Table of Contents

Based on research Contentworks and forex trading statistics, the percentage of traders who lose money is 95%. Public data have shown that 73%- 95% of the broker’s clients lose money. There is always a significant percentage of traders who are not profitable but are not losing traders.

So, how many forex traders are profitable? In the retail industry, around 5%-10%, and in prop companies, approximately 80% of traders are good.

What percentage of traders lose money?

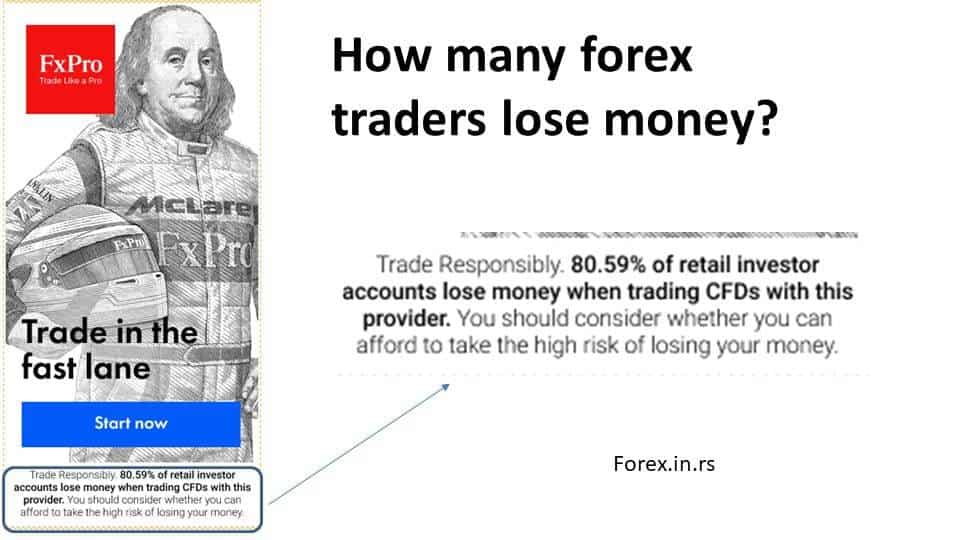

Based on brokers’ available data, 86% of all retail traders lost money trading forex in 2024. Many brokers publish this data on promotional banners so the public can see how many forex traders in percentage lose money.

The problem is in the calculation of profitable traders. Based on brokerage companies’ definition, traders who do not lose money are profitable. That means if some traders do not trade, their account is counted as a profitable account.

We can expect this trend to continue in 2024. 95% of traders are not profitable, while only 5% earn money annually.

But there is one catch here.

I got this number based on the average percentage of the top 35 brokers.

See the example in the image:

In our article Can You Make Money Trading Forex? We explained the problem to a trader who had lost money.

But what does science say about retail traders?

In the article “Do individual currency traders make money,” we can see that profitable traders exist in the currency market as well as daily traders. Risk-taking is problem number 1 for all retail traders (Uninformative Feedback and Risk Taking: Evidence from Retail Forex Trading )

The real question is – can retail forex traders make money? Of course, retail traders can earn, and corporate traders only if they follow risk management rules. When managing a smaller amount (less than 1 million dollars), retail traders can achieve a more significant profit (more considerable risk) than corporate traders. Risk rules and opportunities differ when you manage $ 10,000 and 1 billion dollars.

Experts claim that 95% of forex traders make losses, so they quit forex trading. The DailyFX forex website found that though some forex traders are making a profit, new traders still find it challenging to be profitable.

Forex trading is a waste of time.

After losing a strike, some beginner traders think forex trading wastes time. Forex is a standard business that involves stock trading or commodity trading. Some traders believe that trading wastes time because they have high expectations.

Suppose the best traders and companies in the world have an average annual profit of 20%fit in trading. In that case, beginner traders can not double their accounts every month and become prosperous because they read some super trading strategies on the internet forum. Trading is for patients who manage risk and make trading plans, scenarios, and prediction models.

Let us see the reasons why traders lose money.

Why Forex Traders Lose Money?

