The VIX, often called the “fear gauge,” is a volatility index representing the stock market’s expectations of volatility over the next 30 days. Unlike stocks or bonds, the VIX is not a tradable asset but a measure derived from the price inputs of S&P 500 index options. It indicates the market’s expectation of near-term volatility conveyed by stock index option prices. As a result, investors often use the VIX as a tool to gauge market sentiment, especially during turbulent times. However, one cannot directly invest in the VIX itself; instead, investors may use VIX futures and options or VIX-related exchange-traded products for related investment strategies.

AvaTrade broker VIX

Avatrade CFD broker offers VIX S&P 500 Futures.

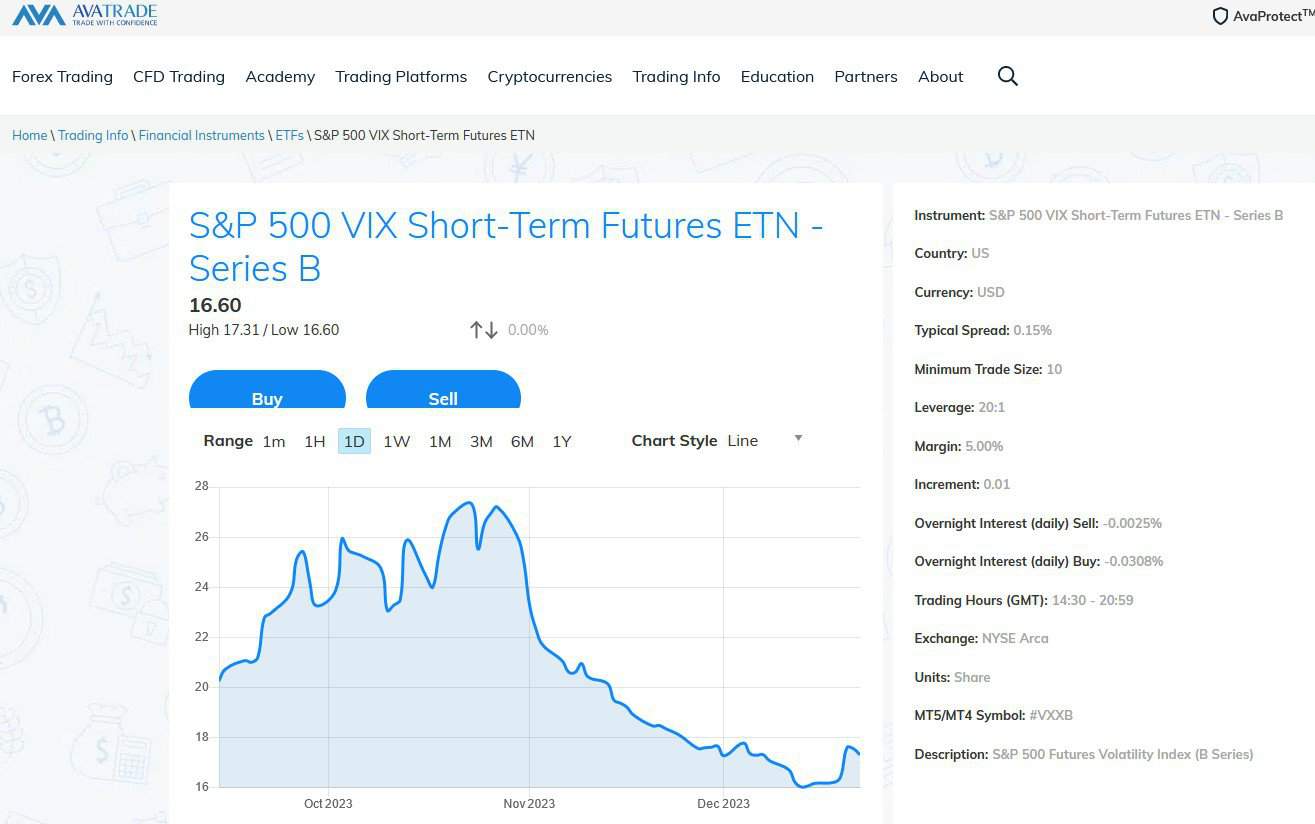

Trading the “S&P 500 VIX Short-Term Futures ETN – Series B” (often symbolized as #VXXB) on AvaTrade or any other broker involves dealing with a specific financial instrument designed to track short-term volatility. Here’s a detailed explanation of how this works and what each term means in the context of AvaTrade:

- Instrument: The S&P 500 VIX Short-Term Futures ETN – Series B is an Exchange-Traded Note (ETN) that aims to expose the S&P 500 VIX Short-Term Futures Index. This ETN is a type of unsecured debt security that tracks an underlying index of VIX futures contracts.

