Table of Contents

Investing in index mutual funds and exchange-traded funds (ETFs) gets excellent attention for a good reason. The best index funds allow investors to track significant stock and bond market indices at a minimal cost. In many circumstances, most managed funds are outperformed by index funds. Investing in index funds may seem like a no-brainer, even a slam-dunk decision. As a result of the growing popularity of index investing, mutual fund and exchange-traded fund (ETF) providers have responded by creating a flurry of new index products.

The fact that you’ve invested in an index fund or two does not guarantee that you’re on the road to attaining any investment or financial planning objectives. In the same way that any other financial product, including index funds, is a tool, so are they. Therefore, it would be best if you had the plan to get the most out of index funds, whether you use them solely or in conjunction with active funds. This post will acknowledge whether you can withdraw from an index fund.

What are index funds?

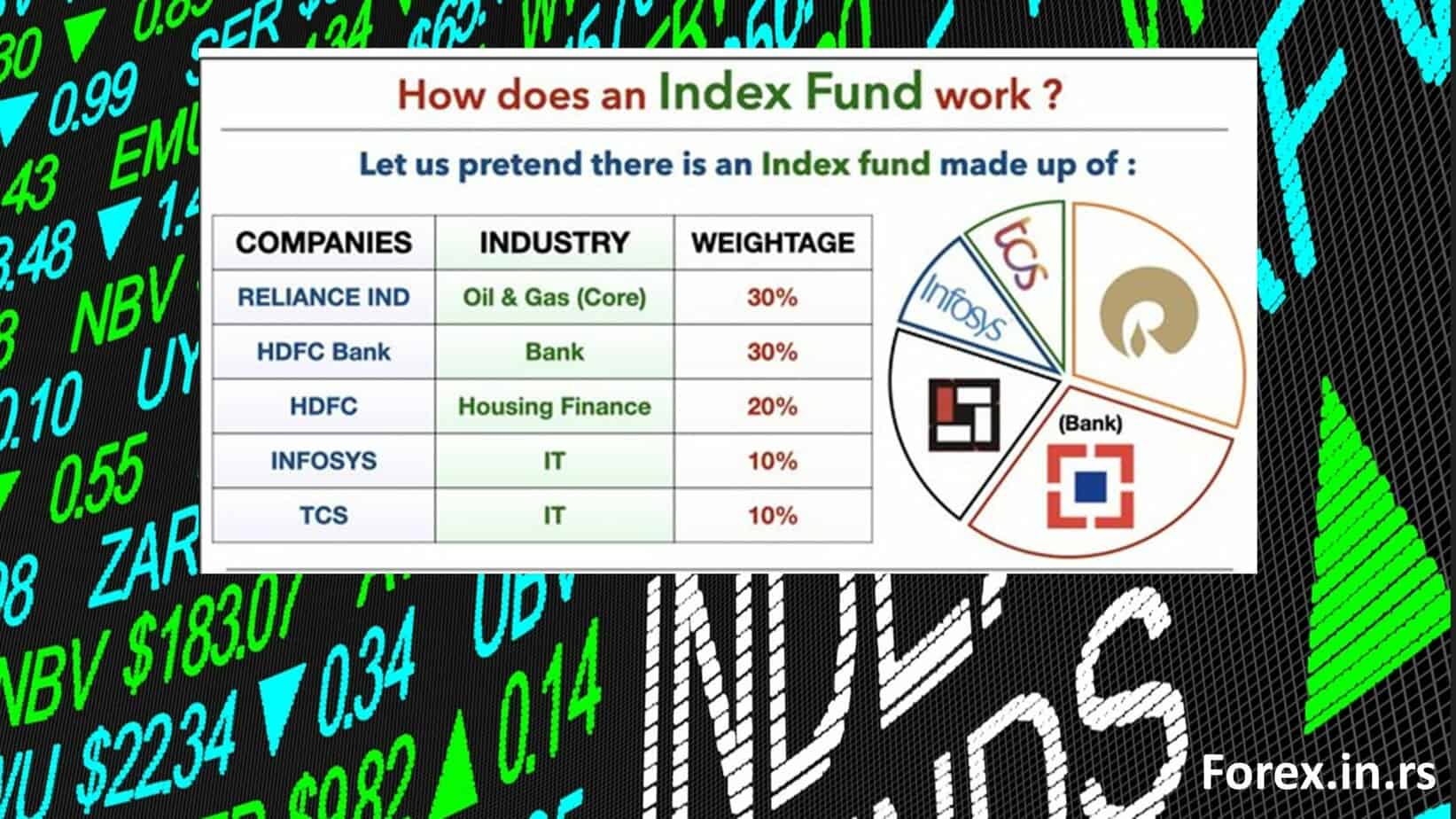

Index funds are a type of mutual fund that seeks to replicate the performance of an index or benchmark, such as the S&P 500 stock index. For example, if you put $1000 in an index fund, you invest equally (or by weight) in each company of a particular index.