Most forex traders lose money because of poor risk management and overtrading, which produces high commissions. Additionally, the lack of detailed analysis creates a rush and puts traders in a position at every moment.

There are many reasons why forex traders lose money. Some traders make poor choices in their trades, while others may not have the proper knowledge or experience to succeed. Additionally, some traders may not have a solid trading plan, which can lead to disastrous results.

One of the main reasons why traders lose money is that they don’t take the time to learn about the market. Forex is a complex market, and it can be difficult to succeed without doing your homework. You must understand how the market works and what factors influence currency prices to succeed. You also need to develop a trading plan and stick to it.

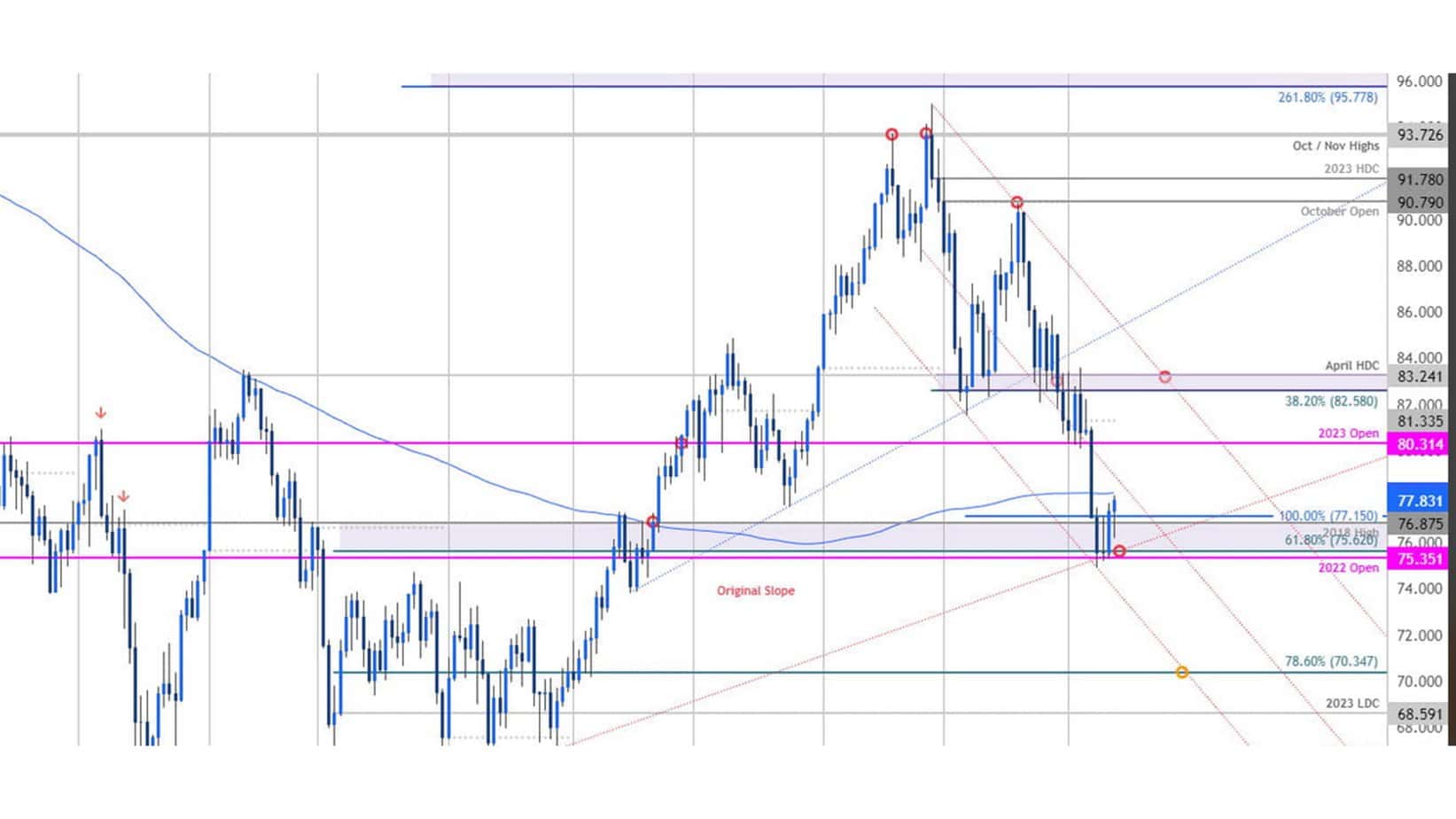

Look at this excellent example of how traders make deep analysis:

