Table of Contents

In the dynamic world of Forex trading, XM Broker has risen as a beacon of reliability, innovation, and superior customer experience. Founded In 2009, XM consistently scaled new heights and redefined industry standards. Over the past decade, it has acquired an impressive clientele of over 10 million traders, making it a globally recognized and respected trading broker.

XM Review

This XM.com forex broker review shows that XM is a reputable ASIC, CySEC, and FSP-regulated broker. Traders can get up to a $5000 trading bonus and trade indices, gold, oil, stocks, and various currency pairs. XM offers low withdrawal fees and a $30 free no-deposit required bonus.

As of 2024, XM Broker has achieved significant milestones in the forex and trading industry. They have amassed over 10,000,000 clients from more than 190 countries worldwide, demonstrating their global reach and diverse customer base. Impressively, XM broker has executed over 2,400,000,000 trades, with a remarkable record of zero requotes or rejections, highlighting their reliability and efficient trading execution. Additionally, their management team has visited over 120 cities to meet with clients and partners, indicating their commitment to personal engagement and international presence.

Please see my XM Review YouTube video:

XM.com is a foreign exchange broker providing online trading services worldwide. Founded in 2009, XM has become one of the largest brokers in the world and is trusted by millions of traders. The broker’s services cover everything from beginner to advanced traders and are available on desktop, web, mobile, tablet, and social media platforms.

XM offers its clients access to over 1000 financial markets, including Forex trading, Cryptocurrencies, Stocks Derivatives, Turbo Stocks, Commodities, Equity Indices, Thematic Indices, Precious Metals, Energies, and Shares. Clients can also choose from numerous order execution methods, such as market execution, instant execution, and exchange-traded funds (ETFs). All transactions are backed by negative balance protection, so traders don’t have to worry about running out of capital during extended periods of drawdown or volatility.

Regarding safety and security, XM holds several licenses from respected regulatory bodies, including IFSC Belize and CySEC Cyprus. All clients’ funds are held in separate accounts managed by reputable banks in Europe and Australia, ensuring that clients’ money is always safe. Furthermore, XM maintains physical offices in more than ten countries worldwide where customers can go for help with any queries.

Regarding trading tools, XM offers various manual and automated trading options. These include access to MetaTrader4 (MT4) and MetaTrader5 (MT5) platforms and copy trading through the MyFXBook Social Trading platform, which features real-time data analysis and news feeds from leading providers such as Dow Jones and Reuters, among others. XM also provides users with powerful charting packages like Autochartist, which can help identify emerging trade opportunities faster than ever.

Regarding customer support services, XM offers 24/7 live chat with multilingual advisors who are always happy to answer questions or assist with any issues. There are also phone numbers in many countries worldwide where you can contact customer service agents directly and email addresses for inquiries or complaints if necessary.

Finally, when it comes to bonuses and promotions offered by XM, there are plenty of options for new and existing customers. These include deposit bonuses up to $5000, depending on your account type, and other rewards, such as cashback bonuses for loyal members who make consistent deposits into their accounts over time. In addition to these incentives, members may be eligible for loyalty points, which can be exchanged for additional trading resources such as signals or books if desired.

My opinion

I was an XM user even when this website was Xe Markets. A few years ago, the XM Xemarkets broker changed the old domain Xemarkets.com to xm.com. Some old websites still write about Xemarkets.

XM is an organized broker. You always know when the payment will be and what the brokerage news is. The platform is unique, intuitive, and unusual for traders and IBs.

For example, this is my payment dashboard:

XM.com is known for its great welcome and loyalty bonuses, its changeable spreads, and the choice of either narrow or wide leverage, allowing traders to customize their experience as much as possible. We carried out extensive testing of xm.com to compile this review. Read on to learn about their services and whether xm.com suits you.

XM bonus review

XM Forex broker offers an attractive deposit bonus of up to $50000 for all traders who trade for the first time. Additionally, first-time traders can try a $30 no-deposit required free bonus and test real live account trading without the risk.

XM Broker Facts

- XM is a global forex broker regulated in Cyprus, Australia, Belize, and the United Arab Emirates.

- The broker has low trading fees and no withdrawal fees. However, inactivity fees do apply.

- XM Broker offers easy accessibility, with a minimum deposit as low as $5 and a swift account opening process that takes just one day.

