recession is a type of economic downturn caused by high financial debt levels. During a balance sheet recession, consumers and businesses focus on paying down their debts rather than spending money, which can hurt the economy’s overall health.

There are several possible causes of a balance sheet recession, including high-interest rates, overly loose credit markets, and insufficient savings during periods of economic growth. These factors can all exacerbate the issue by encouraging people to take on more debt than they can reasonably afford or discouraging them from saving for an emergency or future expenses.

One way to recover from a balance sheet recession is through government stimulus spending or tax cuts, which can encourage borrowers to loosen their purse strings and spend again. However, this strategy comes with challenges, as it is often difficult to determine how much stimulus should be provided to avoid further burdening the economy.

Suppose you want to avoid suffering the effects of a balance sheet recession. In that case, you must maintain healthy financial habits, such as saving for emergencies and making intelligent decisions about your credit card use. Additionally, it is essential to stay informed about current economic trends to make informed decisions about your finances and investments.

Investing in Precious Metals during Recession

Investing in precious metals can significantly diversify your portfolio and protect your assets during economic uncertainty. During a recession, stock prices typically decrease as investors pull their money out of the markets. At the same time, gold and other commodities tend to experience an uptick in value, making them a popular choice for savvy investors looking to capitalize on the economic downturn.

You can use several strategies when investing in precious metals during a recession. One approach is to hold physical gold or silver coins or bars, which can provide stability and liquidity during challenging economic times. Another strategy is to purchase mining stocks, which offer the potential for greater returns if the price of precious metals rises significantly.

Whether buying physical gold or mining stocks, it is essential to do thorough research and choose investments that align with your risk tolerance and financial goals. While investing in precious metals may not be suitable for all investors, it can be a valuable tool for protecting your portfolio during turbulent economic times.

If you live in the US and want to protect your IRA during the recession, visit the website and download a free pdf. However, if you live outside the US, you can trade gold and silver during a recession using an HFM broker.