Table of Contents

Algorithmic trading, algo trading, automated trading, or black-box trading executes orders using automated preprogrammed trading instructions accounting for variables such as time, price, and volume. This type of trading system uses advanced mathematical models for making transaction decisions in the financial markets. The pivotal idea is to employ computer algorithms to break down trading actions into smaller segments, thus minimizing the impact on the stock price. This complex system can manage vast data at high speeds, making thousands of trades daily and allowing investors to set specific rules for trade entries and exits.

Renaissance Technologies, founded by mathematician James Simons in 1982, is a pioneering example of how algorithmic trading has come to dominate financial markets. Simons was my inspiration to start forex programming. The company is renowned for developing and using complex mathematical models to predict and exploit patterns in global securities markets.

Renaissance Technologies’ most notable fund, the Medallion Fund, is famous for its exceptional returns, consistently outperforming the market by a significant margin. This level of success has been primarily due to the firm’s groundbreaking work in developing sophisticated quantitative trading models.

In the last few decades, algorithmic trading has gained immense popularity, making a substantial impact on the world of finance. It has revolutionized the financial markets with its capacity to process and analyze vast amounts of data in fractions of a second, enabling quicker decision-making and faster execution of orders. This capability has not only improved the efficiency of markets but also brought in a new level of transparency and control.

Many firms are adopting algorithmic trading, driven by technological advancements, the rise in computing power, the proliferation of data, and the desire for a more efficient trading process. It’s estimated that as of the mid-2020s, more than 80% of the trades in many leading financial markets are conducted by algorithms, up from less than 10% a few decades ago.

Despite the criticism surrounding its role in market volatility and flash crashes, its popularity shows no signs of abating. The continual developments in artificial intelligence and machine learning have further propelled the growth of algorithmic trading, as these technologies enable the creation of more sophisticated, self-learning algorithms capable of adapting to market changes in real time. The future of trading undoubtedly lies in this symbiotic relationship between finance and technology, a fact made ever more apparent by the growing prevalence and sophistication of algorithmic trading.

What Is EA In Forex?

EA or Expert Advisor is a programming script that automatically opens trades without human intervention, analyzes trading patterns, and closes trades. Generally, expert advisors monitor and trade financial markets using algorithms and preprogrammed instructions. Expert Advisors can be used in strategy testing; even traders trade manually.

Profiting from forex (foreign exchange trading) will require you to undertake in-depth technical analysis, carry out substantial fundamental analysis, regularly follow the news, and attach yourself to a monitor to view the price charts.

Almost every trader understands that it is tough and can lead to burnout resulting in a loss rather than profiting. This realization has surfaced in automatic trading technologies that make trading easy and increases the probability of getting more profits.

An expert advisor is often deployed on MetaTrader 4 (MT4) or MetaTrader 5 (MT5) foreign exchange trading platforms. You can either create your expert advisor or use an existing one. These are written in a programmable MQL (Meta Quotes Language).

I will show you how easily you can activate EA in MT4:

An Expert Advisor (EA) is a software that monitors and trades in the financial market with the help of algorithms. The software will run on the Metatrader 4(MT4) trading platform. Depending on the configuration, the software will automatically open a trading position or notify the trader to decide. After the position is opened, the EA can add conditions for closing the trade, like limits, trailing stops, and stops. Some traders use the EA only to monitor necessary markets, while others automatically open positions. Though they are mainly used for forex exchange(forex) trading, an EA on an enhanced MT4 can be used for trading indices, commodities, and cryptocurrencies.

The EA will allow the trader to define the parameters for which trades are opened and closed, finding opportunities with rules triggering the trade. Traders can build their own EA using the programming language MQL4 or use the EA someone has developed. The EA will combine many rules with yes/no answers to form a complicated algorithm and implement complex trading strategies. Instead of manual calculations, the EA will use the computational power available for making decisions and execute them almost immediately.

No Coding EA

While Expert Advisors (EAs) can be a powerful tool for automated trading, creating one typically requires knowledge of programming languages, such as MQL4 or MQL5 for the MetaTrader platforms. However, recognizing that not all traders are also programmers, some companies and software developers have created platforms and tools that allow traders to create their own EAs without writing any code. These are often referred to as ‘no coding’ or ‘drag-and-drop’ EAs.

Here’s how no-coding EAs generally work:

- User-Friendly Interface: These tools usually provide an intuitive, graphical user interface where traders can define their trading rules. Traders can set their strategies using simple dropdown menus, checkboxes, and text input fields.

- Drag-and-Drop Functionality: Many of these tools use a ‘drag-and-drop’ style where you can select different components (like technical indicators, logical operators, etc.) and arrange them visually to define your strategy.