- Multiple deposit options are available, including bank cards and electronic wallets.

- There are ten base currencies available for trading.

- XM offers a variety of financial products, including Forex, CFD, and real stocks, for clients under Belize (IFSC).

- Different account types have different conditions: Micro and Standard accounts require a minimum deposit of $5, with spreads from 1 pip. XM Ultra Low and XM Zero accounts also require a minimum deposit of $5, with spreads from 0.8 pips. XM Ultra Low and XM Zero accounts may not be available to all clients.

- Leverage of up to 1:1000 is available, but this can vary depending on the client’s location and the financial instrument traded.

- Traders can access CFDs on various instruments, including currencies, shares, stock indices, precious metals, energy products, and cryptocurrencies. Please note that cryptocurrencies are unavailable for clients registered under the Group’s EU-regulated entity.

- XM implements a Margin Call at 50% and Stops at 20%. However, these levels are 100% and 50% for clients registered under the EU-regulated entity.

- XM broker prides itself on efficient order execution, with 99.45% of orders delivered nearly instantly.

- Various trading instruments, including over 55 currency pairs and CFDs on various commodities and stocks, are available.

- XM broker does not charge a commission for replenishment and withdrawal of funds.

- Clients can access support services in over 25 languages, 24/7.

- XM Broker adheres to strict regulatory compliance and is authorized and regulated by multiple entities, including the Cyprus Securities and Exchange Commission (CySEC), the International Financial Services Commission (IFSC), the Australian Securities and Investment Commission (ASIC), and the Dubai Financial Services Authority (DFSA).

XM.com video tips :

See how to open a trading account at XM.com forex broker:

Forex XM mt4 Platforms

XM bids a concrete mixture of exchanging stages, from MetaTrader to the natural XM trading post. The MetaTrader 4 stage accompanies Live Feeds for News and with broad support. Currently, XM offers six diverse electronic exchange steps that customers can utilize.

- XM MetaTrader 4, third gathering programming with the master consultant

- XM WebTrader 4, third gathering programming for web exchanging

- XM MetaTrader 4 Multi-terminal

- XM MetaTrader 4 for Mac, the port of Meta Trader 4 for Mac OS X

XM mt4 vs. mt5 platform: XM forex broker offers an MT5 platform. There are no significant differences between these platforms because major forex, stocks, indexes, and critical financial instruments are on both platforms.

There is an XM.com Android application :

Please see how to use the Mobile Trader app – How to use the MT4 Android Phone Application Video:

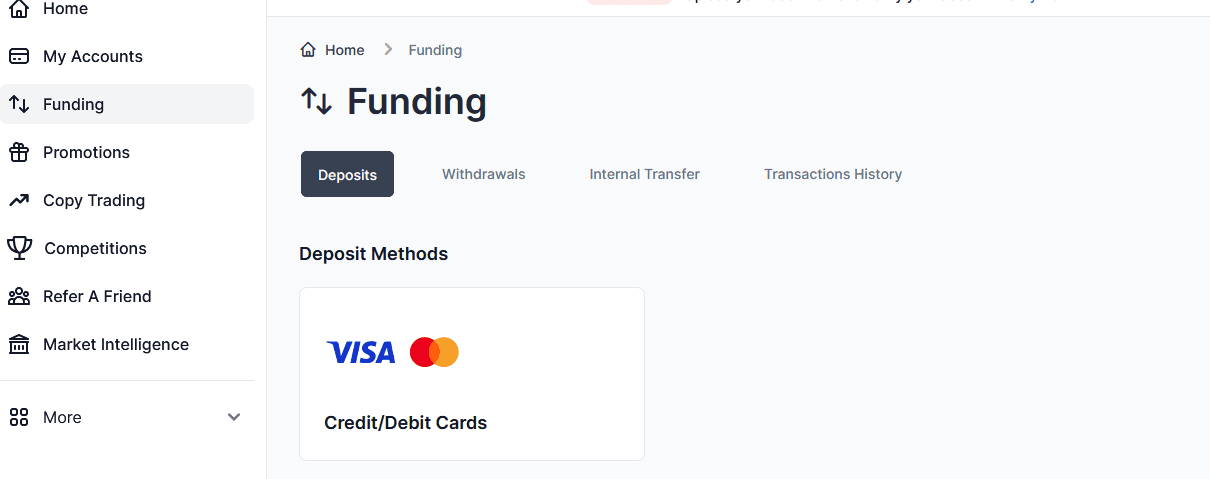

XM deposit and withdrawal methods

XM offers various deposit and withdrawal payment options. XM deposit and withdrawal methods include credit card, bank wire, Skrill, Neteller, and electronic payment.

