Table of Contents

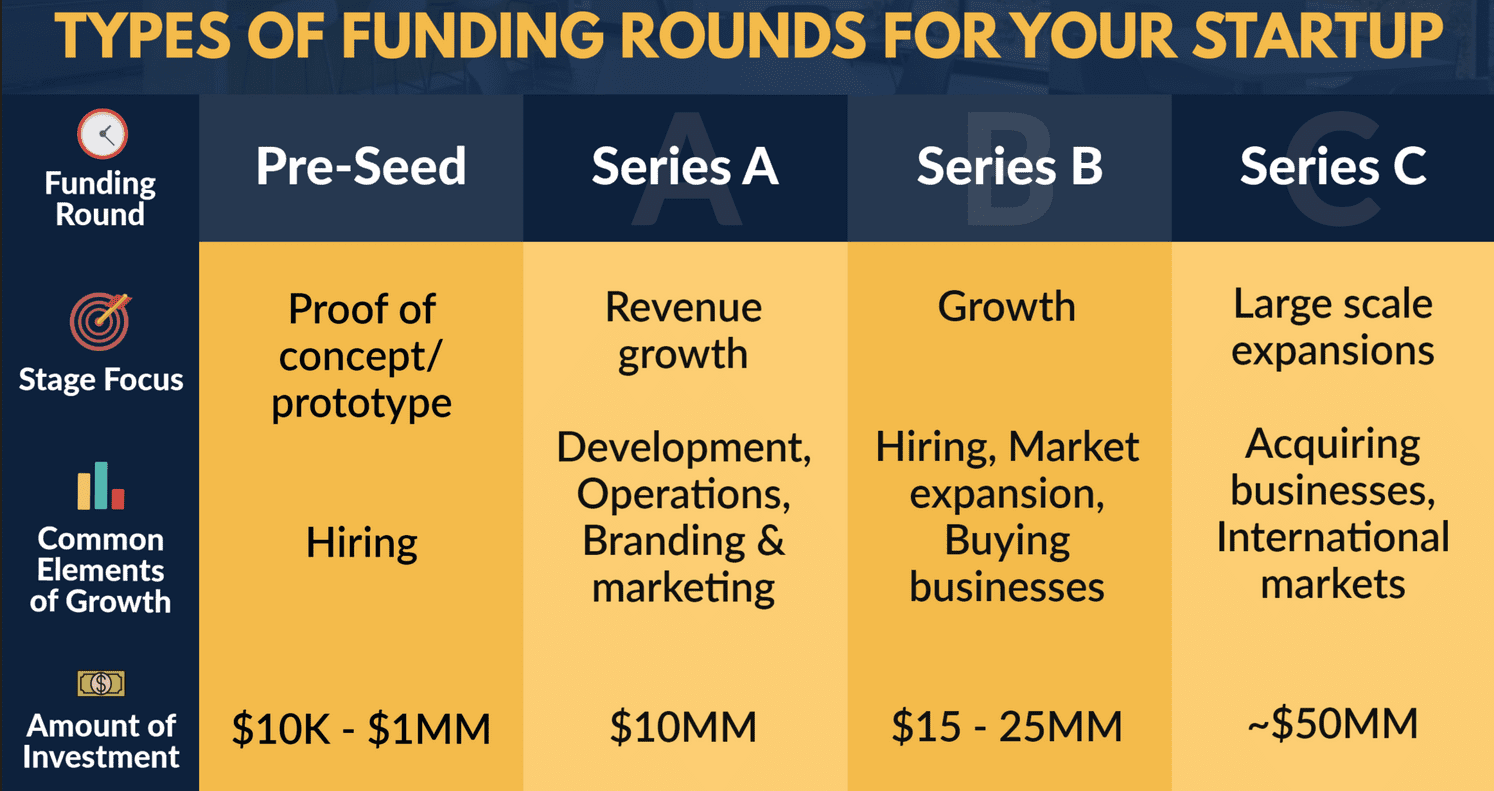

Numerous funding rounds are accessible to startups, relying on the industry and the extent of interest among the active investors. It is common for startups to involve in the ‘angel investor funding’ or ‘seed funding at the start. Then, these funding rounds may usually be followed by series A, B, and C rounds and different endeavors to earn capital, if suitable.

Series A, B, and C are essential tools for a business that works out bootstrapping or just surviving off the benevolence of the families and friends, and the extent of their pockets will not be enough. Once you get sufficient information about the rounds of funding, including how do they work and the distinction among them, it will be comfortable for you to evaluate and analyze the title relevant to the startups and investing world by grabbing the background of the rounds for the hope, vision, and direction of a company.