Investing can be done either by passively holding all stocks in the index or replicating the index’s composition and weightings.

By following a set of predetermined rules, investors can benefit from the diversification benefits of buying a basket of stocks while saving on time and fees typically associated with actively managed funds.

An index fund is essentially a collective investment vehicle that holds all or most of the securities in a particular market index—such as the S&P 500 Index—in proportion to their weighting. Since no effort is made to pick individual securities for outperforming purposes, these investments have little cost and minimal portfolio turnover, making them one of the least expensive ways to buy into an entire asset class like U.S. large-cap stocks.

- Popularity of Index Investing: Index mutual funds and ETFs are highly regarded for their ability to track significant stock and bond market indices at minimal costs, often outperforming most managed funds.

- Need for a Plan: Despite the simplicity and appeal of index funds, investors need a strategy to maximize their benefits, whether used alone or alongside active funds.

- Definition and Mechanics: Index funds aim to replicate the performance of specific benchmarks, like the S&P 500, by investing in all or most index components, offering cost efficiency, low turnover, and diversification.

- Advantages: They are known for lower costs, tax efficiency, and simplicity, making them suitable for novice investors and a favored option for long-term investment due to their broad market exposure and endorsement by prominent investors like Warren Buffett.

- Withdrawal Flexibility: Investors can generally withdraw from index funds at any time, except in specific cases like equity-linked savings schemes (ELSS) with a three-year lock-in period.

- Mutual Fund Liquidity: Most mutual funds, including index funds, offer high liquidity, allowing for withdrawals at any time, although exit fees may apply, and certain funds may have lock-in periods.

- Drawbacks of Early Selling: Selling mutual funds prematurely can lead to missing out on long-term returns and compounding benefits, with market volatility potentially leading to losses if sold during downturns.

- Index Fund Limitations: Include lack of downside protection, inability to react quickly to market changes, no control over holdings, limited exposure to varied strategies, and diminished personal satisfaction from active investing.

Index funds track an underlying index – such as an equity or bond market – using a passive investing approach. Instead of attempting to beat the market (as active managers do), they match it by investing in all or most of its components in proportion to their weightings on that index. They are typically structured as mutual funds with holdings that match a target benchmark (e.g., S&P 500). As such, they offer investors lower costs than actively managed portfolios due to their low level of trading activity and expense ratios; they also provide broad diversification across asset classes without requiring individual security selection decisions from investors.

Not only do index funds tend to have lower costs than actively managed funds, but they’re also more tax efficient since investors aren’t taxed on trades within an index fund unless distributions are taken out – unlike with actively managed funds, which usually necessitate frequent rebalancing activities and therefore higher turnover that can lead to increased taxation liabilities for investors over time.

Additionally, because there’s no real research work required when constructing an index fund portfolio – only establishing weights based on the underlying benchmark – this makes them much more straightforward for novice investors compared to managing individual stocks, bonds, or other securities through active management strategies which require more specialized knowledge and experience to generate alpha returns over time.

Overall, while the risk is associated with investing in any security—including indexes—investors can benefit from owning shares in an indexed fund due to its simplicity, low cost nature, and ability to provide broad diversification across markets without making individual stock selections. However, it’s worth noting that each strategy has pros and cons. Hence, investors must evaluate both before deciding what best suits their needs and objectives.

One example of an index fund is a mutual fund or ETF whose portfolio is intended to mirror or follow one of the components of an index, like the S&P 500 (S&P 500). Because of its low fees and low portfolio turnover, an index mutual fund is claimed to offer broad market exposure.

Regardless of the status of the markets, these funds adhere to their benchmark index. Individual Retirement Accounts (IRAs) and 401(k) accounts are considered excellent core portfolio holdings for index funds. Warren Buffett has endorsed Index funds as a safe shelter for retirement savings by the legendary investor. Because of the low cost, he believes it makes much more sense for the average investor to invest in an S&P 500 index fund rather than individual equities.

Passive fund management is known as indexing. With this strategy, instead of selecting individual stocks or markets to invest in and timing when to purchase and sell, the fund manager creates an index-based portfolio that mirrors the holdings of that index. By mirroring the index’s profile—the stock market as a whole, at least a significant portion—the fund will also match its performance. Almost every financial market has an index or an index fund. Index funds that follow the S&P 500 are the most popular in the United States.

Can you withdraw from an index fund at any time?

Yes, you can withdraw from an index fund at any time. However, if you have a contract known as an “equity-linked savings scheme (ELSS),” you will have a three-year lock-in period and cannot withdraw your money afterward.

