Table of Contents

Arbitrage trading represents the simultaneous buying and selling of identical financial instruments in different markets or forms to profit by exploiting price differences. For instance, if a trader can buy the stock of Company Y at $100 on the New York Stock Exchange (NYSE) while selling it at $100.06 on the London Stock Exchange (LSE), the trader can earn a profit of 6 cents per share. Arbitrage trading is prevalent in various financial markets, including forex, commodities, and equities, due to its low-risk nature and the potential for quick profits.

Arbitrage Trading in Forex

Arbitrage trading in forex involves buying and selling identical or similar currency pairs in different markets or forms to profit from price discrepancies. For example, a trader can buy EUR/USD and sell USD/CHF, a highly correlated currency pair. Alternatively, a trader can buy a spot currency, EUR/USD, and sell an EUR/USD futures contract. Forex arbitrage takes advantage of inefficiencies in the currency market, which various factors, including differences in market liquidity, transaction costs, and time zones, can cause.

Understanding Arbitrage Trading

Arbitrage trading is possible because financial markets are not perfectly efficient. The price of any asset in the financial market depends on the demand and supply of the asset. Hence, any change in the supply or demand can decrease or increase the asset’s price. Arbitrage traders try to profit from the temporary glitches in the financial asset values in the markets. They aim to be the first to spot price differences, which may occur if there is any mismatch in the demand or supply levels in the exchanges dealing with these assets.

Once a trader notices a price discrepancy, they can quickly make a profit with minimal risk. Traders often use automated trading systems as part of their strategy for arbitrage trading. These systems incorporate algorithms that detect price discrepancies immediately and alert the trader, enabling them to exploit these differences for a quick profit. Over time, other traders will also notice the discrepancy and the market asset prices will adjust accordingly.

Types of Arbitrage in Forex

Forex arbitrage can be classified into three main categories:

- Two-currency arbitrage: Involves making a profit from the differences in the prices quoted for currency pairs. It does not consider the differences in the prices of the currencies in the pair being considered.

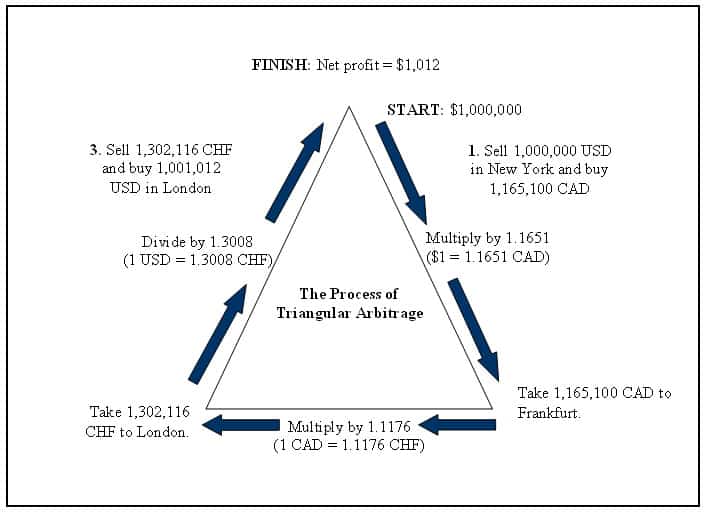

- Triangular arbitrage: Utilizes the differences in the prices of three different currencies. The asset in one currency is converted into two other currencies before it is converted back into the original currency to make a profit.

- Covered-interest arbitrage involves profiting from differences in interest rates in two countries. The trader uses a forward contract for hedging to reduce the risk caused by fluctuations in the exchange rate.

Two-Currency Arbitrage

Two-currency arbitrage is the most popular form of forex arbitrage. The trader trades the same currency pair with different forex brokers to profit from the price differences. For example, the EUR/USD currency pair is widely traded. The selling price and buying price of different banks may vary. If the selling price at Bank A is lower than the buying price at Bank B, the trader can purchase euros from Bank A using dollars and sell the euros to Bank B for a dollar profit. However, the trader must act quickly since other traders will also notice the price difference.

When many traders try to profit from the same difference in bank rates for a currency pair, the increased demand will cause Bank A to raise its price and Bank B to lower its price due to increased supply until both banks offer similar prices.

Triangular Arbitrage

Banks quote different prices for currency pairs based on supply and demand. In triangular arbitrage, the trader exchanges currency pairs at three banks, hoping to profit from the price differences. Exchanging currencies at the same bank will not yield profits since banks have efficient pricing systems and do not allow traders to profit through arbitrage. Commonly traded currency pairs include USD/EUR, EUR/GBP, and GBP/USD. The trader monitors the exchange rates different banks offer and considers the transaction costs charged for currency conversion, which can reduce profits.

