Table of Contents

Dogecoin (DOGE) recently saw a dramatic price surge, primarily attributed to a whirlwind of news and social media buzz. The meme coin originated as a lighthearted take on cryptocurrency and has periodically captured attention with high volatility and sudden spikes. This time, the surge follows the announcement that President-elect Donald Trump has appointed Elon Musk and Vivek Ramaswamy to lead a new “Department of Government Efficiency,” nicknamed DOGE. This amusing coincidence fueled Dogecoin speculation.

This article will explore why DOGE will likely experience a pullback despite the recent boost and why shorting it could be a profitable strategy soon.

Check my video first:

My opinion:

This recent Dogecoin surge has been something else. Honestly, it feels surreal, and it’s almost like watching a meme come to life. I’ve been watching this closely over the last few days, and it’s had me thinking: Why on earth is this happening?

At first glance, it seems like the price of Dogecoin shot up because of news linked to Trump’s recent win. But the reasoning here feels, well, a little wild. So, let’s break it down: after Trump’s victory, the market got a boost, and crypto gained momentum. Somewhere along the way, the news spread about a new “Department of Government Efficiency,” cheekily abbreviated as DOGE, which, naturally, got tied to Dogecoin. And Elon Musk—the self-proclaimed Dogefather—has supported Dogecoin for years, tweeting and even hinting at big dreams for the coin’s future. So, throw Musk’s support in with a clever bit of political news, and we have the recipe for a surge. But is this real growth or just hype?

I can’t help but feel this is more of a “fake push” than anything sustainable. It’s clear to me that there’s no solid, fundamental driver behind this spike—just a few lighthearted coincidences tied together by public excitement. How people took the DOGE joke and ran with it shows how much social media and meme culture can drive market behavior.

Looking at the technicals, Dogecoin’s jump was much stronger than most other cryptos during this time. Bitcoin, for example, rose about 30% following the election results, but Dogecoin saw a much more extreme move, doubling in value. That raised my eyebrows; usually, such a drastic jump isn’t backed by anything substantial. It feels like we’re heading for a typical “pump and dump” scenario.

1. Examining the Factors Behind DOGE’s Recent Surge

Dogecoin’s recent price jump highlights the meme coin’s vulnerability to hype and news cycles. Elon Musk, a long-time advocate of Dogecoin, continues to be an influential figure for the cryptocurrency, and his association with DOGE has previously caused spikes in its price. But unlike other assets that may rally based on fundamental strengths, Dogecoin’s recent surge seems primarily based on:

- News Events: The announcement of the “Department of Government Efficiency,” ironically abbreviated as DOGE, led some to speculate that Dogecoin is gaining institutional or governmental endorsement.

- Social Media and Memes: Elon Musk’s playful history with Dogecoin—calling it “the people’s crypto” and sharing family stories of owning DOGE—adds a quirky appeal that can quickly spike retail interest.

- Trump’s Election Victory: Optimism around Trump’s victory and a perceived potential for a more crypto-friendly regulatory stance has contributed to broad gains in the crypto market.

Despite these reasons, they lack solid grounding to sustain the long-term price increase, especially for a coin like Dogecoin, which doesn’t have robust utility or innovation backing its valuation.

2. The Case for Shorting DOGE After the Spike

Shorting a cryptocurrency involves betting on the price going down. Based on recent market patterns, here’s why DOGE may be overvalued following this news-driven rally:

-

- Lack of Fundamental Value: Unlike Ethereum, which offers smart contract functionality, or Bitcoin, which is often considered digital gold, Dogecoin lacks intrinsic value or unique technological advantages. Thus, its rallies often stem from social trends rather than technical advancements or increased adoption.

- Potential Overvaluation Due to Hype: Dogecoin saw a 153% increase in value, outpacing Bitcoin’s 30% rise, yet there’s no apparent reason for Dogecoin to surge to this extent beyond news-related speculation.

- Historical Pump-and-Dump Patterns: Dogecoin has previously exhibited pump-and-dump behavior. It tends to see strong rallies when media or celebrity interest spikes, only to undergo sharp corrections as the initial excitement fades.

- Market Correction Signals: Following its rally, DOGE has seen some stabilization but remains vulnerable to retracement. A typical indicator of overvaluation is when price trends deviate significantly from general market movements. Dogecoin’s recent outperformance relative to other significant cryptocurrencies may indicate that it’s due for a pullback.

3. Technical Analysis for Shorting DOGE

A technical analysis of DOGE can further clarify the strategy for shorting:

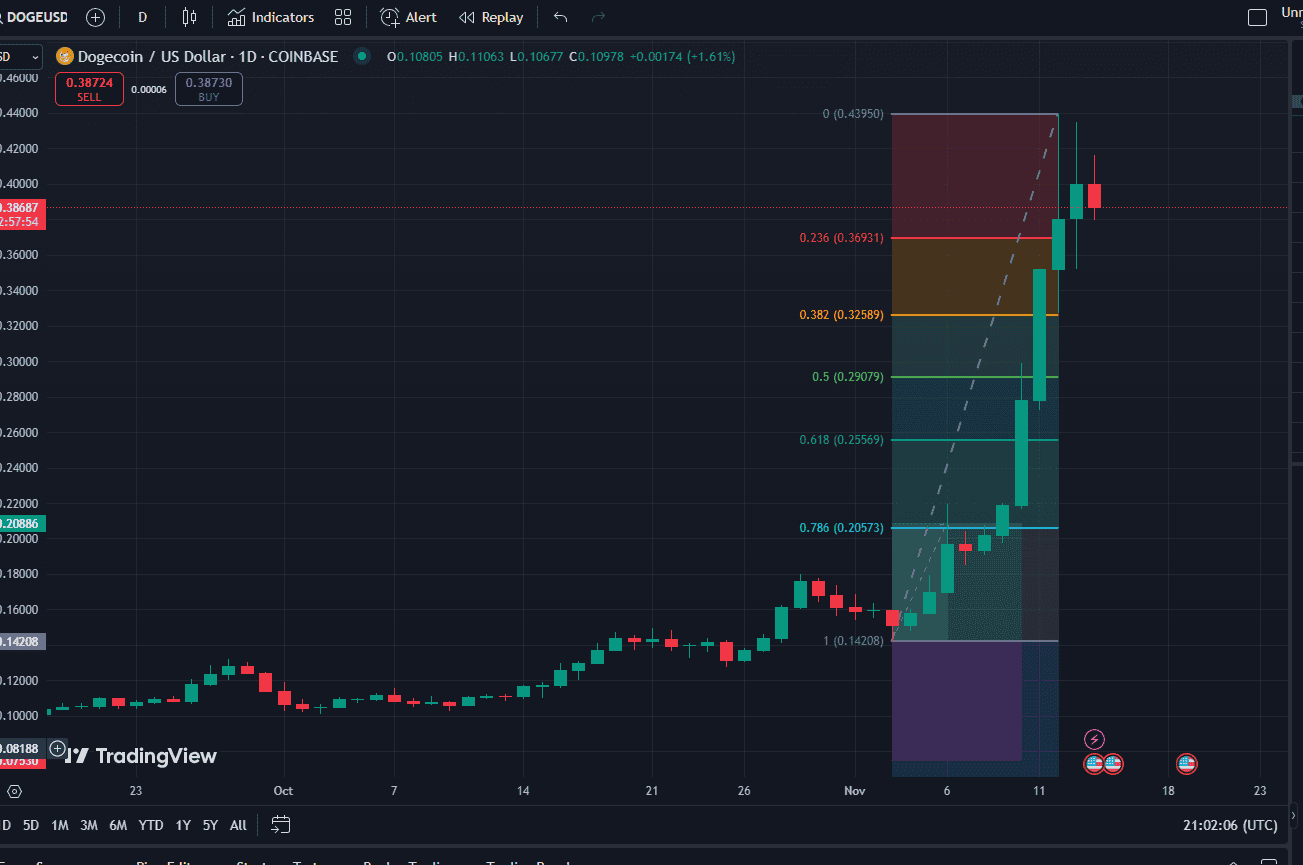

- Fibonacci Retracement Levels: Using Fibonacci retracement, traders can identify likely pullback levels. For example, if DOGE hits a high near $0.43 following the news, we can use the Fibonacci retracement tool to target key support levels. A 50% retracement would bring DOGE back toward $0.325, a realistic correction target.

- Support and Resistance Levels: Strong resistance points formed during the rally could become the new upper limit, while support levels around $0.29 to $0.32 may be where DOGE stabilizes after a pullback. These levels offer potential exit points for traders looking to capitalize on a price decline.

- Trend Reversal Patterns: DOGE’s trading history shows patterns of rapid ascent followed by consolidations or reversals. If the coin moves sideways or fails to break above recent highs, it could start a downward trend.

4. Risks and Considerations When Shorting DOGE

As with any high-volatility asset, shorting DOGE carries inherent risks:

- High Volatility: Cryptocurrencies are inherently volatile, and Dogecoin is even more so due to its speculative appeal. The price could spike further if Musk or other influencers make statements or tweets that reignite buying interest.

- Media Influence: In this case, media hype can drive unexpected price increases. A high-profile endorsement could quickly shift sentiment and delay or disrupt an anticipated correction.

- Broader Crypto Market Dynamics: The overall sentiment in the crypto market can affect DOGE’s trajectory. If the market continues to rally, it may carry DOGE despite its weaker fundamentals.

I’m thinking about shorting Dogecoin in the near term because I don’t see this price level as sustainable. If anything, the chart seems primed for a correction. Sure, there may be a bit more momentum as some traders ride the wave, but these moves often cool off just as quickly. Using some Fibonacci retracement, I expect Dogecoin could pull back to more realistic levels around $0.325 or even lower to $0.29.

I’ve seen these wild surges before in penny stocks and other cryptos, and they often have a similar story—an initial rush that draws everyone in, then a slide back down as reality sets in. For now, I’ll keep watching the charts and, hopefully, see Dogecoin settle into a more stable range after this frenzy dies down.

5. Concluding Thoughts

In conclusion, DOGE’s recent rally is likely driven more by social media hype and speculative bets than intrinsic or fundamental improvements. Its inflated valuation relative to other significant cryptocurrencies suggests that a pullback is likely, especially if the rally fades without further significant developments. Shorting DOGE after a spike may offer profitable opportunities for experienced traders who understand the risks.

However, it’s essential to monitor market sentiment and be prepared to adjust as new developments arise, mainly if Musk or other influential figures make further comments on DOGE. As always, this analysis represents a market perspective rather than investment advice, and investors should carefully consider their risk tolerance before making any moves in the highly volatile cryptocurrency space.