You can sell index funds if you’re working with a reputable broker. Selling index funds while the market is down might result in a loss of money. This is generally the case. In addition, index funds are long-term investments, not short-term ones. As a result, you should only invest money you won’t need shortly. It is possible to withdraw cash from an open-end investment at any moment. Except for an equity-linked savings scheme (ELSS), where the lock-in period is three years, there have been no limits on investment redemption.

Investors should know any exit fees associated with their investment only if appropriate exit loads are subtracted from the redemption price. AMCs commonly impose exit loads to discourage speculative or short-term investors from participating in a scheme. The automatic redemption of all units at maturity is not an option with closed-end funds. Only a recognized stock exchange allows investors to sell their closed-end plan units to other investors. You can withdraw an open-ended investment at any moment.

Mutual funds are among the most accessible when it comes to liquid assets. Offline redemption requires the unit owner to submit a completed Redemption Request form to the authorized officer of the AMC or Registrar. Unitholders must include their name, folio number, scheme name, or the number of units they wish to redeem on the application. The redemption funds will be deposited into the first designated unit holder’s bank account. You may also use the mutual fund’s website to buy and sell mutual funds. Your Folio number and PAN number are all you need to connect to the mutual fund website, pick the fund scheme from which you want to redeem units and complete your transaction.

Can you withdraw your mutual funds at any time?

Most mutual funds are liquid investments, meaning you may withdraw them from your fund anytime.

There are many mutual funds out there that you may withdraw from anywhere at any moment. However, certain funds have a lock-in period. One of these schemes is the Equity Linked Savings Scheme, which has a three-year maturity. After the lock-in term, an investor can partially redeem the plan or continue committing for an extended time. So, how can you get your money back from a mutual fund? You can consider it a withdrawal when you’re done with your investments.

Mutual fund redemption is a term for this. You must redeem your units when you withdraw money from the mutual fund. You are paid the NAV for the teams you’ve sold, and you’re done. As an illustration, let’s say you want to put Rs 10,000 in a mutual fund. Units can be exchanged, sold, or withdrawn following your needs.

If you invested in a mutual fund through a broker or distributor, you could withdraw your money through them. You might ask for a withdrawal from your broker. To make an offline withdrawal, you must complete a withdrawal request form. The broker will send the form to the asset management company. Redeeming online is possible if the broker provides a site or mobile app.

You may connect to the mutual fund account, pick the withdrawal option, and input the number of units you want to withdraw. It will execute the request in real time. You can withdraw your mutual fund plan directly from the AMC. Alternatively, you can request a withdrawal online or visit your local AMC branch office. Redeeming yourself is as easy as visiting AMC’s website or downloading its mobile app. The R & T Agent can assist you in investing and withdrawing from mutual fund schemes. Requesting a withdrawal from R & T agents is simple.

You can withdraw money from mutual fund investments through Demat and trading accounts. Go to your account, pick the amount you want to withdraw, and submit the request to verify your mutual fund investment. Once the request has been approved, it will be deposited into your linked bank account. For urgent financial needs, mutual fund assets might provide a quick source of cash.

You may redeem these in unit and money terms with mutual fund investments, but you could use them in whole or part. As a result, investors in mutual funds have more freedom to sell their shares later. Find out if you should cash withdraw from a mutual fund in person or online. Consider the exit burden and tax consequences when redeeming mutual fund units.

What are the drawbacks to selling mutual funds at any time?

Investors sell the mutual fund either too early or too late, and you can sell the fund when the market is down. These are the two drawbacks of selling mutual funds.

As a rule of thumb, you should aim to keep your index funds for at least 30 years to reap significant returns. It is because you must allow your savings to accumulate through compounding. Compounding is the process of reinvesting your stock market gains repeatedly. This money is then reinvested, making you even more money. If you don’t reinvest your capital gains, the cycle will continue until you have made as much as you would otherwise. If you’re patient and persistent, you can make money here. On the other hand, it is possible to lose out on enormous financial rewards if you sell the investments too early.

You’d be better off putting away $100 monthly for 20 years at an average interest rate of 8% and then taking it out to pay a mortgage. A little more than $60,000 would be yours. If users invested the same amount at the end of 35 years, they would have more than $220,000. It may seem like a lot of money, but if you wait a few more years, you may virtually quadruple the value of your investment. As a result, it may be a bad idea to sell the index funds early on.

As an investor, you can always count on one thing: the marketplace is never stable. It might flourish one day and collapse the next. Because of this volatility, you might lose a lot of money if you sell index funds at the incorrect moment. In 2020, for example, the market was down about 10%. Because of this, if you decided to sell during that year, you could lose 10% of your money.

Selling at a high point isn’t easy, either. Predicting when the market will reach its apex before plunging again is impossible. As a result, it isn’t easy to sell stocks in general. Because timing the markets is difficult, many people panic and sell whenever the market drops. As a result, your funds might be sold over months or years. Because of this, It will preserve your portfolio’s value despite the market’s ups and downs.

What are the drawbacks of index funds?

The drawbacks of index funds include a lack of downside protection, reactive ability, no control over holdings, limited exposure to different strategies, and dampened personal satisfaction.

Long-term, the stock market has proven to be a terrific investment, but there have been some hiccups. An index fund, such as one that tracks the S&P 500, provides you with the upside when the market is performing well, leaving you completely vulnerable to the downside. While shorting S&P 500 futures contracts or purchasing a put option against the index may be a possibility for investors with a lot of exposure to stock index funds, doing so may negate the whole point of investing (it’s a break-even strategy). Hedging is a short-term solution in most circumstances.

There is no room for wise play when it comes to indexing investing. If a stock is overpriced, it becomes critical to the overall index. Unfortunately, this coincides with the exact time when prudent investors would like to reduce their holdings of that company in their portfolios. Put another way, investing through an index won’t allow you to act on information like whether a stock is expensive or undervalued. Some indexes are predetermined portfolios. Investors who buy index funds have no say in the portfolio’s composition. You may have a favorite bank or food firm you’ve researched extensively and wish to purchase.

You may feel that one organization is superior to another in the real world, perhaps because it has better branding, management, or customer service. As a result, you might want to put your money into that firm rather than one of its competitors. You may also harbor negative views toward other businesses for moral and personal reasons. You may be concerned about a company’s environmental policies or the quality of its products. It can’t change a section of your portfolio’s index, but you may add certain stocks you prefer.

An index market might not even give you access to many outstanding ideas and tactics that successful investors have employed. In some cases, investors might benefit from combining several investment techniques. For example, if you want to invest in an index, you can diversify with as few as 30 stocks or the 500 stocks tracked by the S&P 500 Index. As a result of your study, you could be able to identify some of the most excellent value and growth companies. Ultimately, you’ll have a more focused portfolio with fewer holdings because of your studies. A portfolio is more suited to your particular objectives and risk tolerances than the markets may be available.

When the stock market is in chaos, investing may be a nerve-wracking and unpleasant experience. An index investment will not save you from continually monitoring stock prices and tossing and turning at night because you’ve chosen a few specific stocks. Even if you don’t follow the market closely, it’s easy to become paranoid about the state of the economy. But, then, to add insult to injury, you’ll miss out on the sense of accomplishment and satisfaction that comes with making smart investments and achieving financial success.

Discussion

Can you withdraw from an index fund at any time? When considering how to invest their money, this is a common question. The short answer is yes, but that doesn’t mean it’s always the best decision.

Index funds track a market index, such as the S&P 500 or the NASDAQ composite. Investors can purchase shares in these funds and benefit from the diversification they provide since they include hundreds of stocks and bonds in their portfolios. This makes them attractive investments for many people because they require less effort than actively managed funds, providing potential steady returns while minimizing risk.

However, investors must know the potential drawbacks when investing in an index fund. One of those issues is liquidity: while you can withdraw money from your index fund at any time, fees may be associated. Depending on the specific fund, early withdrawals could incur redemption charges or other penalties that can eat into your returns if you’re not careful.

Another essential factor to consider is taxes: any profits made when selling index fund shares are subject to capital gains taxes, which could significantly reduce your overall return from the investment depending on your tax bracket. Additionally, short-term capital gains may be taxed at a higher rate than long-term gains, so withdrawing money after only a few months could leave you with less money than expected after Uncle Sam takes his cut.

Finally, it’s worth noting that withdrawing from an index fund causes the investor to miss out on potential returns due to missing out on future market movements and growth opportunities. Index funds tend to do well over more extended periods than shorter ones; if you decide to withdraw early, you won’t benefit from any future growth of the underlying assets within the fund during that period.

Therefore, while it’s possible to withdraw money from an index fund whenever desired — no matter what type of account it is held in — it’s essential to weigh all factors carefully before making such decisions since there can be significant costs associated with early withdrawal and missing out on potential returns.

Conclusion

Index funds are a breeze to trade overall. Ten minutes or a few business days later, you’ll have the money in your bank account. On the other hand, choosing when to sell is a lot more complicated. Knowing whether to sell when the stock market is down is impossible.

A market fall shortly before retirement is terrible, but if you don’t want to get caught up in it, consider a low-cost investing approach for all or part of your portfolio, and consider index mutual funds and exchange-traded funds (ETFs). Like any other approach, investing in index funds necessitates familiarity with the investments. Investors must go beyond the “index fund” label to find low-cost products that match an appropriate benchmark for their investment approach. We hope you have understood everything related to whether you can withdraw from an index fund anytime.