- Predefined Conditions and Actions: These platforms come with a variety of predefined conditions (like price crossing above a moving average) and actions (like placing a buy order) that you can combine to create your strategy.

- Backtesting and Optimization: Once a strategy is built, these tools typically offer backtesting capabilities. This allows you to see how your strategy would have performed on historical data. Some also offer optimization features, which can automatically test variations of your strategy to find the most profitable settings.

- Exporting the EA: After defining and testing the strategy, the platform will automatically generate the code for the EA. This can then be exported and used in a trading platform like MetaTrader.

Examples of such platforms include EA Builder, Forex Robot Factory, StrategyQuant, and many others.

See the example of testing TradingView EA without coding:

EA Advantages

- Emotionless Trading: EAs operate based on pre-set rules and strategies, eliminating emotions’ impact on trading decisions. This can help prevent rash decisions driven by fear or greed.

- 24/7 Trading: EAs can operate round the clock, taking advantage of any market opportunities, even when the trader is sleeping or away from their trading desk.

- Speed of Execution: EAs can respond instantly to market changes faster than humans. This speed can make a difference in fast-moving markets.

- Consistency: EAs apply the same rules consistently, ensuring that trading strategies are applied precisely every time.

- Multitasking: EAs can monitor multiple markets or assets simultaneously, far beyond the capacity of a human trader.

- Backtesting: EAs can be tested on historical data to gauge their potential effectiveness before being applied in live trading.

- Minimizing Errors: EAs minimize the risk of human errors in placing trades. For example, they prevent mistakes in order size or forgetting to set a stop loss.

- Discipline: Since EAs follow predefined rules, they help maintain trading discipline even in volatile markets.

- Scalability: EAs allow trading strategies to be applied to many instruments, enabling the scaling of operations more efficiently than manual trading.

Forex markets remain open 24 hours and seven days a week. Using an EA, you can have the liberty to carry out trading opportunities even when you are not present on the scene, such as when you are asleep or occupied with some work.

Using an EA will detach any emotional attachment from your trading. Your greed or fear won’t hinder choosing or declining to trade signals. As per your instructions, the EA will perform the trades without considering how it might weather a loss or spend a profit. You can follow EA only to manage money.

An EA can process far more variables at one time than you can ever imagine. It can consider those variables along with several currency pairs at the exact moment. It doesn’t matter how intelligent you are, but you cannot perform similarly.

If you are trading forex, and it is your only income generator, using an EA could reduce stress levels because the EA will relieve you from all the mental exhaustion required to build a successful enterprise.

EA Disadvantages

A vital aspect differentiating a human from a robot is that the former can react to real-life situations, whereas the latter will follow orders.

If your EA cannot respond to current news, it might ignore the fundamental reason to make a trade. But if you were watching the news at the desk, you may probably avoid such mistakes.

Even though your EA can manage more variables in a single moment than you, it will act according to your programmed schedule. You may not be flexible in your thinking, but you can respond to certain variables within your parameters. Sometimes that might be necessary to avoid making a colossal trading error or taking advantage of an outstanding opportunity.

Unlike an online trading platform, you must install the program in your system. That means you can access the program only on your installed device. Your EA can run when that system is turned on with MT4, and you can access the internet.

The Significance Of Testing EA:

Whether you create your own EA or use someone else’s, testing it on various time frames is essential. Test it on a practice account that does not put real money at stake to determine its ability to perform. For instance, it may perform well on definite currency pairs and not others.

If you use your own programmed EA, be prepared to be devious with the variables occasionally. Market trends will fluctuate from time to time, and so your program has to make necessary alterations.

Remember that the forex market is highly unregulated and vulnerable to scammers using an expert advisor from a firm or any other individual. Beware of commitments that promise higher returns from EA creators. You must realize many scammers will understand that overpromising will be a red flag. An expert advisor provider may also be a scammer if he tries to balance credibility and hope.

How Does An EA Works?

Typically, an EA uses predetermined rules or strategies for building trade decisions. This rule is programmed in a robot that automatically enters and exits forex trading. With embedded strategies, the EA can implement trade decisions that humans cannot.

The workings of an EA can be broken down into the following steps:

- Initialization: The initialization stage starts when the EA is applied to a chart. Here, it sets up necessary variables, initializes predefined parameters, and performs other setup processes. If there’s a previous state to be loaded, it does so here.

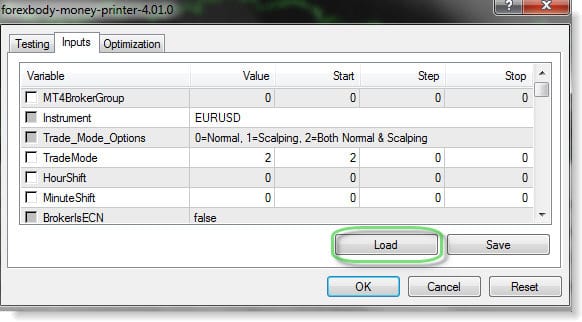

- Input Parameters: Input parameters are pre-set conditions the trader defines before the EA starts running. These parameters could include the lot size, stop loss and take profit levels, risk level, or specific indicators’ settings. The user can usually set these parameters when the EA is attached to a chart.