Excellent price level analysis example made by Micheal Boutros

Another reason traders lose money is that they trade too often. Frequent trading can lead to costly mistakes, especially if you’re not experienced. It’s essential to carefully research each trade before making it and only enter into trades with a high probability of success.

Traders also lose money when their emotions get the best of them. Trading is very emotional, and getting caught up in the excitement of making money or trying to recoup losses is easy. However, this can lead to bad decision-making and ultimately result in losses. Trading with emotion is never a good idea – you must always stay calm and logical to make intelligent trading decisions.

There are many other reasons why traders lose money, but these are some of the most common. To succeed in forex trading, you must avoid these mistakes and educate yourself on the market conditions.

Trades lose money because of the following:

- Understanding the market

Many traders make the mistake of thinking that they can beat the forex market and make a significant profit with little capital. These traders may be aggressive, go against trends, and lose money. Instead, they should understand the market and try to make money from well-defined trends.

- Low capital

Usually, traders start forex trading to make quick money or get rid of debt. Forex marketers often encourage these traders to trade with high leverage and use larger sizes of lots to make more significant returns, using small initial capital. In the short term, a forex trader may get the high returns he seeks. However, since the risk is very high due to the higher leverage and less capital, traders often become emotional and time their trades at the worst possible time, making a loss. Hence, forex traders should have at least $1000 before trading; they will likely lose.

- She is managing risk.

Like in life, risk management is essential if a forex trader wishes to survive. Skilled traders can lose their capital if they do not manage risk. The trader should focus on protecting his capital before making a profit. Once the wealth is depleted, the forex trader’s ability to make a profit will be reduced. A recommended risk management practice involves placing stop-loss orders after the forex trader has made a reasonable amount of profit. The lot sizes should be small compared to the capital in the account, and the trader should exit trades that are not viable.

Please read more about this table below in our article about trading risk and risk management:

- Being greedy

Some forex traders want to make the maximum profit possible from every move in the market. Traders who wait for the last pip before the rate change reverses may hold their positions too long and lose profitable trade. Hence, the trader should be happy with a reasonable profit and not wait daily to maximize his profit. It is possible to profit by trading forex daily, so traders should not be greedy.

- Trading without plan

Traders often find that the trade they have chosen is not immediately profitable, so they close the trade and reverse it, only to see that their market is moving in the opposite direction. The trader will regret his decision. Choosing a specific direction for trade and being patient is essential. Switching trades based on short-term trends will result in the depletion of the capital invested.

- Predicting the top or bottom

Many new forex traders try to predict the turning point for forex pairs, often going against the market trends. They may add more funds to the trade and make a more significant loss than predicted. Though it is not worth boasting about, trading based on market trends is safer. If traders wish to pick the bottom, they should choose the bottom of the uptrend. Similarly, if they want to trade at a peak, they should trade when the market moves up, not down.

- Refusing to accept mistakes

Though most people always want to be correct, forex traders should accept that they made a trading mistake and continue to waste resources. This could deplete the balance in the Forex account. It is always better to assume that the trade was a mistake, close it, and look for the next profit opportunity.

- Purchasing forex trading systems

Many forex trading systems are advertised extensively online, promising huge profits. Some traders make the mistake of investing money in these automated systems and yet make losses. New forex traders should understand that there are no automated systems for profit trading in forex; each trader should develop their method and strategy after understanding the forex market.

How much do currency traders make a year?

Currency traders who work in trading companies earn an average of 77K annually, based on the U.S. Bureau of Labor Statistics. However, a currency trader’s salary depends on how extensive his managed portfolio is. Based on the managed portfolio, the best traders earn an average of 20% annual return.

Read more about the wealthiest trader in the world in our article.