What is seed funding?

Seed funding represents the first amount of money start-ups receive from investors before Series A funding.

What is Stock Series?

The term ‘Stock Series’ represents the first, second, or third round of financing undertaken for a new business venture. Common stock and standard stock options are issued to company founders, friends, employees, family, and angel investors after the Series C round goes to IPO.

Series capital is the money or funds a startup raises in a series of steps. The series capital is collected in different rounds, including seed, pre-seed, and series A, B, and C. The series capital is a building block for any business and helps founders grow faster to achieve the company’s goals without being anxious about their financial needs. Each kind of funding uniquely contributes to a company’s progress to the advanced level.

The standard stock series involve series A, B, and Series C funding rounds that offer the external investors an opportunity to invest their cash at the right place for a growing company in trade for the equity.

What is Series A Funding?

Series A funding represents the first round of financing for a new business venture. Common stock and standard stock options are issued to company founders, friends, employees, family, and angel investors. Series A investors usually purchase from 10% to 30% of the company to capitalize on the company. Usually, Series A funding will collect enough funds for six months to 2 years, and that money will be spent on company development.

How Many Companies Fail after Series A?

From 60% up to 70% of all startup companies fail after Series A. Usually, failed companies do not achieve pre-market milestone goals. The main reason they fail is that the startup’s product or service is not needed in the market.

How Many Startups Make it to Series A?

The number of startups which make it to series A is not a lot. Analysis reveals that in seven years between 2011 to 2018, out of total startups that raised pre-seed and seed funding in the United States, only one to three startups ran on to series A round.

The problem is that once a business makes progress in building a track record: an installed user base, revenue valuation, or any other appreciable performance indicator, that company may go for series A funding to raise the user base and product offer.

What is the Range of Series A Funding?

The range of series A funding fluctuates from approximately $2 million to $15 million. Still, the high-tech industry valuations have typically increased this number on average, and for the year 2021, the median Series A funding is approximately $10 million.

What is Series B Funding?

Series B funding represents the second round of financing undertaken for a new business venture where investors are venture capitalists, private equity investors, crowdfunded equity, and credit investors. Series B investors will pay a higher share price for investing than Series A investors.

Series B funding type :

- The startup already has met planned milestones from the initial startup stage

- Stage focus is growth

- The goal is to hire employees and buy other business

- Usually, collect from $15 million up to 25 million dollars.

Series B is one of the stock series funding rounds that aims at taking the businesses to the next advanced level over the developmental stage. Investors encourage startups to get by that means extending the market reach. Companies that have experienced seed series with A funding rounds have already refined significant user bases and have shown to investors that they are willing and ready for a favorable outcome on a larger scale. The series B funding is applied for the growth and development of a company so that it may achieve these levels of need.

Quality skill acquisition is essential for growing a team or developing a winning product. Expansion in business development, advertising, selling, tech, support, and labor costs a firm a few cents. In 2020, Series B’s median approximated capital increase was 26 USD.

Companies going through a Series B funding round are firmly established. Their estimated worth indicates that most Series B companies have cost between approximately 30 million and 60 million USD. The median before any round of financing, the valuation of Series B companies was 40 USD.

When we talk about the processes involved and critical players, Series B sounds equivalent to Series A. But many of the similar characters as the former round usually lead the Series B, including a crucial anchor investor that assists in drawing in the other stockholder. The distinction between Series B incorporates the latest tide of other enterprise capital firms that specify in the next stage of investing.

What is Series C Preferred Stock?

Series C Preferred Stock is the funding exercised by the already successful businesses. The companies want additional financing to develop the new products, expand these latest products into a new market, or even get hold of other companies.

Series C round induces the investors to introduce their financial assets into the meat of effective and profitable businesses to receive twice in return. Series C funding is primarily concerned with scaling the company, successfully growing as effectively as possible. An exciting and probable way of scaling a company is obtaining the hold of another company.

Suppose a startup typically focuses on creating vegetarian substitutes for meat products. If this company achieves a Series C funding round, it has probably already manifested unparalleled success in selling its products in the United States. The business has already achieved targets coast to coast. The confidential market research and business planning enable investors to firmly believe that the company would do well if conducted in Europe.

The vegetarian may have a competitor who owns a massive market share. The competitor also has a benefit from which the startup could take advantage. The culture sounds good as investors and the founders believe the merger would be a synergistic partnership. In this case, Series C funding can be used to buy another company.

Is Series B Funding Good?

Yes, series B funding is suitable for the companies that are prepared for their progressive stage in development. These companies generate excellent revenue and earn a reasonable profit. The reliable valuations of these companies are more or less $10 million.