XM offers multiple methods for depositing funds into your trading account, catering to the needs of different traders worldwide. These deposit methods include:

- Credit and Debit Cards: This is a fast and secure method of depositing funds. You can use any Visa, MasterCard, or other major credit or debit card. Transactions are usually processed instantly.

- Neteller: Neteller is a popular e-wallet service that allows you to deposit funds securely and conveniently. Deposits made through Neteller are typically processed instantly.

- Skrill: Skrill is another widely used e-wallet service. It offers quick and secure deposits, which are usually processed instantly.

- UnionPay: For traders based in China, UnionPay provides a convenient method to deposit funds.

- WebMoney is a global settlement system and environment for online business activities. It is widely used in many countries.

- Bank Wire: This method lets you deposit directly from your bank account. While it’s secure, it may take a few days for the funds to appear in your trading account.

XM Withdrawal Methods

XM offers different methods for withdrawing your funds. These include:

- Credit and Debit Cards: Just like with deposits, you can withdraw funds to your credit or debit card. The processing time can vary but usually takes a few business days.

- Neteller: Neteller also serves as a withdrawal method. Funds withdrawn through Neteller are typically available almost immediately after processing the withdrawal.

- Skrill: Similarly, Skrill is available as a withdrawal method. Withdrawals to Skrill are usually processed quickly.

- Bank Wire: You can also withdraw funds directly to your bank account. While this method is secure, it may take a few business days for the funds to appear in your bank account.

- Sticpay is a global e-wallet service that offers instant money transfers. It’s a convenient withdrawal option for XM partners.

Here you can see how to place orders in the XM mt4 platform if you are a beginner trader:

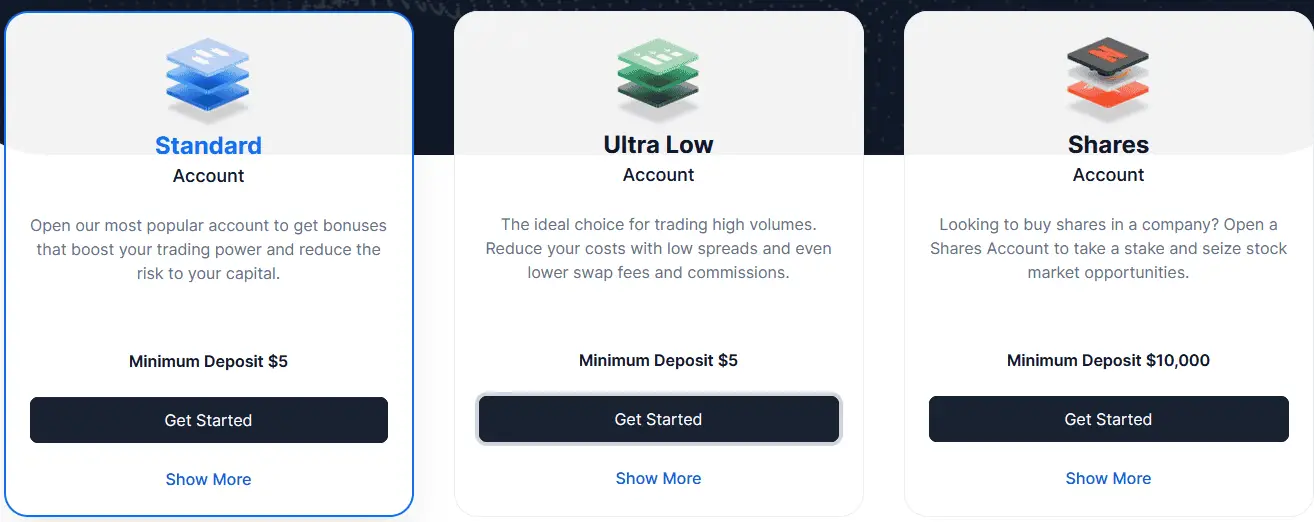

XM accounts

XM offers four main types of trading accounts to accommodate the needs of a wide range of traders: Micro, Standard, XM Ultra Low, and Shares accounts.