- Country, Currency, and Exchange: This instrument is based in the U.S., trades in USD, and is listed on the NYSE Arca exchange. These factors determine the regulatory environment, currency risk, and the trading market for the instrument.

- Typical Spread: The spread of 0.15% is the difference between the buy and sell price offered by the broker. A lower spread typically indicates lower trading costs.

- Minimum Trade Size: The minimum trade size of 10 indicates the smallest number of units you can trade. In this case, the minorst trade you can make is ten shares of the ETN.

- Leverage and Margin: With a leverage of 20:1 and a margin requirement of 5.00%, you can control a prominent position with a relatively small capital. Leverage amplifies both potential profits and losses.

- Increment: The increment of 0.01 indicates the slightest price movement the instrument can make. This is important for understanding how much the value of your position can change with small movements in the underlying asset.

- Overnight Interest: The overnight interest rates for selling (-0.0025%) and buying (-0.0308%) indicate the cost of holding a position open overnight. These are fees charged by the broker and can affect the profitability of trades held for more than a day.

- Trading Hours (GMT): The instrument can be traded from 14:30 to 20:59. These hours are essential to know as they determine when to enter and exit trades.

- Units: Trading is conducted in units of shares. Each transaction involves buying or selling a certain number of shares of the ETN.

- MT5/MT4 Symbol: #VXXB is the symbol used to trade this instrument on MetaTrader platforms (MT4 or MT5), popular trading platforms many brokers offer, including AvaTrade.

- Description: The S&P 500 Futures Volatility Index (B Series) is a benchmark index that the ETN aims to track. It exposes volatility through futures contracts on the VIX, which measures the market’s expectation of volatility based on S&P 500 index options.

When trading this ETN, it’s crucial to understand that it represents an investment in futures contracts on the VIX, not the VIX index itself. This ETN is designed to replicate the performance of the VIX through short-term futures, which can be quite different from the actual VIX index, especially over more extended periods. Additionally, as with any leveraged product, a higher level of risk is involved.

Which Broker Has VIX 75?

Almost all brokers offer VIX 75 because VIX is an indicator, not a tradable asset. You can use VIX on MetaTrader, Thinkorswim TD Ameritrade, E*TRADE, Robinhood, Fidelity, TradeStation, Webull, MetaStock, etc.

So, if you visit our list of forex brokers, each offers stocks CFD and VIX 75.

Brokers typically provide access to VIX trading and analysis through several methods:

- Exchange-Traded Funds (ETFs) Linked to the VIX: These are funds that track the performance of the VIX Index. When investors buy shares in a VIX ETF, they are essentially speculating on the level of volatility in the stock market. The value of the ETF changes in response to fluctuations in the VIX Index.

- Exchange-Traded Notes (ETNs) Linked to the VIX: ETNs are similar to ETFs in that they track the VIX Index but are structured as debt securities. This means that they carry the issuer’s credit risk, unlike ETFs. Investors in VIX ETNs are exposed to the index’s performance, which reflects market volatility expectations.

- VIX as a Market Indicator: Many brokers offer the VIX Index as a market indicator. This allows traders and investors to monitor real-time market volatility expectations directly. The VIX is often used as a “fear gauge” in the market, with higher values indicating increased uncertainty or fear among investors. By providing the VIX as an indicator, brokers enable clients to use it as a market analysis tool and inform their trading strategies, especially in options and futures.

In all these cases, the VIX is a central tool for investors looking to gauge or invest based on market volatility. While ETFs and ETNs offer a way to trade on the VIX, the indicator provides valuable insights into market sentiment and potential future market movements. However, it’s essential to understand the complexities and risks involved in trading products linked to market volatility.

In summary, while the standard VIX index is widely available across many platforms and is an indicator, the VIX 75 is a specific tradable instrument offered by particular Forex and CFD brokers. It requires access through platforms like MetaTrader 4 and 5. Traders need to understand the nature of this instrument and the risks involved in trading it.