Covered-Interest Arbitrage

Covered-interest arbitrage exploits the differences in interest rates between two currencies to make a profit. The trader uses a forward contract to control risk exposure. The forward contract allows the trader to purchase currency at the current market rate and fix the exchange rate at a future date. Here’s a detailed explanation of the covered-interest arbitrage strategy for EUR/USD:

- Determine Interest Rate Difference: Identify how much higher the Eurozone interest rates are than U.S. interest rates.

- Convert and Invest: Convert the available U.S. dollars into euros at the spot price and invest the euros at the higher interest rate in the Eurozone. Arrange for a forward contract specifying the EUR/USD exchange rate to protect against exchange rate fluctuations during the investment period.

- Earn Interest: Receive interest in euros from the investment.

- Convert Back: Convert the euros back into U.S. dollars at the guaranteed exchange rate, ensuring a profit.

Challenges and Limitations of Forex Arbitrage

Despite the potential for profits, forex arbitrage presents several challenges and limitations:

- Market Efficiency: Modern financial markets are highly efficient, and price discrepancies are often minimal and short-lived. High-frequency trading algorithms and sophisticated traders quickly exploit and eliminate these inefficiencies.

- Transaction Costs: Arbitrage opportunities must be significant enough to cover transaction costs, including spreads, commissions, and fees. High transaction costs can erode potential profits.

- Technology Requirements: Successful arbitrage trading often requires advanced technology, including high-speed internet, automated trading systems, and access to multiple trading platforms. These resources can be expensive and may not be accessible to all traders.

- Liquidity Constraints: Low liquidity in specific markets can limit the ability to execute arbitrage trades efficiently. Traders may be unable to buy or sell the desired quantity of currency pairs at the quoted prices.

- Regulatory Barriers: Regulatory differences between countries can impact arbitrage opportunities. Traders must navigate varying regulations, tax implications, and capital controls, complicating the arbitrage process.

Practical Applications of Arbitrage Trading in Forex

Despite the challenges, arbitrage trading in forex can be profitable for traders with the necessary resources and expertise. Here are some practical applications of arbitrage trading in forex:

- Statistical Arbitrage: Traders use statistical models to identify and exploit price discrepancies between correlated currency pairs. For example, if EUR/USD and GBP/USD typically move in tandem but diverge temporarily, a trader might buy one pair and sell the other, anticipating a convergence.

- Latency Arbitrage: Traders leverage differences in the speed at which price information is disseminated across markets. By accessing faster data feeds and execution platforms, traders can exploit price discrepancies before they are corrected.

- Cross-Exchange Arbitrage: Traders exploit price differences between currency pairs listed on different exchanges. For instance, if EUR/USD is priced lower on one exchange than another, a trader can buy on the cheaper exchange and sell on the more expensive one.

- Interest Rate Arbitrage: Traders capitalize on differences in interest rates between countries by using carry trades. They borrow in a low-interest-rate currency and invest in a high-interest-rate currency, profiting from the interest rate differential.

- Futures and Spot Arbitrage: Traders exploit discrepancies between currency pairs’ spot and futures prices. If the futures price is higher than the spot price, a trader can buy the spot currency and sell the futures contract, locking in a risk-free profit.

Risks and Mitigation Strategies

While arbitrage trading is considered low-risk compared to other trading strategies, it is not without risks. Here are some potential risks and mitigation strategies:

- Execution Risk: Delays in executing trades can result in missed opportunities or losses. Traders should use high-speed trading platforms and algorithms to minimize execution delays.

- Counterparty Risk: The other party in a trade may default on its obligations. To reduce counterparty risk, traders should use reputable brokers and exchanges and diversify their trading partners.

- Market Risk: Unexpected market movements can impact arbitrage positions. Traders should use stop-loss orders and other risk management techniques to protect against adverse price movements.

- Regulatory Risk: Changes in regulations can impact arbitrage opportunities. Traders should stay informed about regulatory developments and adjust their strategies accordingly.

- Liquidity Risk: Insufficient market liquidity can hinder trade execution. Traders should focus on highly liquid currency pairs and monitor market conditions to ensure sufficient liquidity.

Conclusion

Arbitrage trading in forex involves exploiting market inefficiencies to profit with minimal risk. Traders can capitalize on price discrepancies by simultaneously buying and selling identical or similar currency pairs in different markets or forms. While modern markets are highly efficient, presenting challenges for arbitrage traders, those with advanced technology, expertise, and resources can still find profitable opportunities.

Arbitrage trading requires a deep understanding of market dynamics, quick decision-making, and effective risk management. Traders must navigate various challenges, including transaction costs, regulatory barriers, and liquidity constraints. Despite these challenges, arbitrage remains a valuable strategy for those who can effectively identify and exploit price discrepancies in the forex market.