As discussed earlier, the exciting thing about Series B funding is that it helps the company grow well to reach the next level. The raised capital is invested in sales, marketing, expanding recent technologies, and talent acquisition.

In series B funding, a company commonly sells preferred shares that do not give its possessor the right to vote. But, the shares are usually linked with a convertibility option, which means that the possessors of the preferred shares have a right to convert them into a typical stock in the future.

How Much Equity in Series C?

The median pre-money equity is approximately $68 million in Series C for 2021; however, fewer companies passing through Series C funding would have much higher valuations. The valuations are set up on complex data instead of expectations for coming success. Before indulging in Series C funding, the companies establish firm customer bases, revenue streams, and reasonable histories of growth and development.

Many of these companies take benefit of Series C funding to help raise their valuation in anticipation of an IPO (Initial Public Offering). At this stage, the companies enjoy benefits and higher valuation.

What is Pre-Seed Funding?

The pre-seed funding is an earlier funding phase; the company comes with the process so early that it does not contribute to funding rounds. This funding level refers to the duration in which the founders of a company typically get operations off the ground.

The most common ‘pre-seed’ founders are the founders of the company, their close friends, supporters, and family members. The development of the business idea and its setup primarily depends on the company’s nature and initial cost. Whether this funding stage results quickly or sometimes takes a long time, there is a possibility that the investors are not investing in exchange for equity in ‘pre-seed funding. Mostly, the investors in pre-seed funding conditions are the company founders.

How to Raise a Seed Round?

Seed round depicts the official opening money you have to raise as an enterpriser. If you grow a seed round, understand and follow the following points to learn how to submit a seed round.

- Choose the nature of your funding, and be sure about the good time

- Determine the total money you need, make conversation with the investors

- Build a file and note down the names of potential investors

- Encourage the investors to build determination

- Negotiate the dealings to reach the final results

How Long Does Series B Funding Last?

CBInsights estimates that the series B funding may last for more or less 15 months.

This duration is slightly greater than that of the Series A round, and it commonly occurs when a company has achieveS its milestones in developing businesses.

How Long Does Series C Take?

The Series C round may take typically more or less 27 months, and this series C funding arises from the former investors as well as the investors of the later stage, including Hedge Funds, Private Equity Firms, and Investment Bankers if the company is possibly excellent and close to an IPO or acquisition.

What is a Seed Round in Business?

The seed round is the earliest official equality funding phase analogous to planting a tree. The first financial support is theoretically “the seed” that assists in growing the business. The availability of sufficient revenue, the most acceptable business strategy, and the persistence and determination of investors collectively play a vital role in increasing a company hopefully into a “tree.”

This is the seed funding that helps to finance its initial steps, including the processes of market research and product development. The company gets the advantage of determining the final products and targeted demographic with the help of seed funding. The seed funding is applied to employ a group to complete these tasks.

You see sufficient potential investors in the seed funding circumstances: founders, friends, families, incubators plus venture capital companies, and many more.

Angel investor is one of the most common and traditional types of investors participating in seed funding. Angel investors incline to the insecure ventures, for example, a startup with a small-scale proven track, and they hope for an equity stake in the company in exchange for their funding.

How Much is a Seed Round?

Even though seed funding rounds fluctuate significantly in terms of capital they bring about for a new company, the seed round can commonly produce anywhere from $10,000 to $2 million for the startup in a debate.

For the year 2020, the median seed round funding is $1million. The founders realize that the seed funding round is essential for some startups to get their companies. These companies do not involve in a Series A round of funding.

Most companies raising seed funding are treasured in the range of $3 million to $6 million. The median seed round pre-money valuation for 2020 is $6 million.

How Do You Prepare For a Seed Round?

Although raising a seed round is challenging, we can do it with a pre-planning and strategy. We can pull the right potential investor for your business in a way that is less hard than many of us think it to be.

While raising a seed round, the goal is to attract the right persons to invest in our business. We can do this by presenting our business concisely and comprehensively and proving it is worth investing in.

The difficult task of the seed round, especially when the business is in its infancy, can be done effectively by following the following points:

The explicit purpose gives investors a sufficient summation of the reason for the business and its targeted achievements. This purpose is the fundamental point and foundation that helps us develop a firm story for our business, describing what our company is trying to do and achieve.

We should get on with our vision. The visual description of a company’s success and its meaningful effects on the world encourage the investors to come ahead to succeed us in what we are trying for. Do not try to present the business for what the investors might want to listen to whenever you prepare a vision. Instead, flip around and ensure them how authentic and enthusiastic you are to achieve what you want in our business.

A purpose and a vision work well with proper planning to achieve the goals. A clear plan is your projection to indicate the progress you will succeed with the fund you intend to raise. You have to fix 12-18 months to prepare a perfect plan. Never think about the limitation of cash; instead, ponder the possibilities of courageously achieving significant and accepting challenges.

After planning well, work out to determine how much it will cost. Initially, suppose that no income will factor in and assess the total expenditure in the worst case. If you raise a smaller amount of funds, you will have to grow again on lower than the favorable terms. If you submit more funds, you will have founder dilution to think about.

You may need to make an effort to break the plan. Put an independent glance over your work and challenge it if required. Be open to feedback, and find and eliminate the weakness and issues. If the plan holds good to heavy scrutiny, be confident and prepare as it is the time for investors.

Then, a time comes to be clear on the terms. The team here talks about and agrees upon the financing terms, but at this point, you must have a net dollar figure for funding. Whenever you reach an outcome in the dealings, be sure that it is not unfavorable to you, making it too attractive to the potential customers.

Once you have worked out the purpose, vision, planning, and financial terms, it is time to combine them collectively to formulate a sticking story for the investors.

You are undoubtedly looking for investors who ally themselves with the purpose and goal of your companies, and this is what you focus on while leading. Make it clear why the business exists effectively, and we can achieve collaboratively in the future.

What is Raising a Seed Round?

Raising a seed round collects official money from the potential investors that generally range from a hundred thousand dollars to several million. This fund is raised to initiate a business, and the seed round is particularly invested in market research and product development. The seed round raising process is complex, and you need to entice the potential investors through the advantageous outcomes of your company.

How Long is a Seed Round Supposed to Last?

The discussions with the founders at RocketSpace and the VC Community reveal that a seed round commonly takes an average duration of three to six months. If you have any previous experience in a seed round, it may take four months, but if it is the first time, be ready and manage at least six months.

What is a Pre-Seed Round?

The pre-Seed round is the stage of opening funding that does not belong to the main series of funding rounds. In most cases, a pre-seed round is initiated by the company’s founders to develop ideas for the business. There is no role for the potential investors who invest in exchange for equity.

How Do You Get a Series?

We can get a series of funding rounds if our startup company proves that the product or services will get market clicks and engagements. The series consists of Series A, B, C, and beyond. Further, the founder has to formulate a compelling idea with planning and strategy to get a series of funding rounds with the help of the potential customer.

What Do Series A Investors Look For?

The series A funding is not only the significant idea the investors are seeking, but the investors also look for the stressful strategy for turning that idea into a fruitful and profitable business. This is why the firms commonly go through series A funding rounds to be valued at more or less than $24 million.

The series A funding aims at formulating a plan for developing a business for long-term profit. More often, seed startups have a great concept of generating a provable amount of sufficient enthusiastic users, but the company has no idea of monetizing the business.

The investors who come up with the series A round arise from conventional venture capital firms. Renowned venture capital firms involved in series A funding consist of IDG Capital, Sequoia Capital, Google Ventures, and Intel Capital.

Most investors commonly participate in the political process by this stage of the Series A round. It is not uncommon for new venture capital firms to overcome. A single investor can be an anchor. Once a company successfully secures a first investor, it becomes a child’s play to attract more investors for participation. Angel investors also invest in series A rounds, but their influence is far more significant in a seed funding round.

It is significantly common and developing with the time that those companies which use equity crowdfunding generate finance as a part of a Series A round. This reality is that numerous companies, even those that successfully generate sufficient seed funding, cannot develop interest among the investors as a component of a Series A round struggle. No doubt, less than ten percent of seed-funded companies proceed to raise the series A rounds as well.

What is the Series of Funding Before IPO?

Series C funding begins before IPO because Series C funding companies do not restrict their product to their home country but the desire to take their effect into the international market. They also consider increasing their valuation before proceeding with an Initial Public Offering (IPO) or an acquisition.

How Long after Series B Do You Get IPO?

After two years of each round, including the series B round, we get IPO. Still, if we talk about the start of any successful startup, for any rough average and a successful business, it generally takes ten years from the beginning to get IPO.

At What Series Do Companies Go Public?

This is the Series D funding at which most the public corporation software companies go public. During the stage D round, the founders of the companies find a new way and opportunity for expanding their business before going for an IPO. It is common for multiple companies to pass through the Series D round or even beyond to increase their market price or value before going public.

How Many Rounds of Funding Until a Company Goes Public?

A company may need four or five rounds of funding to go public. These rounds include Series A, B, C, D, and beyond. However, fewer companies can be significantly successful with an initial seed round or a Series A round plus subseries of A That include series A1 and A2.