- Event Handling: The EA waits for specific events and reacts accordingly. This might include market price movements, changes in indicator values, timing events, or user interactions.

- Market Analysis: EAs analyze market conditions using various technical indicators or custom algorithms. They process real-time data, like price and volume, or historical data to make trade-related decisions. This could involve checking for specific patterns, comparing past and present data, or assessing the overall market trend.

- Trade Execution: The EA makes trading decisions based on market analysis and pre-set rules. If conditions are met, the EA will send an order to the broker’s server to execute a trade. This can include instructions for both trade entry (buy or sell) and exit (closing an open position).

- Monitoring and Adjusting: Post-trade execution, the EA monitors market conditions and adjusts the trade as needed. This might involve moving the stop loss to break even, trailing the stop loss to lock in profits, or closing the trade early if the market conditions change.

- Logging and Reporting: The EA keeps track of all trades and actions it makes. It typically includes a logging feature that records the EA’s actions, which is helpful for troubleshooting and performance analysis.

Some of them are programmed in such a robust way that they can effectively and thoroughly scan an entire market, looking for chances with a high level of accuracy rather than humans.

For example, if you have developed a successful trading strategy that relies heavily on candlestick patterns, indicators, resistance levels, support, or other things, you can program them on the EA. After that, relax and watch your computer program do the hard work.

Moreover, if your EA is programmed to perform a sell whenever a pair reaches a certain resistance level, the EA will abide by that instruction always. You can open your coding and include your desired parameters to make amendments.

The targets for trading are also encoded into the program. Almost every automated trading strategy includes a takeaway profit and stops loss level that safeguards profits with prevention for an extensive loss.

Forex EA Example

Here’s a simple example of an MQL4 Expert Advisor (EA) script that implements a basic moving average crossover strategy. This script will buy when the fast-moving average crosses above the slow-moving average and sell when the fast-moving average crosses below the slow moving average. This is just the central concept that I created in the MQL4 programming language.

Please note that this is a simplified example for illustrative purposes and doesn’t include many features that a real-world EA would typically have, such as risk management and optimization of parameters.

// Parameters input int FastMA = 10; // Fast moving average period input int SlowMA = 20; // Slow moving average period input int Slippage = 2; // Slippage input double LotSize = 0.1; // Lot size // Global variables double FastMA_previous; double SlowMA_previous; // On initialization int OnInit() { // Calculate previous bar's MAs FastMA_previous = iMA(NULL, 0, FastMA, 0, MODE_SMA, PRICE_CLOSE, 1); SlowMA_previous = iMA(NULL, 0, SlowMA, 0, MODE_SMA, PRICE_CLOSE, 1); return(INIT_SUCCEEDED); } // Main function void OnTick() { double FastMA_current = iMA(NULL, 0, FastMA, 0, MODE_SMA, PRICE_CLOSE, 0); double SlowMA_current = iMA(NULL, 0, SlowMA, 0, MODE_SMA, PRICE_CLOSE, 0); // Check for buy signal if (FastMA_current > SlowMA_current && FastMA_previous <= SlowMA_previous) { OrderSend(Symbol(), OP_BUY, LotSize, Ask, Slippage, 0, 0); } // Check for sell signal if (FastMA_current < SlowMA_current && FastMA_previous >= SlowMA_previous) { OrderSend(Symbol(), OP_SELL, LotSize, Bid, Slippage, 0, 0); } // Store current MAs for the next tick FastMA_previous = FastMA_current; SlowMA_previous = SlowMA_current; }

Conclusion

Expert Advisors (EAs) represent a powerful tool in the modern trading landscape. Their ability to execute trades automatically, based on predefined conditions and rules, can significantly increase efficiency and consistency and allow traders to operate in markets around the clock.

By removing emotional bias from the trading process, EAs can help maintain trading discipline and reduce the likelihood of rash decision-making. Furthermore, with their multitasking capabilities, they can monitor multiple markets simultaneously, which would be challenging, if not impossible, for a human trader.

Additionally, EAs can backtest trading strategies on historical data, allowing traders to refine their strategy before applying it in live markets.

However, it’s important to remember that EAs are not a guaranteed path to trading success. They are tools that operate based on their programming and the quality of the strategy they’re based on. Therefore, they require regular updates and adjustments in response to changing market conditions. The broker’s trading conditions and internet connection quality can also heavily influence their performance.