Table of Contents

Short-term trading and scalping, a popular investment approach, promises high returns and quick profits by capitalizing on market volatility. However, this fast-paced strategy isn’t without its hazards. One pitfall that both novice and seasoned traders frequently grapple with is the tendency towards overtrading.

What is Tick Scalping?

Tick scalping represents high-frequency trading from a few milliseconds up to several minutes. Usually, the average trading duration is less than a minute. This high risking trading some traders perform manually.

Over-trading occurs when traders excessively buy and sell securities compared to their predefined trading plan or risk tolerance. It’s a common pitfall in high-frequency trading strategies like tick scalping due to the focus on making multiple transactions quickly. The propensity to over-trade when implementing a tick scalping strategy may stem from various factors, including:

- Chasing Losses: A trader may enter into a cycle of making more and more trades to recover from previous losses. This behavior, however, often leads to further losses as these trades are usually not well-thought-out and reactive rather than based on sound analysis.

- Overconfidence: Success in a few trades can lead to a sense of overconfidence, resulting in increased trading frequency. This increased activity, however, can lead to neglecting careful trade evaluation and risk management, thereby increasing the likelihood of substantial losses.

- Market Noise: Tick scalping typically involves reacting to minor market fluctuations or ‘noise.’ However, these short-term fluctuations may not always indicate a genuine trading opportunity and can lead to unprofitable trades if not correctly discerned.

Over-trading can quickly erode a trader’s capital and potentially result in significant financial losses. Furthermore, the psychological toll from continuous losses can negatively impact a trader’s decision-making ability, creating a vicious cycle that can be hard to break.

High Commissions

Since tick scalping involves making many trades, transaction costs can quickly increase. High commissions are one of the most detrimental aspects of tick scalping. Here’s why:

- Eroding Profits: Each trade incurs a commission fee. As the number of trades increases, so does the total amount spent on commission fees. If the profits from these trades are not substantial enough, these fees can quickly consume any earnings and even lead to net losses.

- Requiring Higher Breakeven Point: The more commissions a trader pays, the more they need to earn to break even. This requirement can push traders into making riskier trades to achieve higher profits, thereby increasing the potential for substantial losses.

- Disproportionate Impact on Small Accounts: Traders with smaller accounts may find that commission costs represent a more significant proportion of their account size. This proportion can make it harder for these traders to turn a profit when compared to those with larger accounts.

To mitigate the impact of commission costs, traders must carefully consider their broker’s fee structure and how it affects their potential profitability. Some brokers offer volume-based discounts that can be beneficial for tick scalpers.

Pros and Cons of Tick Scalping

Pros

- Reduced Exposure to Risk: Since scalpers hold positions for brief periods, they have less exposure to market downturns than traders using long-term strategies.

- Moderate Potential for Profit: Given the sheer volume of trades, even minor profits from each trade can accumulate into substantial earnings. However, excellent infrastructure and low commissions are necessary.

- Market Volatility: Scalpers can exploit volatile markets as more price changes mean more trading opportunities.

Cons

- Requires Extensive Time and Attention: Tick scalping is not a set-and-forget strategy. It requires constant monitoring and quick reactions to market changes.

- Trading Costs: Scalpers often face high transaction costs due to the large volume of trades, which can eat into profits.

- Emotional Stress: The high-speed nature of this strategy can induce significant stress and require a robust psychological constitution.

Essential Components for Tick Scalping

Advanced Technology

Given the speed at which trades must be executed, sophisticated software and hardware are crucial. Many scalpers use Direct Market Access (DMA) and high-speed algorithms to execute trades faster than humanly possible.

Market Analysis

Successful tick scalping requires a comprehensive understanding of market trends and indicators. Tools like tick charts are essential to visualize price movements and facilitate decision-making. Scalpers need to develop a systematic strategy tested on the previous period. However, this is very hard to do in practice. Usually, pro traders use “big data” analysis for this scalping strategy.

Regulatory Awareness

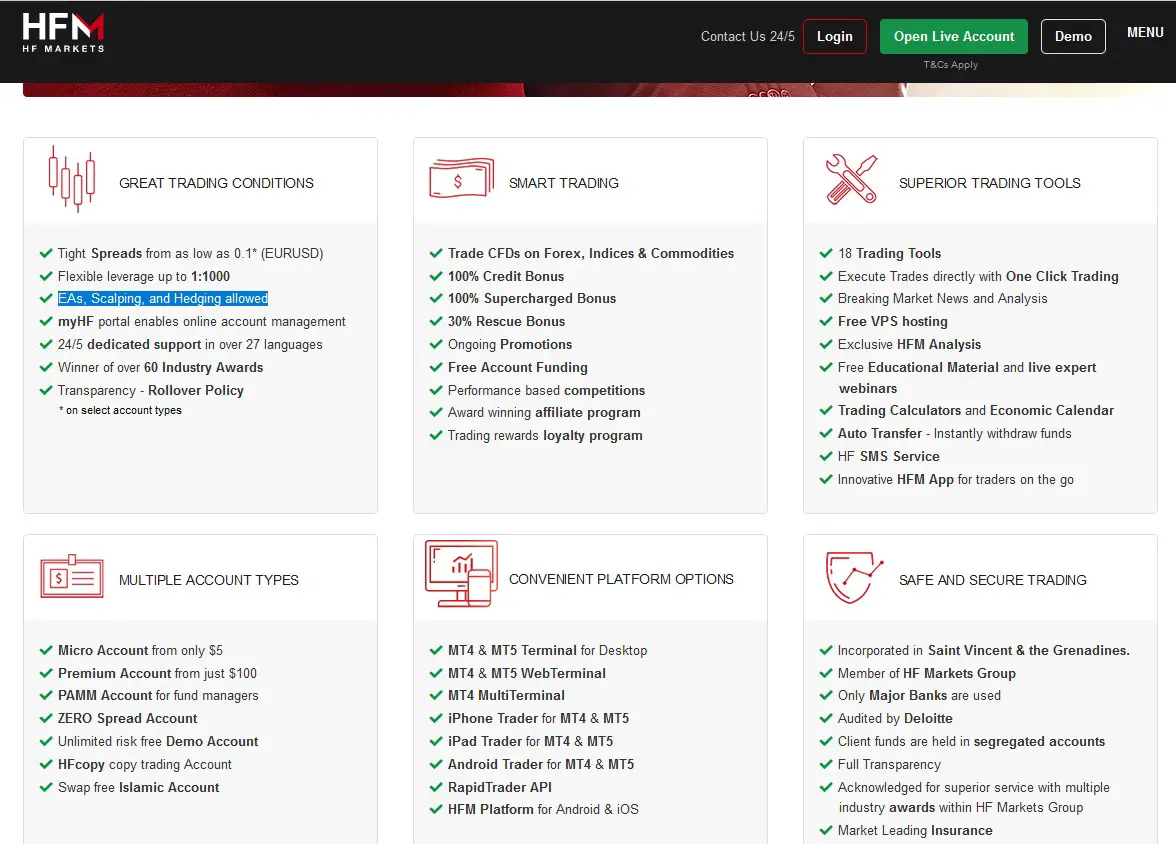

Regulations can vary widely between different regions and change over time. Thus, traders must stay updated on the latest regulatory changes that could impact their trading strategy. Some brokers do not allow tick scalping!

Conclusion

Tick scalping is a unique and potentially lucrative trading strategy experienced traders and investment firms primarily employ. Despite its potential for high returns, it requires a significant time commitment, technological resources, market analysis, and a deep understanding of regulatory landscapes. As with any investment strategy, it’s essential to thoroughly research and understand tick scalping before embarking on it.