Micro Account:

- The base currency options include USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, and ZAR.

- The contract size for each lot is 1,000 units.

- Leverage of up to 1:1000 is available.

- It provides negative balance protection, and the spread on all majors can be as low as one pip.

- The maximum number of open/pending orders per client is 300 positions.

- The minimum trade volume is 0.1 lots for both MT4 and MT5 platforms.

- The lot restriction per ticket is 100 lots.

- Hedging is allowed, and swaps are applied.

- An Islamic account option is available.

- The minimum deposit is 5 USD.

Standard Account:

- Base currency options include USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, and ZAR.

- The contract size for each lot is 100,000 units.

- Leverage of up to 1:1000 is available.

- It provides negative balance protection, and the spread on all majors can be as low as one pip.

- The maximum number of open/pending orders per client is 300 positions.

- The minimum trade volume is 0.01 lots.

- The lot restriction per ticket is 50 lots.

- Hedging is allowed, and swaps are applied.

- An Islamic account option is available.

- The minimum deposit is 5 USD.

XM Ultra Low Account:

- Base currency options include EUR, USD, GBP, AUD, ZAR, and SGD.

- The contract size for Standard Ultra is one lot = 100,000, and for Micro Ultra, one lot = 1,000.

- Leverage of up to 1:1000 is available.

- It provides negative balance protection, and the spread on all majors can be as low as 0.6 pips.

- The maximum number of open/pending orders per client is 300 positions.

- The minimum trade volume is 0.01 for Standard Ultra and 0.1 for Micro Ultra.

- The lot restriction per ticket is 50 for Standard Ultra and 100 for Micro Ultra.

- Hedging is allowed, and swaps are applied.

- An Islamic account option is available.

- The minimum deposit is 5 USD.

Shares Account:

- The base currency option is only USD.

- The contract size is one share.

- There’s no leverage available.

- It provides negative balance protection, and the spread is per the underlying exchange.

- The maximum number of open/pending orders per client is 50 positions.

- The minimum trade volume is one lot.

- The lot restriction per ticket depends on each share.

- Hedging is allowed, and swaps are applied.

- The minimum deposit is 10,000 USD.

These account types are XM’s standard offerings but offer the flexibility to create custom-tailored Forex account solutions for every client. If the deposit currency isn’t USD, the amount indicated should be converted to the deposit currency.

XM zero spread account (my favorite)

XM offers a zero-spread account and a tight-spread account, the name of which is XM zero. The minimum deposit for the XM zero account is $50. However, although the spread is almost zero, the commission for the XM Zero Account is $3.5 per $100,000 traded.

They have 37 feature instructional exercises, webinars in 12 dialects, and classes held everywhere. Another merchant has a long way to go by going to this agent.

XM Advantages

- Regulated: XM is regulated by several authorities globally, ensuring high trust and reliability.

- Low Trading Fees: They offer low trading fees, making it affordable for traders of all levels.

- No Withdrawal Fee: XM does not charge a fee for withdrawing funds.

- Accessible: With a minimum deposit as low as $5 and the ability to open an account within one day, XM is accessible to new and experienced traders.

- Multiple Deposit Options: They provide various payment methods, including bank cards and electronic wallets.

- Variety of Trading Instruments: XM offers various financial products, including Forex, CFD, and real stocks, giving traders numerous trading opportunities.

- High Leverage: XM provides high leverage of up to 1:1000, enhancing trading capabilities. However, leverage depends on the financial instrument traded and the client’s registered entity.

- Efficient Order Execution: XM ensures efficient order execution, with 99.35% of orders fulfilled nearly instantly.

- No Commission on Deposits/Withdrawals: XM doesn’t charge any commission for depositing or withdrawing funds, making transactions cost-effective for traders.

- Comprehensive Customer Support: Their customer support is available in over 30 languages, ensuring a wide range of traders can receive the assistance they need.

- Robust Regulatory Compliance: XM adheres strictly to regulatory standards, assuring clients about the legality and security of their trading activities.

- Demo Account: They offer a demo account for practice and learning, enabling traders to understand the platform before engaging in live trading.

- Wide Range of Base Currencies: With ten base currencies, traders can manage their currency risks.

- Advanced Trading Platform: XM offers high-performance MT4 and MT5 trading platforms with a range of advanced features and tools that cater to the needs of serious investors.

- Variety in Account Types: XM offers different account types to cater to traders’ varying needs, each with different conditions and benefits.

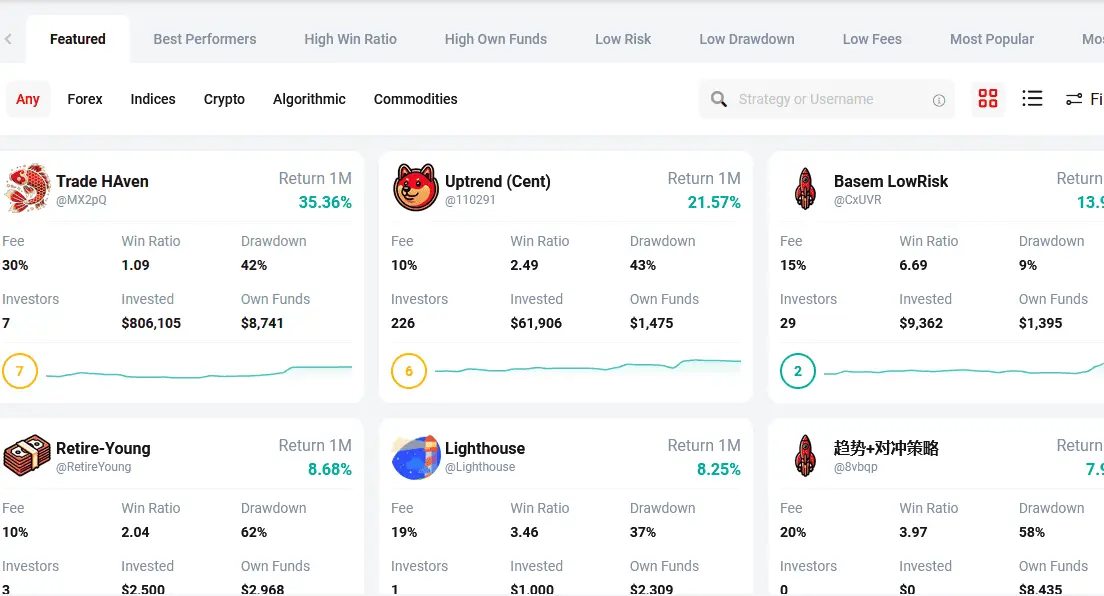

XM offers copy trading as well:

XM Customer Service

XM Broker takes customer service seriously and is committed to exceptional customer support. They ensure that their client’s needs are met efficiently and professionally. Here are some critical points about XM’s customer service:

- Availability: XM offers 24/7 customer support, which means you can contact them anytime, any day, regardless of location. This is a massive advantage for traders across different time zones and those who trade in non-standard hours.

- Multiple Contact Options: They provide several ways to contact their customer support team. You can email them at support@xm.com with any inquiries or for assistance. Contact them at +501 223-6696 or +501 227-9421 for immediate assistance. This flexibility allows for convenient and efficient communication.

- Response Time: XM Broker aims to respond to all queries promptly. Their swift response time is advantageous to traders as it minimizes potential trading downtime.

- Professionalism: The customer support team at XM Broker is known for its professionalism and knowledge. The team is equipped to handle various issues and ensure that the resolution provided is accurate and helpful.

- Accessibility: Besides digital communication, their headquarters is at Suite 404, The Matalon, Coney Drive, Belize City, Belize. This provides a physical location where the company can be reached, increasing its reliability and accessibility.

Ending Thoughts

Although we only spent a few weeks reviewing xm.com, we were incredibly impressed with the consistent quality of service experienced throughout that time. Like other forex brokers, xm.com remains supportive and helpful throughout trading.

Overall, XM is an excellent choice for almost any type of trader due to its high-quality services, competitive prices, and tight spreads across multiple asset classes, making it one of the best brokers in the industry today! Its user-friendly tools and top-notch customer support make it an ideal option for those looking to start forex trading regardless of experience level or budget constraints!

Please see other excellent brokers similar to XM: